Try GOLD - Free

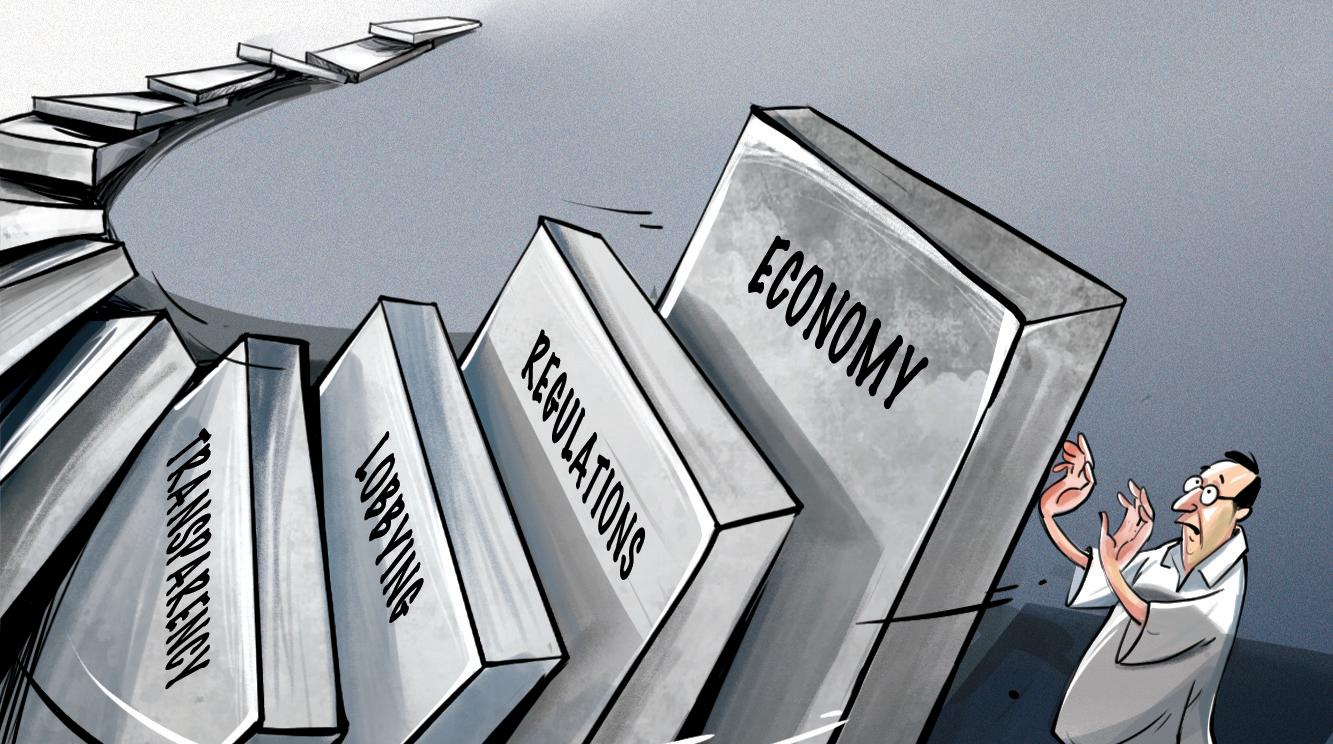

Too Big To Fail Isn't Too Clever To Regulate

The Morning Standard

|August 20, 2025

With debt driving the economy, banks have become powerful. They often use their influence to chip away at the curbs imposed. Regulators need to be better equipped to make them toe the line

Stricter banking regulations known as Basel 3, introduced after the 2008 financial crisis to strengthen the global financial system, are now being systematically weakened. Understanding how regulatory 'sausage' is made gives insights into the problems.

Banks facilitate payments, accept deposits and provide credit and risk management tools. Deregulation and the drive for size and profitability have led banks to expand into underwriting securities, insurance, asset management and trading.

The risk of banking is simple. Unlike funds, banks guarantee the return of deposits. Losses from loans or other activities can jeopardize their ability to meet obligations. High leverage (10-12 times) exacerbates this risk. Banking involves maturity transformation. Deposits have shorter maturities than assets, meaning simultaneous large withdrawals create liquidity risk. Mismatches of maturities can expose the bank to rate fluctuations.

These risks can be addressed by less leverage with banks holding more capital, maintaining liquidity reserves and reducing maturity mismatches. Riskier activities, especially trading, can be restricted or supported by high levels of shareholder funds. Basel 3's attempts to do this were unnecessarily complicated.

Equity, which encompasses many types of securities, is supplemented by a separate leverage ratio. Capital calculations often require arbitrary and subjective differentiation between risks. Banks must meet a liquidity ratio and net stable funding ratio. For off-balance sheet instruments, like derivatives whose risks are difficult to estimate, there is a bewildering mix of central clearing, collateral and counterparty risk charges. Trading exposure is measured by complex formulas. Proprietary trading is theoretically restricted. Banks must prepare 'living wills', a funeral plan for unwinding transactions in the event of failure.

This story is from the August 20, 2025 edition of The Morning Standard.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM The Morning Standard

The Morning Standard

PLAYING IT BY EAR

French guitarist Yarol Poupaud made his Delhi debut this week, bringing to the stage material he has developed with Rajasthani folk musicians. He talks to TMS about life on the road, his band that defined French rock music, and why he will always be a performer.

3 mins

December 18, 2025

The Morning Standard

Lok Sabha clears nuclear bill amid Oppn walkout

THE Lok Sabha on Wednesday cleared the Sustainable Harnessing and Advancement of Nuclear Energy for Transforming India (SHANTI) Bill to open up the nuclear sector for private players.

1 mins

December 18, 2025

The Morning Standard

TELANGANA'S VISION 2047 MUST ENRICH ALL CITIZENS

THE Vision 2047 document unveiled on the final day of the Telangana Rising summit lays out a transformative blueprint for the state's future. Coinciding with the Congress government's two-year anniversary in office, the event broke the mould of conventional investment gatherings by focusing less on chasing capital and more on setting the wheels of economic metamorphosis in motion.

1 mins

December 18, 2025

The Morning Standard

Construction workers to get ₹10K aid

AMID worsening air quality and the enforcement of GRAP III and IV restrictions, the Delhi government on Wednesday announced a ₹10,000 assistance for construction workers affected by the ban on construction activities, while also mandating a maximum of 50% physical attendance in all government and private offices from Thursday.

1 mins

December 18, 2025

The Morning Standard

Munir in pickle as Don wants Pak troops in Gaza

PAKISTAN'S most powerful military chief in decades is facing a critical test of his newly consolidated authority as the US is pressing it to contribute troops to a proposed international stabilisation force in Gaza, a move analysts say could trigger strong domestic backlash, Reuters reported.

1 min

December 18, 2025

The Morning Standard

Gunman in Bondi attack charged with 59 offences

Families gathered in Sydney as funerals began for the victims of the Beach massacre

2 mins

December 18, 2025

The Morning Standard

Key accused in kabaddi player’s killing held in city

TWO days after a 30-year-old kabaddi player, Kanwar Digvijay Singh alias Rana Balachauria, was killed, the mastermind of the murder, Aishdeep Singh, was nabbed from Delhi's IGIA.

1 min

December 18, 2025

The Morning Standard

HC pulls up govt for failing to regulate sale, transfer of used vehicles

THE Delhi High Court on Wednesday castigated the city government for its failure to regulate the sale and transfer of used vehicles, while stressing that a secondhand car was used to trigger the Red Fort blast on November 10.

1 min

December 18, 2025

The Morning Standard

WHEN ALL ABOARD ARE FLYING BLIND

THE IndiGo turbulence has again brought the issues of corporate governance and marquee boards into public discourse. This article, however, is not about the airline.

3 mins

December 18, 2025

The Morning Standard

B’DESH ENVOY SUMMONED AMID WORRY OVER MISSION'S SECURITY

INDIA on Wednesday summoned Bangladesh's High Commissioner Riaz Hamidullah and lodged a strong protest over what it described as plans by extremist elements to create a security situation around the Indian High Commission in Dhaka.

1 min

December 18, 2025

Listen

Translate

Change font size