試す 金 - 無料

How China secretly pays Iran for oil and avoids U.S. sanctions

Mint Chennai

|October 07, 2025

Hidden arrangement secured by prominent Chinese insurer connects Tehran with its biggest customer

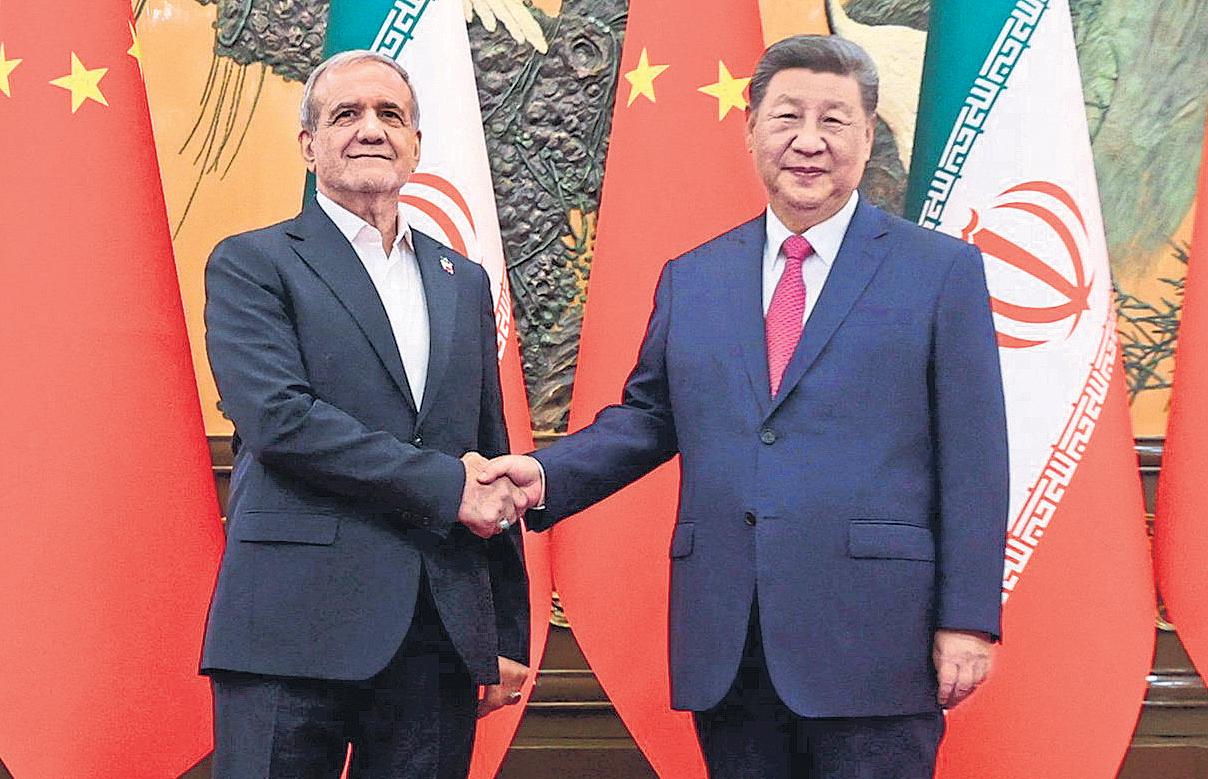

In September, Chinese leader Xi Jinping (right) hosted Iranian President Masoud Pezeshkian at a multinational summit. REUTERS

(REUTERS)

U.S. sanctions make it nearly impossible to pay Iran for its oil. China has figured out how to do it anyway, in an arrangement that has largely been secret.

The hidden funding conduit has deepened economic ties between the two U.S. rivals in defiance of Washington’s efforts to isolate Iran.

The barter-like system works like this, according to current and former officials from several Western countries, including the U.S.: Iranian oil is shipped to China—Tehran’s biggest customer—and, in return, state-backed Chinese companies build infrastructure in Iran.

Completing the loop, the officials say, are a Chinese state-owned insurer that calls itself the world's largest export-credit agency and a Chinese financial entity that is so secretive that its name couldn't be found on any public list of Chinese banks or financial firms.

The arrangement, by sidestepping the international banking system, has provided a lifeline to Iran’s sanctions-squeezed economy. Up to $8.4 billion in oil payments flowed through the funding conduit last year to finance Chinese work on large infrastructure projects in Iran, according to some of the officials.

Iran exported $43 billion of mainly crude oil last year, according to estimates by the U.S. Energy Information Administration. Western officials estimate that around 90% of those exports go to China.

China has been the predominant buyer of Iranian oil since 2018, when President Trump pulled the U.S. out of the 2015 nuclear accord and reimposed U.S. sanctions.

Two weeks after returning to office, Trump ordered the use of “maximum pressure” to force Tehran to curb its nuclear program and end support for allied militia groups. The directive sought to drive Iranian oil exports to zero.

このストーリーは、Mint Chennai の October 07, 2025 版からのものです。

Magzter GOLD を購読すると、厳選された何千ものプレミアム記事や、10,000 以上の雑誌や新聞にアクセスできます。

すでに購読者ですか? サインイン

Mint Chennai からのその他のストーリー

Mint Chennai

Al nostalgia has a new generation loving the 1980s

The baffling popularity of Al-generated 80's videos and other news this week

1 min

November 26, 2025

Mint Chennai

Apple iPhone 17 vs Google Pixel 10: a ₹80,000 close call

In a face-off between the iPhone 17 and Google Pixel 10, find out which flagship phone deserves your investment

3 mins

November 26, 2025

Mint Chennai

IndoSpace Core acquires six logistics parks for over $300 mn

IndoSpace Core, a joint venture between the Canada Pension Plan Investment Board, or CPP Investments, and IndoSpace, has acquired six industrial and logistics parks valued at over $300 million.

1 min

November 26, 2025

Mint Chennai

India’s first privately made PSLV is close to lift-off

handling the core hardware manufacturing part of the deal, and if all goes well, we should see multiple PSLV launches in 2026 itself,” said Amit Ramchandani, senior vice-president and head of precision engineering and systems at L&T, confirming the launch timeline.

2 mins

November 26, 2025

Mint Chennai

Let ‘nowcasts’ precede our economic numbers

‘Nowcasting’ that captures data from early indicators could aid policymaking, especially in the face of high economic uncertainty. But it must supplement existing data, not supplant it

2 mins

November 26, 2025

Mint Chennai

Businesses mustn't wait for a global climate consensus

This year’s United Nations climate summit in Belém, Brazil, ended last week. Countries made promises on paper and avoided hard decisions. Having gathered nearly 200 nations to chart out climate action, CoP-30 produced a ‘Belém Political Package’ that deferred questions rather than answer them. We should not pretend that this is progress.

3 mins

November 26, 2025

Mint Chennai

Ore shortage hits Adani copper plant

Indian tycoon Gautam Adani’s $1.2 billion copper smelter in Gujarat is receiving only a fraction of the ore required to operate the 500,000-tonne-a-year plant at full capacity, as a global supply squeeze tightens.

1 min

November 26, 2025

Mint Chennai

New emission norms for small tractors likely to be deferred

The Centre is set to give Indian tractor makers major relief by delaying the rollout of the next phase of emission rules—the Tractor and Machinery Emission Standards V (TREM V)—for tractors below 50 horsepower (HP), two officials told Mint.

1 mins

November 26, 2025

Mint Chennai

PPFAS’s new fund to run like an index fund, with an edge

Fund will use futures market discounts, merger opportunities and index-rebalancing tactics

3 mins

November 26, 2025

Mint Chennai

Wipro to enter pet foods with ‘HappyFur’

Wipro Consumer Care and Lighting, the consumer venture of Wipro Enterprises, is set to enter India’s fast-growing pet food market with a new brand, ‘HappyFur’, said three people aware of the plan.

2 mins

November 26, 2025

Listen

Translate

Change font size