Essayer OR - Gratuit

Investing in China: the how and why of it

Mint Mumbai

|March 17, 2025

Even as Indian stock markets go through a rough patch, Chinese equities have rebounded after lagging for around a decade.

Global investors are looking to ride this rally. Over the past 10 years, the Shanghai SE Composite Index rose just 2.5%. However, the Chinese government's stimulus measures to boost domestic consumption and DeepSeek's AI model lifted the sentiment. China's benchmark index has delivered 12.55% returns over the past one year compared with a 1.8% rise in the Nifty 50 during the period in terms of local currency.

Trading volumes of iShares China Large-Cap ETF, which tracks Chinese blue-chip stocks, swelled 2.8 times in February, according to data from global investing platform Vested Finance.

In this series on global investing, we explore how Indians can invest in different geographies. Here is a look at the investment routes available for local investors looking to participate in the Chinese markets.

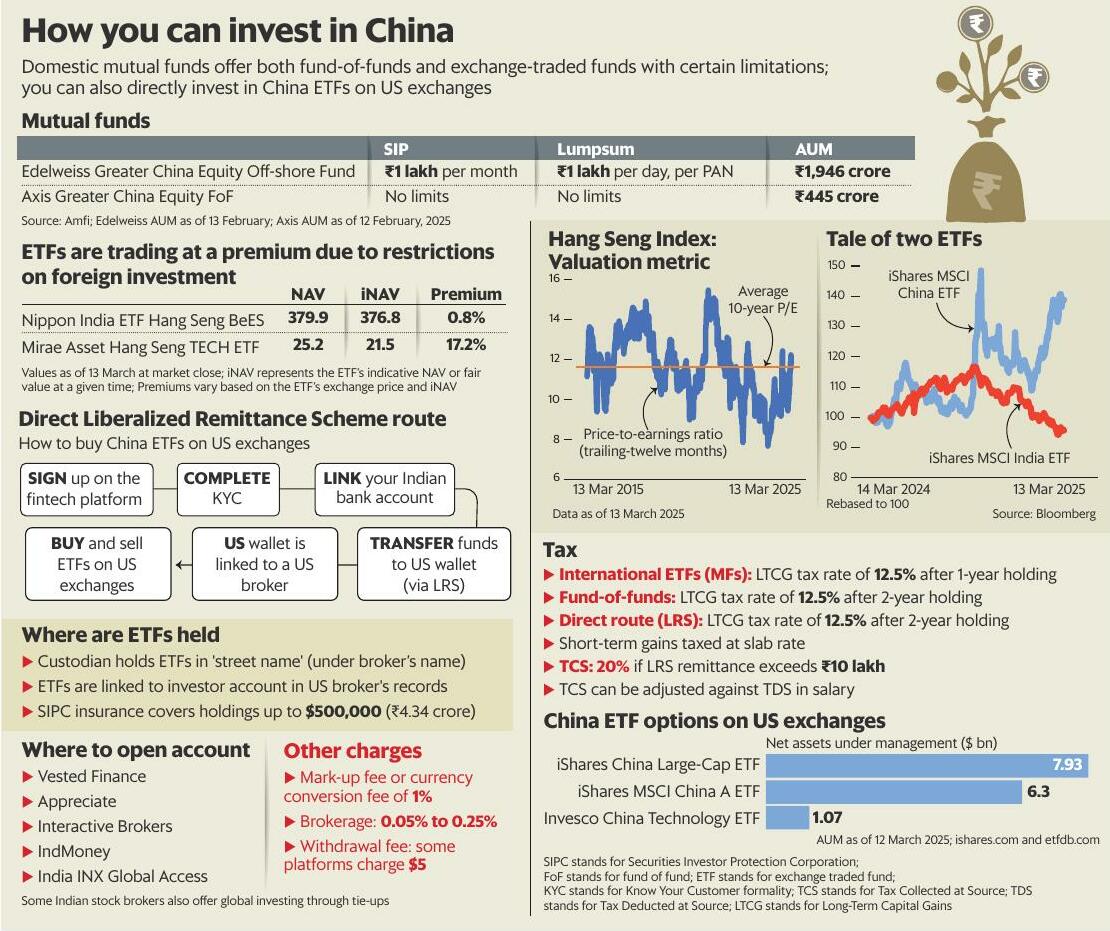

Mutual funds

Mutual funds Edelweiss Greater China Equity Off-shore Fund and Axis Greater China Equity FoF are two funds of funds open for Indian investors. For Edelweiss's fund, the lumpsum investment limit is 1 lakh a day, per PAN (permanent account number) and that also applies to monthly systematic investment plans (SIPs). The fund had ₹1,946 crore in assets under management (AUM) as on 13 February. The Axis Greater China Equity FoF is fully open without investment limits. Its AUM stood at ₹445 crore as of 12 February 2025.

As an FoF, Edelweiss fund feeds into JPMorgan Greater China Fund while the Axis fund feeds into the Schroder International Selection Fund Greater China. Capital gains from the funds will be taxed as long-term capital gains at 12.5% if the investment is held for more than two years, and if held for less, short-term gains are taxed at the income tax slab rate of an investor.

Cette histoire est tirée de l'édition March 17, 2025 de Mint Mumbai.

Abonnez-vous à Magzter GOLD pour accéder à des milliers d'histoires premium sélectionnées et à plus de 9 000 magazines et journaux.

Déjà abonné ? Se connecter

PLUS D'HISTOIRES DE Mint Mumbai

Mint Mumbai

The trouble with 'good vibes only' spirituality

Wellness culture on social media idealizes positivity at the cost of depth. Experts warn that this shift can encourage emotional avoidance

2 mins

November 25, 2025

Mint Mumbai

AI ignites the return of Bezos the inventor

‘Tm the least retired person in the world,’ Amazon founder says

4 mins

November 25, 2025

Mint Mumbai

Govt plans reform push in winter session

The government is preparing to push a packed reform agenda through parliament's short winter session that will start 1 December, with 15 sittings scheduled to clear major legislations tied to crucial issues, including ease of doing business, regulatory consolidation, foreign investment, and sectoral reforms.

1 mins

November 25, 2025

Mint Mumbai

Rupee jumps 50p against US dollar

The rupee rebounded sharply by 50 paise to settle at 89.16 against the greenback on Monday, due to US dollar selling by banks and importers amid a dip in global crude oil prices.

1 min

November 25, 2025

Mint Mumbai

Centre to review stalled RE projects

Union minister for new and renewable energy Pralhad Joshi on Monday said officials have been directed to carry out an assessment of renewable energy projects for which power sale agreements (PSAs) and power purchase agreements (PPAs) have not been signed.

1 min

November 25, 2025

Mint Mumbai

Tesla vs Tesla: HC grants protection to Musk’s company

The Delhi High Court on Monday granted interim protection to Elon Musk-led Tesla Inc. in its trademark infringement case with Gurugram-based Tesla Power India Pvt. Ltd.

1 mins

November 25, 2025

Mint Mumbai

Wipro VC eyes exits, packaged food bets

Wipro Consumer Care Ventures, the venture capital arm of consumer goods major Wipro Consumer Care & Lighting, is looking to cash out of some of its investments from its first fund of ₹200 crore.

1 mins

November 25, 2025

Mint Mumbai

Independent films fight for screen space despite critical acclaim

Critically acclaimed Indian filmsthat sparkle onthe international festival circuit are finding it hard to be screened in the country even though theatresare struggling with low supply of new commercial films.

2 mins

November 25, 2025

Mint Mumbai

Banks, state firms plan $3.5 bn bond sales before GDP, RBI policy

Indian lenders and state-run firms are racing to raise up to $3.5 billion through bonds ahead of India’s GDP data and monetary policy decision amid concerns that interest rates might not be slashed, bankers said on Monday.

1 min

November 25, 2025

Mint Mumbai

KKR flags risks in AI, data centre bets

KKR & Co.’s Raj Agrawal said he’s among those concerned about excess exuberance in data centers and artificial intelligence and that the firm is being selective to mitigate risk.

1 min

November 25, 2025

Listen

Translate

Change font size