Opportunities and Risk for Traditional Banks in Embracing Open Banking

BANKING FINANCE

|February 2025

Technology has simplified our lives by making the processes easier and integrating into our daily routines.

-

Today we cannot imagine making payments without using UPI, that's the impact technology had on the payment systems. UPI has achieved such rapid success in a short period.

Technology has simplified our lives by making the processes easier and integrating into our daily routines. Today we cannot imagine making payments without using UPI, that's the impact technology had on the payment systems. UPI has achieved such rapid success in a short period. The total number of payments done through UPI channel for 23-24 stands at 13.11 trillion which is around 80% of the total digital payments made in India during the period. Beyond its user-friendly interface, it's the interoperability of UPI that stands out as a game changer.

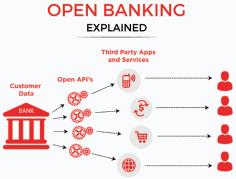

A major credit for the growth of instruments like UPI goes to the Open Banking. It has helped in connecting traditional banks and innovative FinTechs through APIs to provide solutions for payments, lending, investing etc. Open banking has fostered an era of collaboration between the banks and FinTechs. It has been a win-win for all i.e. Banks, FinTechs, and customers.

A major credit for the growth of instruments like UPI goes to the Open Banking. It has helped in connecting traditional banks and innovative FinTechs through APIs to provide solutions for payments, lending, investing etc. Open banking has fostered an era of collaboration between the banks and FinTechs. It has been a win-win for all i.e. Banks, FinTechs, and customers. What is Open Banking?

Open Banking refers to access to the customer data of the banks to third-party developers and service providers via APIs to develop and offer competitive products and services. The sharing of data to the third party API is solely based on the discretion/consent of the customer. The concept originated around 2007 with the European Union's implementation of the "Payment Services Directive" (PSD), creating uniform payment solutions across EU nations. After that in 2015, "Payment Services Directive 2" (PSD 2) was introduced, to widen the scope of payment systems. In India, open banking began with RBI establishing an entity called "Account Aggregator (AA)" in 2016.

Esta historia es de la edición February 2025 de BANKING FINANCE.

Suscríbete a Magzter GOLD para acceder a miles de historias premium seleccionadas y a más de 9000 revistas y periódicos.

¿Ya eres suscriptor? Iniciar sesión

MÁS HISTORIAS DE BANKING FINANCE

BANKING FINANCE

India's Fiscal Discipline: A Path to Economic Stability and Growth

A fiscal deficit occurs when a government's total expenditures exceed its total revenues, excluding money from borrowings, within a specific fiscal period, usually a year. It essentially indicates that the government is spending more than it is earning from taxes and other sources of income.

5 mins

December 2025

BANKING FINANCE

Synergistic Financing: Unlocking Co- Lending Potential

Co-lending is an arrangement where multiple lenders, typically a bank and a Non-Banking Financial Company (NBFC), partner to provide loans to borrowers. This helps increase lending capacity and reduces risk for individual lenders. Each lender sets their own terms and conditions.

11 mins

December 2025

BANKING FINANCE

Tackling Trade-Based Money Laundering in the Modern Financial Landscape

TBML schemes can also involve misrepresenting the price, quantity, or type of goods or services in trade transactions. In misrepresentation schemes, the parties involved in the trade transaction may under or over invoice goods or services; issue multiple invoices for the same goods or services.

5 mins

December 2025

BANKING FINANCE

Axis Mutual Fund debuts micro-investment feature for first-time investors

Axis Mutual Fund has introduced an industry-first micro-investment option enabling new investors to start SIPS with as little as Rs. 100 per scheme.

1 min

December 2025

BANKING FINANCE

PPFAS Mutual Fund explains rationale behind proposed large-cap fund launch

PPFAS Mutual Fund, known for its conservative and product-lite approach, has filed draft documents with SEBI to launch a large-cap fund.

1 min

December 2025

BANKING FINANCE

Domestic pension fund flows into equities hit record high

Domestic pension funds have made their highest-ever net investment in Indian equities, deploying Rs. 41,242 crore during the first nine months of 2025, NSE data shows.

1 min

December 2025

BANKING FINANCE

SC asks Centre to adopt blockchain for property registrations

The Supreme Court said property transactions in India were \"traumatic\" and asked the Centre to take the lead in adopting blockchain technology to make the registration process seamless nationwide.

1 min

December 2025

BANKING FINANCE

NCDEX gets final board approval to launch mutual fund distribution platform

The National Commodity and Derivatives Exchange (NCDEX) has received board approval to roll out an electronic mutual fund distribution platform, sources told Bloomberg.

1 min

December 2025

BANKING FINANCE

Kerala Bank: Mohanan elected President of Asia's largest Co-op Bank

CPI (M) leader P. Mohanan Master from Kozhikode has been elected as the President of Asia's largest cooperative bank, the Kerala State Cooperative Bank (Kerala Bank).

1 min

December 2025

BANKING FINANCE

Passive fund AUM rises 5% to Rs. 13.67 lakh crore on strong gold ETF inflows

Passive fund assets grew 5.2% in October to Rs. 13.67 lakh crore, driven largely by inflows into precious metal ETFs, according to AMFI's monthly note.

1 min

December 2025

Listen

Translate

Change font size