INFLECTION POINT

Business Today India

|March 03, 2024

THE INDIA MUTUAL FUND INDUSTRY'S ASSETS HAVE GROWN MANIFOLD IN THE PAST COUPLE OF YEARS, ATTRACTING A CLUTCH OF AGGRESSIVE NEW ENTRANTS. WILL THE DREAM RUN CONTINUE? AND HOW WILL THE PLAYERS CO-EXIST?

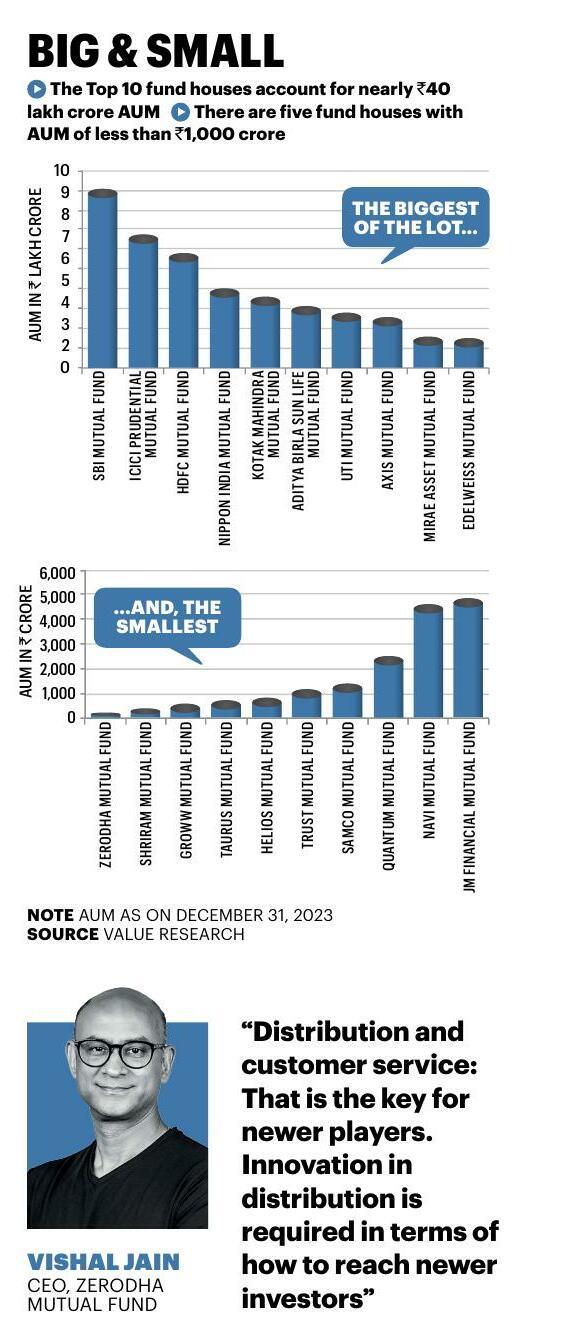

THE INDIAN MUTUAL FUND industry definitely ended 2023 on a high. The industry’s total assets under management (AUM) breached the ₹50-lakh crore mark for the first time.

This was no doubt a big milestone, but what cheered the industry even more was the time it had taken to reach this milestone. The industry’s AUM first crossed the ₹10-lakh crore mark way back in May 2014. It doubled three years later, in August 2017. Three years later, in November 2020, it touched ₹30 lakh crore. And then the gears shifted, and the next ₹10 lakh crore was added in just two years, followed by the last ₹10 lakh crore in a mere 13 months. Put another way, the mutual fund AUM swelled by ₹40 lakh crore in a little under nine years.

Thanks to this spurt in growth, a large section of industry participants believe that the pace of growth will accelerate further and the industry’s AUM could more than double in four to five years.

What’s the reason for this optimism, one may wonder. It’s simple: The recent feats of the industry have been achieved with just a little over 40 million investors—a big jump from around 19 million in December 2018. Now, compare that with India’s population of 1.4 billion, and you can see why industry officials are bullish on the growth potential here.

It is this large opportunity that has attracted a slew of new players into this space, sparking a paradigm shift hitherto not seen until a couple of years ago. They include a number of new-age technology majors like discount broker Zerodha, PhonePe, Navi, Groww, and Samco. Besides, many older firms from the BFSI space are also making an entry here.

Esta historia es de la edición March 03, 2024 de Business Today India.

Suscríbete a Magzter GOLD para acceder a miles de historias premium seleccionadas y a más de 9000 revistas y periódicos.

¿Ya eres suscriptor? Iniciar sesión

MÁS HISTORIAS DE Business Today India

Business Today India

The Start-up She-shift

Women founders are reshaping India's start-up landscape-breaking biases, defying funding gaps, and proving that entrepreneurship is no longer a space they're expected to enter quietly or temporarily

4 mins

December 21, 2025

Business Today India

The Male Gaze at Work

Can India Inc. truly progress if the male gaze continues to shape women's everyday reality at work?

5 mins

December 21, 2025

Business Today India

Towards Financial Independence

While gold and FDs were once the default option, today's women are exploring MFs, equities, and other financial products

5 mins

December 21, 2025

Business Today India

Clothes Maketh A Woman?

Appearance expectations don't always show up as written dress codes or grooming rules. More often, they seep into culture in quiet but powerful ways

3 mins

December 21, 2025

Business Today India

BEST Management Advice

Learning is a constant process and the world that we live in today demands both un-learning as well as learning. So, work to enhance your skills and build your knowledge

2 mins

December 21, 2025

Business Today India

Transforming Women's Rights

The Labour Codes will not only unlock the untapped potential of the female workforce but also empower women through increased participation in the economy

3 mins

December 21, 2025

Business Today India

Ambition versus Biology

Elective egg freezing once largely a medical necessity-has gradually transformed into a planned step in long-term career and life strategy

4 mins

December 21, 2025

Business Today India

The Silent LOAD

Women are climbing the career ladder, but invisible burdens and structural barriers are still weighing them down

5 mins

December 21, 2025

Business Today India

Understanding Egg Freezing

For many, egg freezing is not about delaying motherhood; it is about keeping a door open

3 mins

December 21, 2025

Business Today India

A Bigger Canvas

For Ritu Gangrade Arora, Country Head- India, Allianz Services Pvt Ltd, the latest venture seems like a new beginning

2 mins

December 21, 2025

Listen

Translate

Change font size