Prøve GULL - Gratis

NPS: Why no one wants to be a retirement adviser in India

Mint Mumbai

|August 27, 2025

With 72% taxpayers moving to new tax regime offering no NPS deduction, demand has fallen

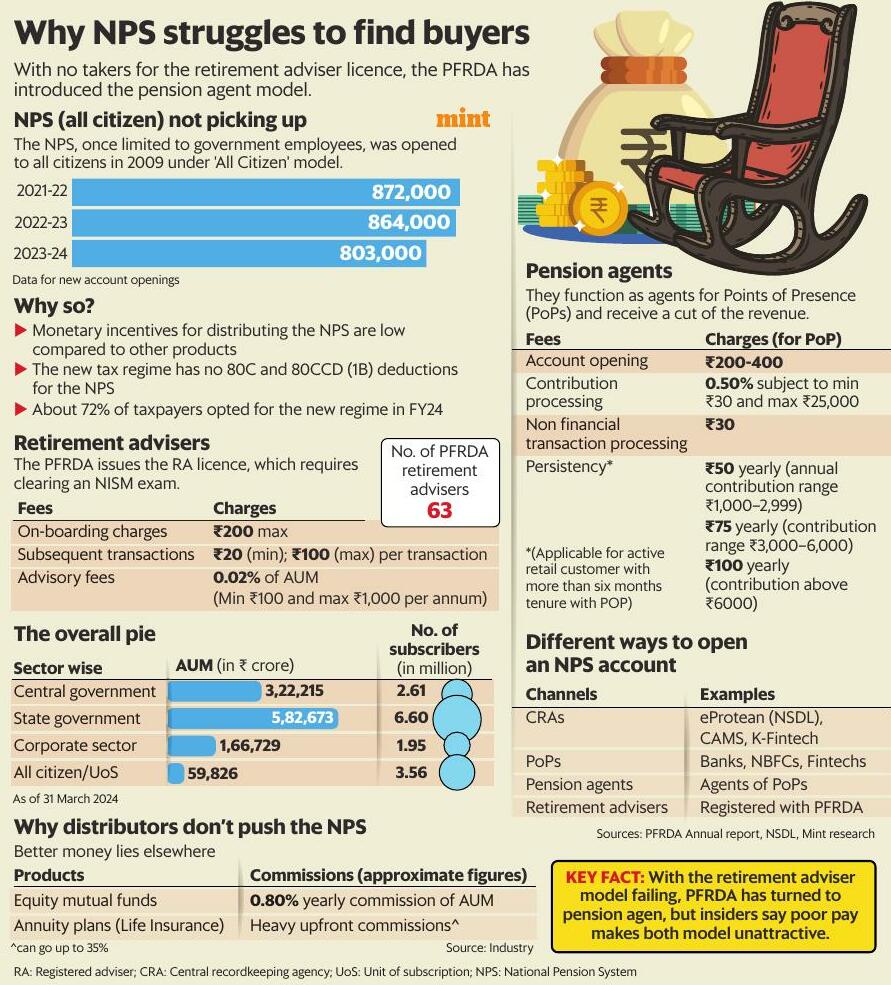

New voluntary enrollments in the National Pension System (NPS), the government-backed market-linked retirement plan, is declining—from 872,000 in 2021-22 and 863,000 in 2022-23 to 803,000 in 2023-24.

Experts attribute the cooling interest to the growing appeal of the new tax regime, which offers no benefits on NPS contributions, and to weak distributor incentives that have kept retirement advisory from gaining traction.

There are only 63 retirement advisers (RAs), according to the latest numbers available with the Pension Fund Regulatory and Development Authority (PFRDA), which had introduced the licence in 2016. And those also had close to no clients.

Aarathi Rajgopal took the RA licence with high hopes after clearing NISM-Series-XVII: Retirement Adviser Certification Examination, but she has yet to service a single client. The key reason, she said, is the low monetary incentive.

If a client invests 10 lakh in the NPS, Rajgopal can charge at most ₹200 as account-opening fees, ₹1,000 a year in advisory fees, and an additional ₹100 per transaction. Now, if the client were to invest the amount in equity mutual funds, she could earn about ₹8,000 every year (assuming 0.80% commissions) through an AMFI (Association of Mutual Funds in India) registration.

If a client invests 10 lakh in the NPS, Rajgopal can charge at most ₹200 as account-opening fees, ₹1,000 a year in advisory fees, and an additional ₹100 per transaction. Now, if the client were to invest the amount in equity mutual funds, she could earn about ₹8,000 every year (assuming 0.80% commissions) through an AMFI (Association of Mutual Funds in India) registration.If the amount were put into annuity, which are closer to the NPS, earnings would be higher still. Life insurers typically pay upfront commissions, as high as 35% for the first year's premiums and 1-7% from the second year onwards.

Denne historien er fra August 27, 2025-utgaven av Mint Mumbai.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Mint Mumbai

Mint Mumbai

Bank-funded acquisitions won't displace private credit

The Reserve Bank of India's (RBI) draft framework for bank-led acquisition finance marks a decisive policy turn: Indian banks can now enter the acquisition finance market within a clear perimeter, reshaping the competitive dynamics between banks and private credit funds.

3 mins

November 20, 2025

Mint Mumbai

Air India lobbies to use airspace over China's Xinjiang

India-China flights resumed after a five-year hiatus.

1 mins

November 20, 2025

Mint Mumbai

Nitish Kumar to take oath as Bihar CM

JD(U) supremo Nitish Kumar to be sworn-in as Bihar chief minister for a record 10th time.

1 min

November 20, 2025

Mint Mumbai

A fresh perspective on abstraction in art

A new exhibition in Mumbai showcases different approaches to abstraction by artists like Zarina, Seher Shah and Mehlli Gobhai

3 mins

November 20, 2025

Mint Mumbai

Govt eyes post-cut GST revenue surge

FinMin expects Nov GST receipts growth to rebound to 10%

2 mins

November 20, 2025

Mint Mumbai

PayMate pulls plug on West Asia operations

The Visa-backed B2B payments firm is scrambling to raise more funds

2 mins

November 20, 2025

Mint Mumbai

Exide's dual bet: Can lithium-ion offset a weakening core?

Exide Industries Ltd is struggling to fuel its core lead-acid business while simultaneously turning its capex-heavy lithium-ion venture into a viable second growth engine.

1 mins

November 20, 2025

Mint Mumbai

Bank-funded acquisitions won’t displace private credit

The Reserve Bank of India's (RBI) draft framework for bank-led acquisition finance marks a decisive policy turn: Indian banks can now enter the acquisition finance market within a clear perimeter, reshaping the competitive dynamics between banks and private credit funds.

3 mins

November 20, 2025

Mint Mumbai

Afghanistan trade minister seeks India investments, goods

Afghanistan's Taliban trade minister arrived in India on Wednesday on a maiden visit to draw greater investments and goods as both countries consider ways to enhance their relations in the backdrop of souring relations with neighboring Pakistan.

1 min

November 20, 2025

Mint Mumbai

Fractal Analytics bets heavily on R&D in AI race before IPO

Enterprise artificial intelligence firm Fractal Analytics plans to maintain high research and development (R&D) spending ahead of its market debut for which a date has not yet been set, a top executive has said.

2 mins

November 20, 2025

Listen

Translate

Change font size