Prøve GULL - Gratis

Diversification holds the key to reducing our trade vulnerability

Mint New Delhi

|November 28, 2025

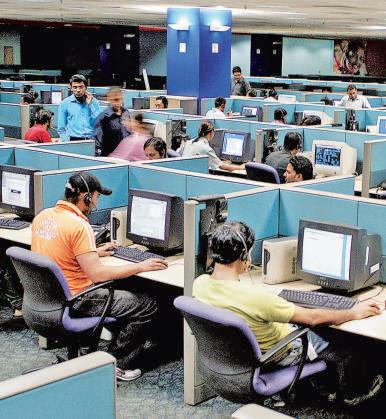

India's merchandise exports are less exposed to US policy vagaries than services. The latter need to find new export markets

India, like the rest of the world, is navigating its way through exceptionally uncertain times.

Much of this uncertainty is attributable to the quixotic policies and flip-flops of US President Donald Trump. The US is the largest economy in the world, accounting for about a fourth of global GDP in nominal terms and Trump is the most powerful man in the world. His executive orders, dealing with the US as much as with its global strategic and trade policies, whether legal or not, unleash waves of turmoil almost daily. We need to minimize our exposure to such turmoil.

A major source of India’s current exposure to such turmoil is its trade relations with the US. Official-level discussions on the trade agreement being negotiated are over. But without President Trump's approval, the shape of the final agreement is not clear. Given that, it is important to be clear about our vulnerabilities and options to minimize such vulnerabilities. As we pointed out in the midterm review of the economy by National Institute of Public Finance and Policy (NIPFP) on 11 November, India’s goods exports to the US are quite limited. About 80% of India’s merchandise exports are to other countries and have no exposure to the US. Of our five largest merchandise exports, 70% go to other countries.

Denne historien er fra November 28, 2025-utgaven av Mint New Delhi.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Mint New Delhi

Mint New Delhi

Sebi now trains sights on commodity derivatives

Following clampdown on equity derivatives after studies revealed steep retail losses, the stock market regulator is turning its attention to the commodity derivatives segment (CDS).

2 mins

November 28, 2025

Mint New Delhi

Investors expect AI use to soar. That's not happening

On November 20th American statisticians released the results of a survey. Buried in the data is a trend with implications for trillions of dollars of spending.

4 mins

November 28, 2025

Mint New Delhi

CANADA'S STARTUP VISA: PUTTING LIVES ON HOLD

Legal uncertainty has left entrepreneurs stuck despite building businesses and putting down roots

8 mins

November 28, 2025

Mint New Delhi

Gupta pilfered from fraud, Trafigura says

Commodity trader Trafigura's lawyers accused Indian businessman Prateek Gupta on Thursday of siphoning off funds from an alleged $600 million metals fraud to prop up his struggling business empire.

1 min

November 28, 2025

Mint New Delhi

Why TCS is walking a tightrope

Tata Consultancy Services Ltd recently outlined an ambitious multiyear $6-7 billion investment plan to build artificial intelligence (AI)-focused data centres and is already making progress in that area.

2 mins

November 28, 2025

Mint New Delhi

Can a dictionary make sustainability simpler?

A new guide aims to bring clarity to sustainability in fashion but it has to be available to everyone, from designers to customers

3 mins

November 28, 2025

Mint New Delhi

Of Marathi plays, picnic in the park

A Mint guide to what's happening in and around your city

1 min

November 28, 2025

Mint New Delhi

Beyond the stock slump—Kaynes’ $1 bn aim is just the start

Shares of Kaynes Technology India Ltd have fallen about 25% from their peak of ₹7,705 in October, amid a management reshuffle and the expiry of the lock-in period for pre-IPO shareholders.

1 mins

November 28, 2025

Mint New Delhi

Avaada to invest ₹1 trillion in 5 years

Renewables-focused Avaada Group is aiming to invest ₹1 trillion across the country over the next five years as part of its expansion into both power generation and associated businesses.

1 min

November 28, 2025

Mint New Delhi

VentureSoul closes first debt fund at ₹300 crore

VentureSoul Partners has announced the close of its maiden debt fund at ₹300 crore, with plans to raise an additional ₹300 crore through a green shoe option by February 2026.

1 min

November 28, 2025

Listen

Translate

Change font size