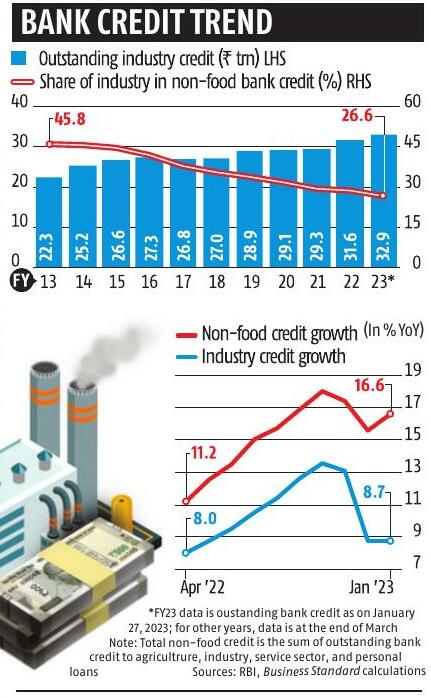

The share of industry in the total non-food bank credit declined to a record low of 26.6 per cent at the end of January 2023, according to the Reserve Bank of India (RBI) data. This share stood at 28.6 per cent as of March 2022, and 45.8 per cent around a decade ago, at the end of March 2013.

Credit to industry grew at a healthy pace - between 10 and 14 per cent - in most months during the first half of 2022-23 (FY23), in contrast to the slowdown seen after November. The outstanding bank credit to industry grew 8.7 per cent year-on-year (YoY) in January this year, as against 13.6 per cent YoY growth in October 2022.

In the first eight months of FY23 (April-November 2022), bank credit to industry grew about 11 per cent YoY, while it was up 9.9 per cent YoY in FY22. In comparison, the overall non-food credit was up 16.6 per cent YoY in January this year.

Non-food credit is the sum of all loans given by banks to firms and individuals other than Food Corporation of India (FCI). Bank loans to FCI for the procurement of foodgrain are called food credit. Credit to industry is all bank loans to firms in the industrial sector such as manufacturing, power, mining, oil & gas, construction, telecom and other infrastructure sectors.

Bu hikaye Business Standard dergisinin March 09, 2023 sayısından alınmıştır.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 8,500+ magazines and newspapers.

Already a subscriber ? Giriş Yap

Bu hikaye Business Standard dergisinin March 09, 2023 sayısından alınmıştır.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 8,500+ magazines and newspapers.

Already a subscriber? Giriş Yap

DPIIT wants 'local content' calculation narrowed

PUBLIC PROCUREMENT ORDER

10 Stocks That Get Institutional Seal Of Approval

Equity investments by foreign portfolio investors (FPIs) and domestic institutional investors (DIIs) in the Indian market have shown a mixed trend over the past six months.

G7's coal phaseout move may impact COP29, G20 talks

The Group of Seven (G7) developed economies, ☐ in the recent meeting of its Climate, Energy, and Environment Ministerial, has decided to phase out unabated coal during the first half of the 2030s.

Small (car) is beautiful

The Indian passenger vehicle industry has had a stellar year.

Declare chronic ailments with insurers willing to cover them

By paying extra premium, you can reduce waiting period for pre-existing conditions

Deal valuations weigh on Apollo Hospitals stock

Brokerages believe the transaction is positive despite valuation concerns

Havells: Positive outlook priced in

Good results for the January-March quarter (Q4) of the financial year 2023-24 (FY24) and the promise of seasonal demand for cooling have led to a positive outlook on Havells.

BSE now corners a fifth of derivatives mkt share

From 0 to 21% in less than a year, the bourse is making further strides

Unfavourable conditions

Workplace culture remains hostile for women

A Chinese invasion of the auto landscape

As seen in Australia, tariff cuts may have an unwelcome outcome for domestic car makers