Intentar ORO - Gratis

Diversification holds the key to reducing our trade vulnerability

Mint New Delhi

|November 28, 2025

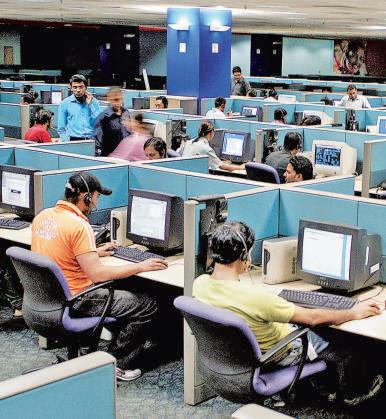

India's merchandise exports are less exposed to US policy vagaries than services. The latter need to find new export markets

India, like the rest of the world, is navigating its way through exceptionally uncertain times.

Much of this uncertainty is attributable to the quixotic policies and flip-flops of US President Donald Trump. The US is the largest economy in the world, accounting for about a fourth of global GDP in nominal terms and Trump is the most powerful man in the world. His executive orders, dealing with the US as much as with its global strategic and trade policies, whether legal or not, unleash waves of turmoil almost daily. We need to minimize our exposure to such turmoil.

A major source of India’s current exposure to such turmoil is its trade relations with the US. Official-level discussions on the trade agreement being negotiated are over. But without President Trump's approval, the shape of the final agreement is not clear. Given that, it is important to be clear about our vulnerabilities and options to minimize such vulnerabilities. As we pointed out in the midterm review of the economy by National Institute of Public Finance and Policy (NIPFP) on 11 November, India’s goods exports to the US are quite limited. About 80% of India’s merchandise exports are to other countries and have no exposure to the US. Of our five largest merchandise exports, 70% go to other countries.

Esta historia es de la edición November 28, 2025 de Mint New Delhi.

Suscríbete a Magzter GOLD para acceder a miles de historias premium seleccionadas y a más de 9000 revistas y periódicos.

¿Ya eres suscriptor? Iniciar sesión

MÁS HISTORIAS DE Mint New Delhi

Mint New Delhi

Sebi now trains sights on commodity derivatives

Following clampdown on equity derivatives after studies revealed steep retail losses, the stock market regulator is turning its attention to the commodity derivatives segment (CDS).

2 mins

November 28, 2025

Mint New Delhi

Refiners, SCI tap Korean giants for local shipyard

Indian Oil, Bharat Petroleum and Hindustan Petroleum are part of the discussions

4 mins

November 28, 2025

Mint New Delhi

360 One, Steadview, others to invest in Wakefit ahead of IPO

A clutch of firms, including 360 One, Steadview Capital, WhiteOak Capital and Info Edge, is expected to invest in home-furnishings brand Wakefit Innovations Ltd just ahead of its initial public offering (IPO) next month, three people familiar with the matter said.

3 mins

November 28, 2025

Mint New Delhi

Would you like to be interviewed by an AI bot instead?

I don't think I want to be interviewed by a human again,\" said a 58-year-old chartered accountant who recently had an interview with a multinational company.

3 mins

November 28, 2025

Mint New Delhi

India, UAE review trade agreement to ease market access

Officials of India and the United Arab Emirates (UAE) met on Thursday to review how the Comprehensive Economic Partnership Agreement (CEPA) is working, and remove frictions that may be impeding trade between the two nations.

1 mins

November 28, 2025

Mint New Delhi

It's a multi-horse Street race now as Smids muscle in

For years, India’s stock market ran on the shoulders of a few giants. Not anymore.

3 mins

November 28, 2025

Mint New Delhi

The curious case of LIC's voting on RIL, Adani resolutions

Life Insurance Corp. of India Ltd, or LIC, consistently approved or never opposed resolutions proposed before shareholders of Reliance Industries Ltd (RIL) or any Adani Group company since 1 April 2022, even as it rejected several similar proposals at other large companies, some even part of other conglomerates, a Mint review of about 9,000 voting decisions by the government-run insurer showed.

8 mins

November 28, 2025

Mint New Delhi

Investors expect AI use to soar. That's not happening

On November 20th American statisticians released the results of a survey. Buried in the data is a trend with implications for trillions of dollars of spending.

4 mins

November 28, 2025

Mint New Delhi

CANADA'S STARTUP VISA: PUTTING LIVES ON HOLD

Legal uncertainty has left entrepreneurs stuck despite building businesses and putting down roots

8 mins

November 28, 2025

Mint New Delhi

Gupta pilfered from fraud, Trafigura says

Commodity trader Trafigura's lawyers accused Indian businessman Prateek Gupta on Thursday of siphoning off funds from an alleged $600 million metals fraud to prop up his struggling business empire.

1 min

November 28, 2025

Listen

Translate

Change font size