Try GOLD - Free

Investing in China: the how and why of it

Mint Mumbai

|March 17, 2025

Even as Indian stock markets go through a rough patch, Chinese equities have rebounded after lagging for around a decade.

Global investors are looking to ride this rally. Over the past 10 years, the Shanghai SE Composite Index rose just 2.5%. However, the Chinese government's stimulus measures to boost domestic consumption and DeepSeek's AI model lifted the sentiment. China's benchmark index has delivered 12.55% returns over the past one year compared with a 1.8% rise in the Nifty 50 during the period in terms of local currency.

Trading volumes of iShares China Large-Cap ETF, which tracks Chinese blue-chip stocks, swelled 2.8 times in February, according to data from global investing platform Vested Finance.

In this series on global investing, we explore how Indians can invest in different geographies. Here is a look at the investment routes available for local investors looking to participate in the Chinese markets.

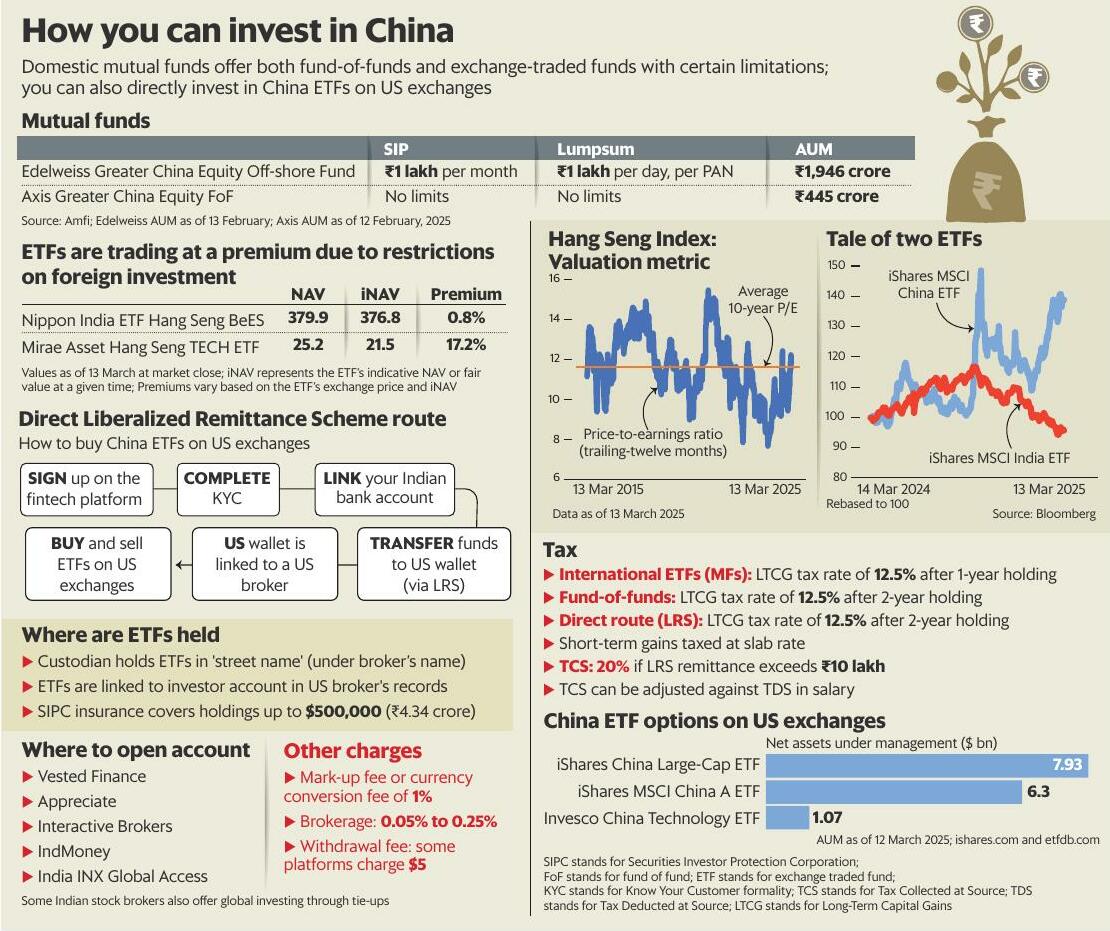

Mutual funds

Mutual funds Edelweiss Greater China Equity Off-shore Fund and Axis Greater China Equity FoF are two funds of funds open for Indian investors. For Edelweiss's fund, the lumpsum investment limit is 1 lakh a day, per PAN (permanent account number) and that also applies to monthly systematic investment plans (SIPs). The fund had ₹1,946 crore in assets under management (AUM) as on 13 February. The Axis Greater China Equity FoF is fully open without investment limits. Its AUM stood at ₹445 crore as of 12 February 2025.

As an FoF, Edelweiss fund feeds into JPMorgan Greater China Fund while the Axis fund feeds into the Schroder International Selection Fund Greater China. Capital gains from the funds will be taxed as long-term capital gains at 12.5% if the investment is held for more than two years, and if held for less, short-term gains are taxed at the income tax slab rate of an investor.

This story is from the March 17, 2025 edition of Mint Mumbai.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM Mint Mumbai

Mint Mumbai

Rupee rumbles

The Indian rupee on Friday slumped to a record low of about 89.60 to the US dollar, zipping past the 89 mark for the first time.

1 min

November 24, 2025

Mint Mumbai

Claims on dubious pre-IBC deals swell

At ₹4 tn, amount matches entire sum recovered via IBC in 10 yrs

3 mins

November 24, 2025

Mint Mumbai

'Stay invested in the stock market, everything is for the long haul'

Veteran value investor Ramesh Damani is ignoring doomsday warnings about a US tech stock correction and noises surrounding corporate earnings growth trajectory back home, staying loyal instead to his credo of long-term investments, using a bottom -up approach. He remains unconcerned about short term market corrections, advising investors to

6 mins

November 24, 2025

Mint Mumbai

CHINA HAS MINERALS, INDIA HAS ITS PEOPLE

In 1992, Chinese leader Deng Xiaoping reportedly said that if West Asia had oil, China would have rare earths.

4 mins

November 24, 2025

Mint Mumbai

Rupee may decline further as RBI has little elbow space

The local currency market is bracing for more weakness in the coming weeks, after the rupee sharply slid to a record low of 89.41 against the US dollar within the last hour of trade on Friday.

3 mins

November 24, 2025

Mint Mumbai

Labour codes could act as an economic catalyst

If enforced as envisioned, the four codes can yield a more secure workforce and strengthen India's economy. Employers should not just comply but also focus on their collective interest

2 mins

November 24, 2025

Mint Mumbai

OYO Assets gets 125 cr fresh funds

OYO parent PRISM-backed OYO Assets has raised ₹125 crore in a fresh funding round from a clutch of institutional and private investors led by InCred, people aware of the development said.

1 min

November 24, 2025

Mint Mumbai

Will realty keep the pre-sale pace?

Listed realty firms are banking on new launches to drive pre-sales in H2FY26.

2 mins

November 24, 2025

Mint Mumbai

How new labour codes impact your gratuity, PF

The new labour codes have overhauled how wages, gratuity, provident fund (PF), pension and other social security benefits are calculated. These changes impact employees and employers alike.

2 mins

November 24, 2025

Mint Mumbai

INDIA’S TERROR THREAT SHIFTS CLOSER HOME

Life, once in a while, throws up events that brutalise your consciousness and traumatise you for the rest of your life. The terror attacks in Mumbai on 26 November 2008, and in Pahalgam and Delhi this year top such chilling incidents.

3 mins

November 24, 2025

Listen

Translate

Change font size