試す 金 - 無料

NPS: Why no one wants to be a retirement adviser in India

Mint Mumbai

|August 27, 2025

With 72% taxpayers moving to new tax regime offering no NPS deduction, demand has fallen

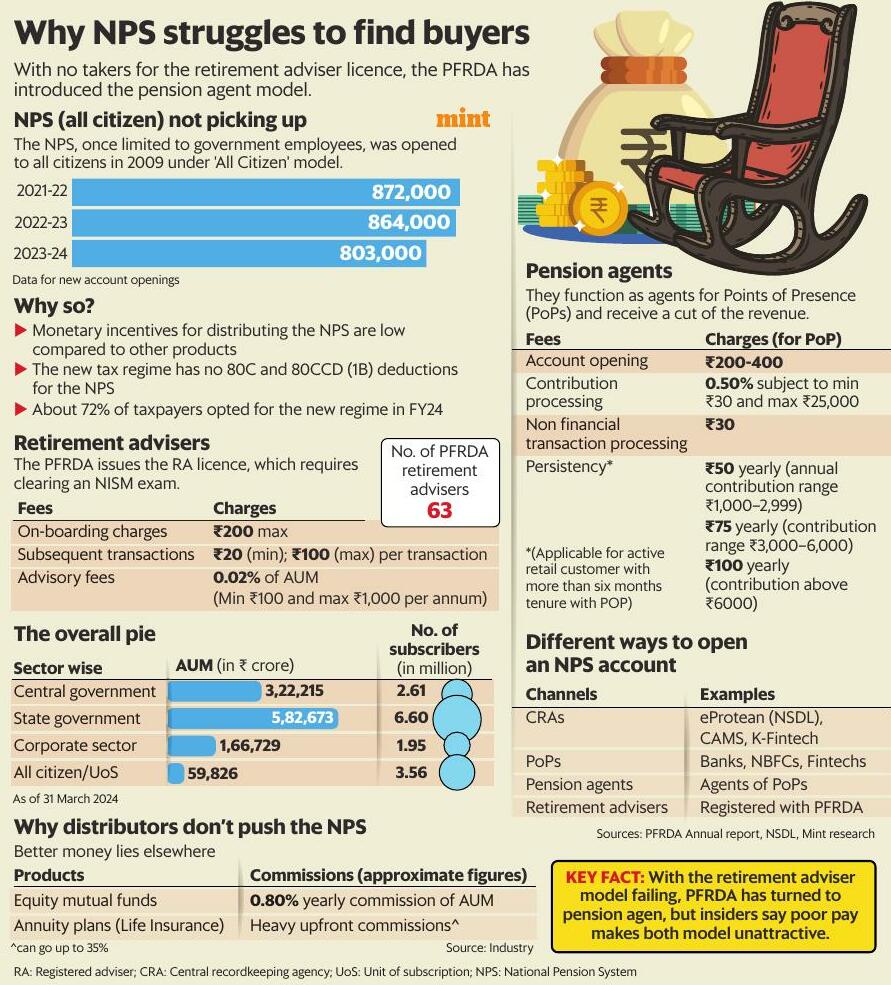

New voluntary enrollments in the National Pension System (NPS), the government-backed market-linked retirement plan, is declining—from 872,000 in 2021-22 and 863,000 in 2022-23 to 803,000 in 2023-24.

Experts attribute the cooling interest to the growing appeal of the new tax regime, which offers no benefits on NPS contributions, and to weak distributor incentives that have kept retirement advisory from gaining traction.

There are only 63 retirement advisers (RAs), according to the latest numbers available with the Pension Fund Regulatory and Development Authority (PFRDA), which had introduced the licence in 2016. And those also had close to no clients.

Aarathi Rajgopal took the RA licence with high hopes after clearing NISM-Series-XVII: Retirement Adviser Certification Examination, but she has yet to service a single client. The key reason, she said, is the low monetary incentive.

If a client invests 10 lakh in the NPS, Rajgopal can charge at most ₹200 as account-opening fees, ₹1,000 a year in advisory fees, and an additional ₹100 per transaction. Now, if the client were to invest the amount in equity mutual funds, she could earn about ₹8,000 every year (assuming 0.80% commissions) through an AMFI (Association of Mutual Funds in India) registration.

If a client invests 10 lakh in the NPS, Rajgopal can charge at most ₹200 as account-opening fees, ₹1,000 a year in advisory fees, and an additional ₹100 per transaction. Now, if the client were to invest the amount in equity mutual funds, she could earn about ₹8,000 every year (assuming 0.80% commissions) through an AMFI (Association of Mutual Funds in India) registration.If the amount were put into annuity, which are closer to the NPS, earnings would be higher still. Life insurers typically pay upfront commissions, as high as 35% for the first year's premiums and 1-7% from the second year onwards.

このストーリーは、Mint Mumbai の August 27, 2025 版からのものです。

Magzter GOLD を購読すると、厳選された何千ものプレミアム記事や、10,000 以上の雑誌や新聞にアクセスできます。

すでに購読者ですか? サインイン

Mint Mumbai からのその他のストーリー

Mint Mumbai

Investors expect AI use to soar. That’s not happening

On November 20th American statisticians released the results of a survey. Buried in the data is a trend with implications for trillions of dollars of spending.

4 mins

November 28, 2025

Mint Mumbai

360 One, Steadview, others to invest in Wakefit ahead of IPO

A clutch of firms, including 360 One, Steadview Capital, WhiteOak Capital and Info Edge, is expected to invest in home-furnishings brand Wakefit Innovations Ltd just ahead of its initial public offering (IPO) next month, three people familiar with the matter said.

3 mins

November 28, 2025

Mint Mumbai

I-T dept to nudge taxpayers to declare foreign wealth

The department was able to collect 30,000 crore disclosed in the previous Nudge drive

2 mins

November 28, 2025

Mint Mumbai

Catamaran to boost manufacturing bets

Catamaran is focused on a few areas in manufacturing, such as aerospace

2 mins

November 28, 2025

Mint Mumbai

India, UAE review trade agreement to ease market access

Officials of India and the United Arab Emirates (UAE) met on Thursday to review how the Comprehensive Economic Partnership Agreement (CEPA) is working, and remove frictions that may be impeding trade between the two nations.

1 mins

November 28, 2025

Mint Mumbai

Beyond the stock slump-Kaynes' $1 bn aim is just the start

Shares of Kaynes Technology India Ltd have fallen about 25% from their peak of 7,705 in October, amid a management reshuffle and the expiry of the lock-in period for pre-IPO shareholders.

1 mins

November 28, 2025

Mint Mumbai

How Omnicom’s IPG buy will change Indian advertising

Two of the advertising world’s Big Four holding companies—Interpublic Group and Omnicom—officially merged this week.

2 mins

November 28, 2025

Mint Mumbai

Why TCS is walking a tightrope

Tata Consultancy Services Ltd recently outlined an ambitious multi-year $6-7 billion investment plan to build artificial intelligence (AI)-focused data centres and is already making progress in that area.

2 mins

November 28, 2025

Mint Mumbai

It's a multi-horse Street race now as Smids muscle in

For years, India’s stock market ran on the shoulders of a few giants. Not anymore.

3 mins

November 28, 2025

Mint Mumbai

Telecom firms flag hurdles in data privacy compliance

Operators need to comply with the data protection norms within 12-18 months

1 mins

November 28, 2025

Listen

Translate

Change font size