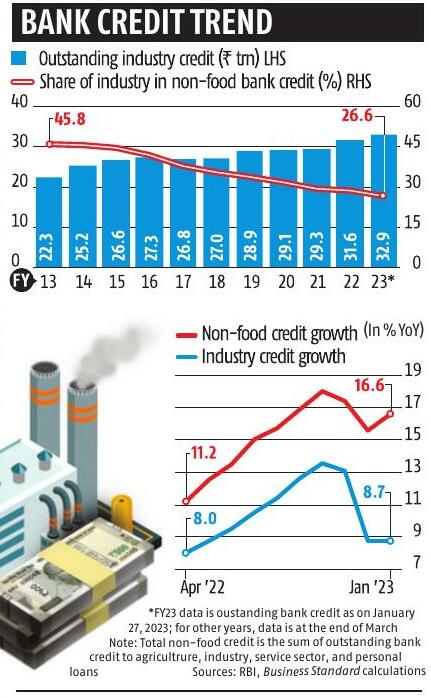

The share of industry in the total non-food bank credit declined to a record low of 26.6 per cent at the end of January 2023, according to the Reserve Bank of India (RBI) data. This share stood at 28.6 per cent as of March 2022, and 45.8 per cent around a decade ago, at the end of March 2013.

Credit to industry grew at a healthy pace - between 10 and 14 per cent - in most months during the first half of 2022-23 (FY23), in contrast to the slowdown seen after November. The outstanding bank credit to industry grew 8.7 per cent year-on-year (YoY) in January this year, as against 13.6 per cent YoY growth in October 2022.

In the first eight months of FY23 (April-November 2022), bank credit to industry grew about 11 per cent YoY, while it was up 9.9 per cent YoY in FY22. In comparison, the overall non-food credit was up 16.6 per cent YoY in January this year.

Non-food credit is the sum of all loans given by banks to firms and individuals other than Food Corporation of India (FCI). Bank loans to FCI for the procurement of foodgrain are called food credit. Credit to industry is all bank loans to firms in the industrial sector such as manufacturing, power, mining, oil & gas, construction, telecom and other infrastructure sectors.

This story is from the March 09, 2023 edition of Business Standard.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 8,500+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the March 09, 2023 edition of Business Standard.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 8,500+ magazines and newspapers.

Already a subscriber? Sign In

Cargo captain

Shetty, the logistics leader who lives where Rajesh Khanna once did, takes DEV CHATTERJEE through his life that started at the docks, with some cinematic stopovers

Infosys slumps to 5-mth low on modest guidance

Firm expects BFSI to recover, which could be a key catalyst for revenue growth

Sebi proposes special call auction for price discovery of holdcos

The Securities and Exchange Board of India (Sebi) on Friday proposed a new framework for price discovery of listed investment holding companies (holdcos) to address the gap between their traded price and book value.

Motilal Oswal shares soar on bonus proposal

Shares of Motilal Oswal Financial Services (MOFSL) surged more than 7 per cent on Friday after the brokerage firm said its board was considering a bonus issue.

enchmark indices snap four-day losing streak

Equity benchmark indices snapped their four-day losing streak to end Friday's session higher amid some short covering and a surge in index heavyweight HDFC Bank.

₹ hits new intraday low, bond yields surge

The rupee hit a new intraday low of 83.57 against the US dollar on Friday as geopolitical tensions escalated in West Asia but pared losses after Iran downplayed the impact of an Israeli missile attack.

HDFC AMC profit jumps 37% in FY24

HDFC Asset Management Company (AMC) on Friday reported a 37 per cent jump in net profit at 1,943 crore for the financial year 20232024 (FY24).

Vi FPO subscribed 49% on Day 2

The follow-on public offering (FPO) of Vodafone Idea (VIL) saw 49 per cent subscription on Friday, a day before its close.

HDFC Bank shares gain ahead of results

Increase in FPI legroom seen as key trigger

MFs pare exposure to banks, NBFCs in fourth quarter

This comes amid persistent margin pressure, regulatory issues