Versuchen GOLD - Frei

Opportunities and Risk for Traditional Banks in Embracing Open Banking

BANKING FINANCE

|February 2025

Technology has simplified our lives by making the processes easier and integrating into our daily routines.

-

Today we cannot imagine making payments without using UPI, that's the impact technology had on the payment systems. UPI has achieved such rapid success in a short period.

Technology has simplified our lives by making the processes easier and integrating into our daily routines. Today we cannot imagine making payments without using UPI, that's the impact technology had on the payment systems. UPI has achieved such rapid success in a short period. The total number of payments done through UPI channel for 23-24 stands at 13.11 trillion which is around 80% of the total digital payments made in India during the period. Beyond its user-friendly interface, it's the interoperability of UPI that stands out as a game changer.

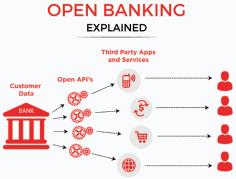

A major credit for the growth of instruments like UPI goes to the Open Banking. It has helped in connecting traditional banks and innovative FinTechs through APIs to provide solutions for payments, lending, investing etc. Open banking has fostered an era of collaboration between the banks and FinTechs. It has been a win-win for all i.e. Banks, FinTechs, and customers.

A major credit for the growth of instruments like UPI goes to the Open Banking. It has helped in connecting traditional banks and innovative FinTechs through APIs to provide solutions for payments, lending, investing etc. Open banking has fostered an era of collaboration between the banks and FinTechs. It has been a win-win for all i.e. Banks, FinTechs, and customers. What is Open Banking?

Open Banking refers to access to the customer data of the banks to third-party developers and service providers via APIs to develop and offer competitive products and services. The sharing of data to the third party API is solely based on the discretion/consent of the customer. The concept originated around 2007 with the European Union's implementation of the "Payment Services Directive" (PSD), creating uniform payment solutions across EU nations. After that in 2015, "Payment Services Directive 2" (PSD 2) was introduced, to widen the scope of payment systems. In India, open banking began with RBI establishing an entity called "Account Aggregator (AA)" in 2016.

Diese Geschichte stammt aus der February 2025-Ausgabe von BANKING FINANCE.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON BANKING FINANCE

BANKING FINANCE

The Race for the Super App: Will India's BFSI Ecosystem Converge?

The concept of a Super App has its roots primarily in Asia. The term is often credited to refer to platforms that began with one core function (messaging, ride-hailing, payments) and then expanded to offer a portfolio of services accessed through the same interface. For example, WeChat in China began as a messaging app and evolved into payments, e-commerce, ride-hailing, mini-programs and more.

11 mins

January 2026

BANKING FINANCE

Digital Sustainability

ESG initiatives are vital for organizations aiming to achieve long-term sustainability, resilience, and stakeholder trust. They help businesses address pressing environmental challenges, such as carbon emissions, resource scarcity, and climate change, while ensuring ethical governance and social inclusion.

11 mins

January 2026

BANKING FINANCE

Ravi Ranjan appointed SBI managing director, to oversee risk and stressed assets

State Bank of India (SBI) has appointed Ravi Ranjan as its Managing Director with effect from December 15, 2025, according to a regulatory filing by the country's largest public sector lender.

1 min

January 2026

BANKING FINANCE

Reserve Bank News

Reserve Bank of India has appointed Usha Janakiraman as Executive Director with effect from December 1, 2025, according to an official release issued by the central bank. Her appointment comes just days ahead of the Monetary Policy Committee (MPC) meeting scheduled for December 3.

7 mins

January 2026

BANKING FINANCE

Mutual Fund News

Children's mutual funds, once a niche investment option, are increasingly becoming a mainstream tool for long-term financial planning in Indian households, especially for education-related goals.

7 mins

January 2026

BANKING FINANCE

Co-Operative Bank News

As per the Reserve Bank of India's Report on Trend and Progress of Banking in India 2024-25, State Cooperative Banks (StCBs) and District Central Cooperative Banks (DCCBs), which together constitute the short-term rural cooperative credit structure, reported steady balance sheet expansion, sustained growth in deposits and advances, and improving asset quality during 2024-25.

2 mins

January 2026

BANKING FINANCE

Legal News

Foreign firms can't claim full deduction for head of- fice expenses on Indian biz: SC

5 mins

January 2026

BANKING FINANCE

Banks unlikely to cut deposit and MCLR rates despite RBI repo rate reduction

Despite the Reserve Bank of India delivering a 25 basis points cut in the repo rate last week, banks are unlikely to reduce term deposit rates or marginal cost of funds-based lending rates (MCLR) aggressively, according to senior bankers.

1 min

January 2026

BANKING FINANCE

Government to divest up to 3% stake in Indian Overseas Bank via OFS

Shares of Indian Overseas Bank (IOB) came under selling pressure after the Government of India announced plans to divest up to 3% of its equity through an Offer for Sale (OFS).

1 min

January 2026

BANKING FINANCE

Unclaimed bank deposits in India more than double in five years

India's unclaimed bank deposits have more than doubled over the past five years, rising to Rs. 67,004 crore as on June 30, 2025, from Rs. 27,824 crore at the end of FY21, highlighting a growing challenge for the banking system.

1 min

January 2026

Listen

Translate

Change font size