Intentar ORO - Gratis

How China secretly pays Iran for oil and avoids U.S. sanctions

Mint Chennai

|October 07, 2025

Hidden arrangement secured by prominent Chinese insurer connects Tehran with its biggest customer

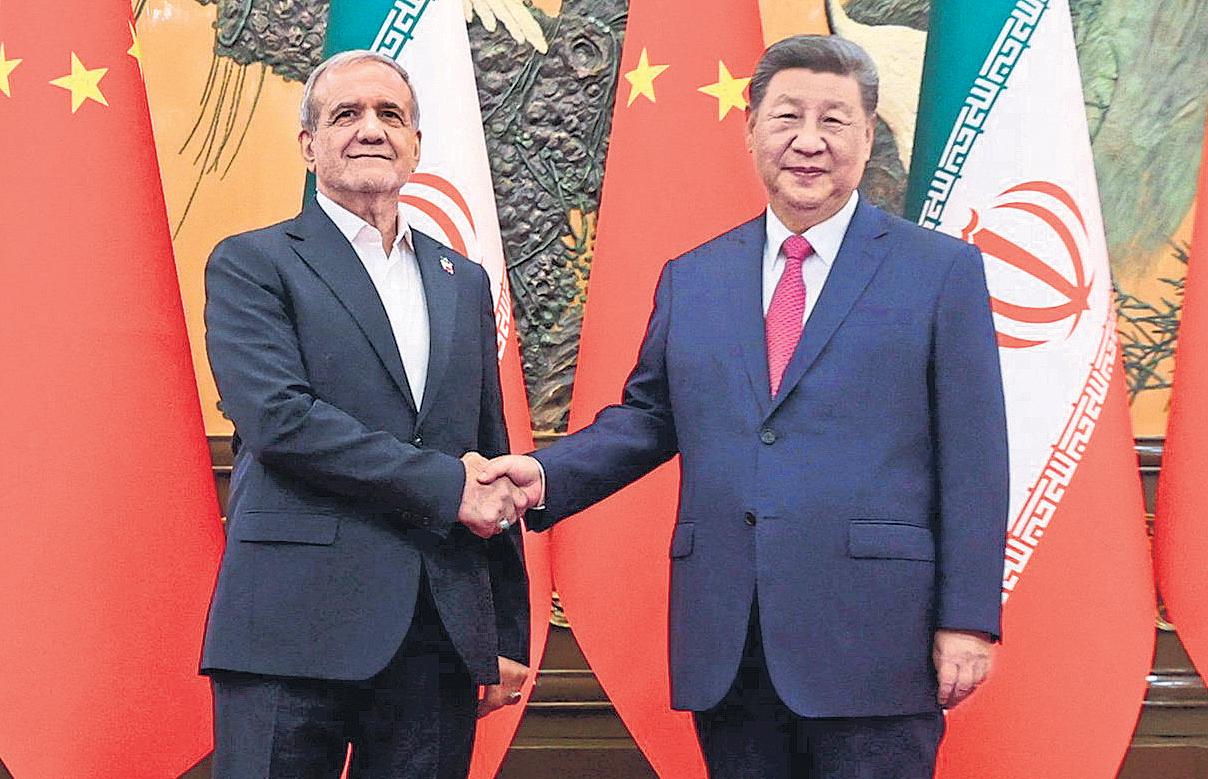

In September, Chinese leader Xi Jinping (right) hosted Iranian President Masoud Pezeshkian at a multinational summit. REUTERS

(REUTERS)

U.S. sanctions make it nearly impossible to pay Iran for its oil. China has figured out how to do it anyway, in an arrangement that has largely been secret.

The hidden funding conduit has deepened economic ties between the two U.S. rivals in defiance of Washington’s efforts to isolate Iran.

The barter-like system works like this, according to current and former officials from several Western countries, including the U.S.: Iranian oil is shipped to China—Tehran’s biggest customer—and, in return, state-backed Chinese companies build infrastructure in Iran.

Completing the loop, the officials say, are a Chinese state-owned insurer that calls itself the world's largest export-credit agency and a Chinese financial entity that is so secretive that its name couldn't be found on any public list of Chinese banks or financial firms.

The arrangement, by sidestepping the international banking system, has provided a lifeline to Iran’s sanctions-squeezed economy. Up to $8.4 billion in oil payments flowed through the funding conduit last year to finance Chinese work on large infrastructure projects in Iran, according to some of the officials.

Iran exported $43 billion of mainly crude oil last year, according to estimates by the U.S. Energy Information Administration. Western officials estimate that around 90% of those exports go to China.

China has been the predominant buyer of Iranian oil since 2018, when President Trump pulled the U.S. out of the 2015 nuclear accord and reimposed U.S. sanctions.

Two weeks after returning to office, Trump ordered the use of “maximum pressure” to force Tehran to curb its nuclear program and end support for allied militia groups. The directive sought to drive Iranian oil exports to zero.

Esta historia es de la edición October 07, 2025 de Mint Chennai.

Suscríbete a Magzter GOLD para acceder a miles de historias premium seleccionadas y a más de 9000 revistas y periódicos.

¿Ya eres suscriptor? Iniciar sesión

MÁS HISTORIAS DE Mint Chennai

Mint Chennai

What went into quadrupling Jio Payments Bank's footprint

Jio Payments Bank Ltd is aggressively expanding its sales network to catch up with market leader Airtel Payments Bank, with the aim of using this wider reach to acquire customers for its more profitable financial products.

2 mins

November 25, 2025

Mint Chennai

British cosmetic co Lush re-enters India

British cosmetics retailer Lush, which is reentering India after close to three decades, looks to tap the fast-growing luxury segment in beauty & personal care and expects the country to be among its top 10 global markets in the next 3-5 years, its co-founder Rowena Bird said.

1 min

November 25, 2025

Mint Chennai

AI ignites the return of Bezos the inventor

‘Tm the least retired person in the world,’ Amazon founder says

4 mins

November 25, 2025

Mint Chennai

Diwali is past, but shopping season is roaring ahead

India's consumption engine appears to be humming well past the Diwali rush, with digital payments showing none of the usual post-festival fatigue.

1 min

November 25, 2025

Mint Chennai

Let digital links and AI fix gaps in power grids as they go green

Digital interoperability and AI can deliver energy efficiency and resilience against transition shocks

3 mins

November 25, 2025

Mint Chennai

TCS, Wipro US patent suits worsen IT's woes

Two of the country’s largest information technology (IT) services companies—Tata Consultancy Services Ltd and Wipro Ltd—faced fresh patent violations in the last 45 days, signalling challenges to their expansion of service offerings.

1 min

November 25, 2025

Mint Chennai

Quality control orders: Let's fix all distortions

Dropping QCOs that act as import barriers for factory inputs will help reduce costs but India should also tackle other distortive aspects of our trade policy that do the economy a disservice

2 mins

November 25, 2025

Mint Chennai

SC clears Sandesarass after ₹5,100-crore settlement deal

Court drops all criminal proceedings against Sterling Biotech promoters in a bank fraud case

3 mins

November 25, 2025

Mint Chennai

Sunteck in Dubai with ₹10,000-cr luxe project

Sunteck Realty Ltd has ventured into the Dubai property market with a ₹10,000-crore luxury project in the prime Downtown Dubai area, at a time when the city is witnessing a surge in demand for high-end properties.

1 min

November 25, 2025

Mint Chennai

Govt plans reform push in winter session

The government is preparing to push a packed reform agenda through parliament's short winter session that will start 1 December, with 15 sittings scheduled to clear major legislations tied to crucial issues, including ease of doing business, regulatory consolidation, foreign investment, and sectoral reforms.

1 mins

November 25, 2025

Listen

Translate

Change font size