Try GOLD - Free

Lenskart IPO today, in test of ₹70,000 cr valuation

Mint New Delhi

|October 31, 2025

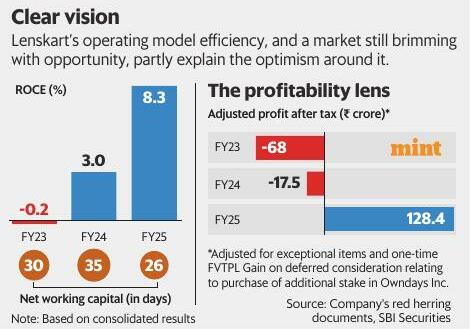

As Lenskart opens its initial public offering (IPO) today, gunning for a near-₹70,000 crore valuation, it is set to test investor appetite for one of India's most celebrated new-age consumer-tech stories. The Street is divided-sceptics call the price stretched, but believers bet on 20-30% gains in short term.

For founder Peyush Bansal, it's the culmination of a 17-year journey from startup to eye-wear powerhouse. For investors, it's a matter of how much of that vision is in the price.

In July, Bansal bought 17 million shares at ₹52 apiece, raising his stake from 9.3% to 10.3%, giving early investors a partial exit at a valuation of just 8,741 crore. Earlier in June, Fidelity had valued the company at $6.1 billion, although the two values are not exactly comparable, as Bansal's share purchase was in lieu of Esops that he couldn't take as he was tagged a promoter.

At the top of its *382-402 price band for the initial public offering (IPO), Lenskart seeks a 69,742 crore ($8 billion) valuation-roughly 31% higher than Fidelity's June estimate.

That jump is hard to ignore.

At 402 per share, the valuation implies a steep earnings multiple and is a rich ask for a company that only turned profitable in fiscal year 2025 (FY25), some of which stemmed from accounting changes, according to analysts.

SBI Securities warned the valuation appears stretched, suggesting muted listing gains. The brokerage pegged Lenskart's valuation at 260x annualized QIFY26 earnings, a 12-month forward estimate adjusted for one-off gains.

But if the grey market premium of 27% is any indication, investors are having none of that scepticism.

But if the grey market premium of 27% is any indication, investors are having none of that scepticism.This story is from the October 31, 2025 edition of Mint New Delhi.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM Mint New Delhi

Mint New Delhi

Stride raises $300-mn India, UK, GCC funds

Stride Ventures launched three funds across India, Gulf Cooperation Council and the UK, raising $300 million in the past six months to be deployed in respective territories, top executives at the venture debt platform said.

1 min

November 01, 2025

Mint New Delhi

Berkshire’s new normal: No Buffett shareholder letter and no ‘Buffett premium’

Warren Buffett still has a couple months left as Berkshire Hathaway’s chief executive. The company’s shares are already feeling his absence.

4 mins

November 01, 2025

Mint New Delhi

How the Mughals built their empire on conquest and contracts

This timely book reminds us that the fate of nations has always been written as much in account books as in battles

5 mins

November 01, 2025

Mint New Delhi

Tata, JBM, others eye India’s biggest electric bus tender

Both officials spoke on the condition of anonymity asthe names of the potential bidders arenot public.

2 mins

November 01, 2025

Mint New Delhi

Apple sets India revenue record on iPhone 17 surge

The company has now logged 14 consecutive quarters of record iPhone sales in the country

2 mins

November 01, 2025

Mint New Delhi

The modern traveller's flexiscape route

Travellers are ripping up rigid itineraries and picking destinations that offer it all: rest and adventure, cultural depth and effortless luxury

4 mins

November 01, 2025

Mint New Delhi

Benetton ex-CEO Sridharan to join as Puma India head

Ramprasad Sridharan, former managing director and chief executive of Benetton India, is set to take over as managing director of Puma India, said two people in the know. India is one of the German sportswear retailer's fastest growing markets where it faces rising competition.

2 mins

November 01, 2025

Mint New Delhi

A fanged and toothed creature called hope

Megha Majumdar's second novel, set in a famine-stricken Kolkata of the near future, far surpasses her debut

3 mins

November 01, 2025

Mint New Delhi

Collabs give desi sneakers a burst of speed

Homegrown shoe brands are dropping limited editions that draw on Indian pop culture

3 mins

November 01, 2025

Mint New Delhi

Snapmint secures $125 million from new funding round

Consumer lending platform Snapmint has raised $125 million in a new funding round led by General Atlantic, with participation from Prudent Investment Managers, Kae Capital, Elev8 Venture Partners, and existing angel investors, the company said in a statement.

1 mins

November 01, 2025

Listen

Translate

Change font size