Prøve GULL - Gratis

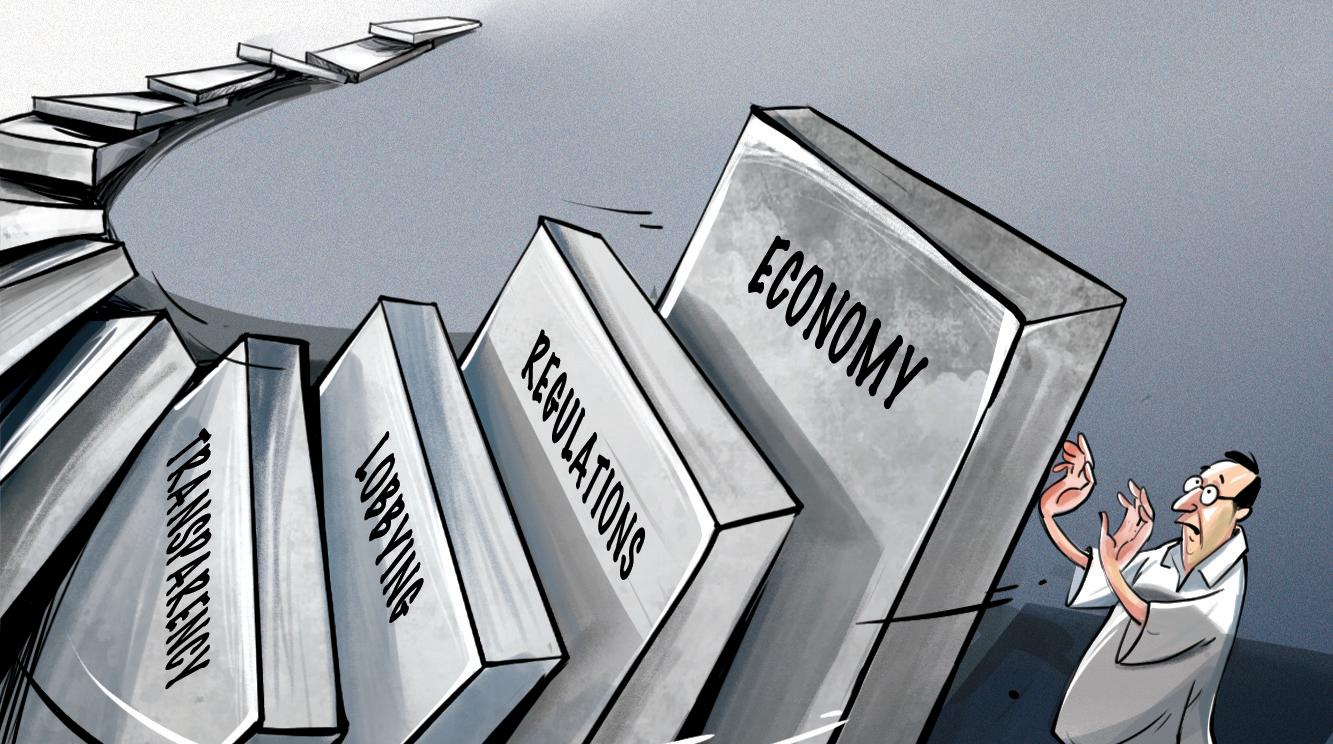

Too Big To Fail Isn't Too Clever To Regulate

The Morning Standard

|August 20, 2025

With debt driving the economy, banks have become powerful. They often use their influence to chip away at the curbs imposed. Regulators need to be better equipped to make them toe the line

Stricter banking regulations known as Basel 3, introduced after the 2008 financial crisis to strengthen the global financial system, are now being systematically weakened. Understanding how regulatory 'sausage' is made gives insights into the problems.

Banks facilitate payments, accept deposits and provide credit and risk management tools. Deregulation and the drive for size and profitability have led banks to expand into underwriting securities, insurance, asset management and trading.

The risk of banking is simple. Unlike funds, banks guarantee the return of deposits. Losses from loans or other activities can jeopardize their ability to meet obligations. High leverage (10-12 times) exacerbates this risk. Banking involves maturity transformation. Deposits have shorter maturities than assets, meaning simultaneous large withdrawals create liquidity risk. Mismatches of maturities can expose the bank to rate fluctuations.

These risks can be addressed by less leverage with banks holding more capital, maintaining liquidity reserves and reducing maturity mismatches. Riskier activities, especially trading, can be restricted or supported by high levels of shareholder funds. Basel 3's attempts to do this were unnecessarily complicated.

Equity, which encompasses many types of securities, is supplemented by a separate leverage ratio. Capital calculations often require arbitrary and subjective differentiation between risks. Banks must meet a liquidity ratio and net stable funding ratio. For off-balance sheet instruments, like derivatives whose risks are difficult to estimate, there is a bewildering mix of central clearing, collateral and counterparty risk charges. Trading exposure is measured by complex formulas. Proprietary trading is theoretically restricted. Banks must prepare 'living wills', a funeral plan for unwinding transactions in the event of failure.

Denne historien er fra August 20, 2025-utgaven av The Morning Standard.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA The Morning Standard

The Morning Standard

Stage set for battle for Bengal in '26: Draft roll out, 58L voters deleted

41.85L voters deleted from Raj rolls under SIR

1 mins

December 17, 2025

The Morning Standard

G-Ram-G bill introduced in LS amid din

THE Lok Sabha on Tuesday witnessed fierce protests from Opposition members after the government introduced a new bill to replace the Mahatma Gandhi National Rural Employment Guarantee Act.

1 mins

December 17, 2025

The Morning Standard

Court rejects ED chargesheet against Gandhis in Herald case

IN a huge relief to Congress leaders Sonia Gandhi and Rahul Gandhi, a Delhi court on Tuesday refused to take cognizance of a chargesheet filed against them by the Enforcement Directorate (ED) in a money-laundering case related to the National Herald 'scam'.

1 min

December 17, 2025

The Morning Standard

Bondi Beach assailant had roots in Hyderabad

Sajid migrated to Australia in '98; no India connect to radicalisation

2 mins

December 17, 2025

The Morning Standard

Luthra brothers deported from Thailand, held; Goa cops get two-day remand

GAURAV and Saurabh Luthra, owners of the Birch by Romeo Lane nightclub in north Goa's Arpora, where a massive fire killed 25 people on December 6, were handed over to the Goa Police on a two-day transit remand on Tuesday.

2 mins

December 17, 2025

The Morning Standard

I apologise to people of Delhi: Sirsa

DELHI Environment Minister Manjinder Singh Sirsa on Tuesday apologised to the people of the capital for the worsening air pollution and its impact on children's health, while announcing a series of strict enforcement measures to curb vehicular and industrial emissions.

1 mins

December 17, 2025

The Morning Standard

13 killed in central Iran bus crash

A passenger bus overturned, killing 13 people and injuring over a dozen others on a highway in central Iran, state-run IRNA news agency reported.

1 min

December 17, 2025

The Morning Standard

This high AuQIb good for health

‘A COACH doesn’t make a player but a player makes a coach’.

2 mins

December 17, 2025

The Morning Standard

With Jadeja moving to RR, CSK break bank for UP’s Veer

Veer was a relatively unknown cricketer from Uttar Pradesh till five-time champions Chennai Super Kings snapped him for a breathtaking price of 714.2 crore on Tuesday.

2 mins

December 17, 2025

The Morning Standard

Ola founder sells stake in firm amid fall in share prices

BHAVISH Aggarwal, co-founder of electric two-wheeler (e-2W) company Ola Electric Mobility, on Tuesday sold 2.6 crore shares, representing a 0.6% stake in the company, through a bulk deal.

1 min

December 17, 2025

Listen

Translate

Change font size