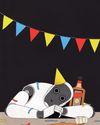

HOW TO KNOW WHEN IT'S TIME FOR YOUR CEO TO GO

Fortune US

|June - July 2024

IT'S EASY TO TELL when some things have expired. Stock options. Eggs. Prescription meds. Credit cards. But corporate America has long been stumped trying to find a more elusive expiration date: How can a company know when it's time for a CEO to go? Anecdotes fall all over the map.

Warren Buffett, the longest-tenured CEO in the Fortune 500, has been running Berkshire Hathaway for 54 years, and the stock is still hitting new highs. By contrast, Fred Kindle needed only three years as CEO (2005-2008) to turn around venerable but money-losing Swiss industrial conglomerate ABB and deliver shareholders a 262% total return.

Between those two extremes, many boards default to the mean. The S&P 500 average is 9.2 years, and despite occasional articles exclaiming that CEO tenures are shortening, they aren't; over the past 20 years they've held fairly stable. Robert Stark, a succession expert at Spencer Stuart, believes it's possible that "the average in and of itself becomes a self-fulfilling prophecy. In the absence of any good insight about how long CEOs should serve, they think, 'Oh, I should be about average."

But those who study CEOs for a living appear to have homed in on more precise answers-and discovered that the expiration date often arrives just when CEOs have reached that stage where they seem strongest. A 2021 study by researchers from Boston University, the University of Cologne, the University of St. Gallen, and the Karlsruhe Institute of Technology examined S&P 1500 companies over 25 years and found that on average, a company's value peaks and plateaus around the CEO's 10th year in the job. After 14 years or so the firm's value starts to fall, at first by a little, then by a lot, and it keeps declining for as long as the CEO holds on.

To check their findings, the researchers conducted a clever, if morbid, test: How do investors respond to news that the CEO has suddenly died? The data showed that investors consider such an event bad news for the company if the CEO has held the job for 13 years or less. But when the CEO has been there longer than 13 years, investors bid the stock up on the news of a sudden demise; they're saying the company is better off with the old coot gone.

This story is from the June - July 2024 edition of Fortune US.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM Fortune US

Fortune US

GET READY TO OWN A TOKENIZED PORTFOLIO

A BLOCKCHAIN \"FREIGHT TRAIN\" IS ALREADY REMAKING WALL STREET'S FINANCIAL PLUMBING. IT COULD MAKE TRADING EVEN FASTER AND CHEAPER

6 mins

December 2025 - January 2026

Fortune US

RESOURCES HOW RARE EARTHS BECAME GROUND ZERO IN THE U.S.-CHINA RIVALRY

THE WATERSHED moment came in July when the federal government became the largest shareholder of MP Materials, a California miner of rare earth elements.

2 mins

December 2025 - January 2026

Fortune US

PASSIONS A BLISSFUL ESCAPE FROM DECISION FATIGUE

THE TASTING MENU at Uberto ends, like many others at restaurants of this caliber, with mignardises.

4 mins

December 2025 - January 2026

Fortune US

JAMIE DIMON OF JPMORGAN CHASE ON STEERING AMERICA'S BIGGEST BANK THROUGH 'INFLATIONARY' TIMES

CEO JAMIE DIMON has led JPMorgan Chase through periods of rapid change and epic turmoil—and Jan. 1, 2026, will be his 20th anniversary in the role.

6 mins

December 2025 - January 2026

Fortune US

WHAT TO BUY, AND NOT BUY, IN 2026

THREE YEARS OF EUPHORIA IN STOCKS AND OTHER ASSETS HAVE INVESTORS BRACING FOR TROUBLE. HERE'S WHAT TO DO IF BAD NEWS ARRIVES.

7 mins

December 2025 - January 2026

Fortune US

Breaking the Mold

The Trade Desk's Al-powered platform and open-web ethos has propelled it onto the S&P 500.

2 mins

December 2025 - January 2026

Fortune US

WINE TARIFF THREATS AND GEN Z SOBRIETY HAVE PUT BORDEAUX ON RED ALERT

IN THE TASTING room of a Bordeaux winery, a photo on the wall shows a pastoral tableau: three generations of the Dubois family, sipping wine on the patio of their Les Bertrands château, with their Australian shepherd, Namek, perched at their feet.

6 mins

December 2025 - January 2026

Fortune US

HOW AN AI BUBBLE COULD RUIN THE PARTY

IF AI REVENUE DOESN'T CATCH UP WITH AI SPENDING, GLOBAL STOCKS WILL BE AT RISK.

6 mins

December 2025 - January 2026

Fortune US

INNOVATION IS THE ERA OF ROBOT-DRIVEN UNEMPLOYMENT ALMOST UPON US?

AT A PRESS EVENT LAST YEAR, Amazon Robotics chief technologist Tye Brady told Fortune that the idea that there's a battle of robots versus humans inside Amazon's warehouse network is a “myth.”

5 mins

December 2025 - January 2026

Fortune US

Nvidia is invincible. Unless it isn't.

The doubters are coming for the world's most valuable company.

11 mins

December 2025 - January 2026

Listen

Translate

Change font size