Try GOLD - Free

How China secretly pays Iran for oil and avoids U.S. sanctions

Mint New Delhi

|October 07, 2025

Hidden arrangement secured by prominent Chinese insurer connects Tehran with its biggest customer

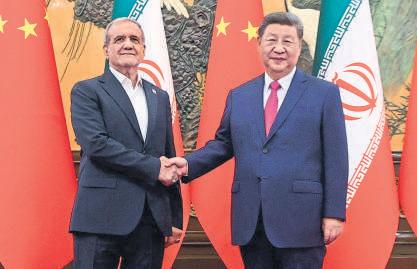

In September, Chinese leader Xi Jinping (right) hosted Iranian President Masoud Pezeshkian at a multinational summit.

(REUTERS)

U.S. sanctions make it nearly impossible to pay Iran for its oil. China has figured out how to do it anyway, in an arrangement that has largely been secret.

The hidden funding conduit has deepened economic ties between the two U.S. rivals in defiance of Washington’s efforts to isolate Iran.

The barter-like system works like this, according to current and former officials from several Western countries, including the U.S.: Iranian oil is shipped to China—Tehran’s biggest customer—and, in return, state-backed Chinese companies build infrastructure in Iran.

Completing the loop, the officials say, are a Chinese state-owned insurer that calls itself the world's largest export-credit agency and a Chinese financial entity that is so secretive that its name couldn't be found on any public list of Chinese banks or financial firms.

The arrangement, by sidestepping the international banking system, has provided a lifeline to Iran’s sanctions-squeezed economy. Up to $8.4 billion in oil payments flowed through the funding conduit last year to finance Chinese work on large infrastructure projects in Iran, according to some of the officials.

Iran exported $43 billion of mainly crude oil last year, according to estimates by the U.S. Energy Information Administration. Western officials estimate that around 90% of those exports go to China.

China has been the predominant buyer of Iranian oil since 2018, when President Trump pulled the U.S. out of the 2015 nuclear accord and reimposed U.S. sanctions.

Two weeks after returning to office, Trump ordered the use of “maximum pressure” to force Tehran to curb its nuclear program and end support for allied militia groups. The directive sought to drive Iranian oil exports to zero.

This story is from the October 07, 2025 edition of Mint New Delhi.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM Mint New Delhi

Mint New Delhi

Diwali is past, but shopping season is roaring ahead

India's consumption engine appears to be humming well past the Diwali rush, with digital payments showing none of the usual post-festival fatigue.

3 mins

November 25, 2025

Mint New Delhi

AI bond flood adds to market pressure

Wall Street is straining to absorb a flood of new bonds from tech companies funding their artificial intelligence investments, adding to the recent pressure in markets.

4 mins

November 25, 2025

Mint New Delhi

TCS, Wipro US patent suits worsen IT's woes

Two of the country’s largest information technology (IT) services companies—Tata Consultancy Services Ltd and Wipro Ltd—faced fresh patent violations in the last 45 days, signalling challenges to their expansion of service offerings.

2 mins

November 25, 2025

Mint New Delhi

Auto parts firms spot hybrid gold

Auto component makers are licking their lips at the ascent of hybrids, spying a new growth engine at a time when electric vehicle (EV) sales have not measured up.

2 mins

November 25, 2025

Mint New Delhi

Micro biz has a harder time securing loan to start up

Bank lending to first-time micro-entrepreneurs has plummeted, signalling tighter credit conditions for small businesses already struggling with cash flow pressures and trade turmoil. In the first six months of the fiscal year, a key central scheme to support such lending managed to sanction just about 12% of what was sanctioned in the entire previous fiscal year, official data showed.

2 mins

November 25, 2025

Mint New Delhi

Why was a fresh approach to QCOs needed?

The government is now withdrawing the quality control orders (QCOS) issued earlier across sectors. Mint examines the original intent, the reasons for the policy reversal, and the expected national benefits from this move.

2 mins

November 25, 2025

Mint New Delhi

Inverted duty fix is next on GST agenda

GST Council to expand work on fixing anomaly at next meet

2 mins

November 25, 2025

Mint New Delhi

Page Industries scouts for missing piece of comeback puzzle

Page Industries Ltd has been struggling with muted growth.Its thrust on operational efficiencies, calibrated distribution expansion and new product launches is yet to reignite the dwindling investor faith.

1 mins

November 25, 2025

Mint New Delhi

REAL ESTATE PLAY: THE END OF INDIA’S BIGGEST TAX HACK

For years, the easiest dinner-table flex in India was a line that began with “You know what I bought that flat for?” and ended with a smug smile. Real estate wasn’t just an investment, it was a moral victory. Hold long enough and inflation would ensure you paid no to minimal tax. All thanks to indexation, a process that adjusts the cost of acquisition for inflation until the year of sale, effectively reducing your capital gains and the tax on them.

3 mins

November 25, 2025

Mint New Delhi

Independent films fight for screen space despite critical acclaim

Critically acclaimed Indian filmsthat sparkle onthe international festival circuit are finding it hard to be screened in the country even though theatresare struggling with low supply of new commercial films.

2 mins

November 25, 2025

Listen

Translate

Change font size