Versuchen GOLD - Frei

How China secretly pays Iran for oil and avoids U.S. sanctions

Mint New Delhi

|October 07, 2025

Hidden arrangement secured by prominent Chinese insurer connects Tehran with its biggest customer

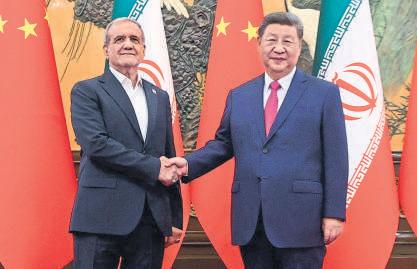

In September, Chinese leader Xi Jinping (right) hosted Iranian President Masoud Pezeshkian at a multinational summit.

(REUTERS)

U.S. sanctions make it nearly impossible to pay Iran for its oil. China has figured out how to do it anyway, in an arrangement that has largely been secret.

The hidden funding conduit has deepened economic ties between the two U.S. rivals in defiance of Washington’s efforts to isolate Iran.

The barter-like system works like this, according to current and former officials from several Western countries, including the U.S.: Iranian oil is shipped to China—Tehran’s biggest customer—and, in return, state-backed Chinese companies build infrastructure in Iran.

Completing the loop, the officials say, are a Chinese state-owned insurer that calls itself the world's largest export-credit agency and a Chinese financial entity that is so secretive that its name couldn't be found on any public list of Chinese banks or financial firms.

The arrangement, by sidestepping the international banking system, has provided a lifeline to Iran’s sanctions-squeezed economy. Up to $8.4 billion in oil payments flowed through the funding conduit last year to finance Chinese work on large infrastructure projects in Iran, according to some of the officials.

Iran exported $43 billion of mainly crude oil last year, according to estimates by the U.S. Energy Information Administration. Western officials estimate that around 90% of those exports go to China.

China has been the predominant buyer of Iranian oil since 2018, when President Trump pulled the U.S. out of the 2015 nuclear accord and reimposed U.S. sanctions.

Two weeks after returning to office, Trump ordered the use of “maximum pressure” to force Tehran to curb its nuclear program and end support for allied militia groups. The directive sought to drive Iranian oil exports to zero.

Diese Geschichte stammt aus der October 07, 2025-Ausgabe von Mint New Delhi.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Mint New Delhi

Mint New Delhi

EV, hydro boom to power 6x rise in battery storage by ‘47

India is preparing to meet a projected cumulative battery energy storage capacity of nearly 3 terawatt-hours (TWh) by 2047 across electric mobility, power, and electronic components, according to two people aware of the development, with electric vehicles (EVs) expected to contribute a third of the demand.

2 mins

November 27, 2025

Mint New Delhi

Taxpayer base soars, but return filings lag sharply: CBDT data

India’s income tax base is growing faster than the number of those conscientiously filing returns, driven by the expanding reach of the tax deducted at source (TDS) system, according to latest data from the central board of direct taxes (CBDT).

3 mins

November 27, 2025

Mint New Delhi

INSIDE THE QUIET RISE OF A GURUGRAM DEVELOPER

Rising from the ashes of NCR's property crisis, Signature Global became India’s 5th-largest listed realty firm in FY25 by sales

7 mins

November 27, 2025

Mint New Delhi

Market nears peak on dollar tailwind

Stocks jump 1.2%, but futures rollovers signal weak conviction

3 mins

November 27, 2025

Mint New Delhi

SP Eyes Tata exit to cut debt costs

Debt-laden Shapoorji Pallonji Group is banking on Tata Trusts softening the stance on its potential exit from Tata Sons to reduce its borrowing costs, two people aware of the matter said.

2 mins

November 27, 2025

Mint New Delhi

Why computers are selling like hot cakes again

Sales of laptops, desktops and tablets had a bad time in India after a pandemic boom.

2 mins

November 27, 2025

Mint New Delhi

Candidates using AI? No, thanks, say IIT recruiters

As the annual placement season dawns at the Indian Institutes of Technology (IITs), colleges and recruiters are working to bar artificial intelligence (AI) tools and prevent cheating at test venues, a concern that first rose last year.

3 mins

November 27, 2025

Mint New Delhi

Reliance JV, L&T to plough $13.5 bn into data centres

India’s data-infrastructure buildout hit a $13.5-billion inflection point on Wednesday, with a Reliance Industries Ltd (RIL) joint venture and Larsen & Toubro (L&T) announcing large-scale investments in data centres, driven by surging demand for artificial intelligence (AI) applications.

2 mins

November 27, 2025

Mint New Delhi

Softbank’s 40% fall from peak shows worry on OpenAI bet

Growing unease over frothy artificial intelligence (AI) valuations is weighing on shares of SoftBank Group Corp.

2 mins

November 27, 2025

Mint New Delhi

PepsiCo taps gourmet taste buds with Red Rock Deli’s India debut

Snack and cola maker PepsiCo is finally giving gourmet a chance with the launch of Red Rock Deli chips, priced ₹60 and ₹125 a pack, in a shift from its years-long focus on mass-market Lay's that starts as low as ₹5.

2 mins

November 27, 2025

Listen

Translate

Change font size