Try GOLD - Free

Trump's Tariffs: Why the Trade War Isn't Over for America's Biggest Banks

Mint Mumbai

|April 11, 2025

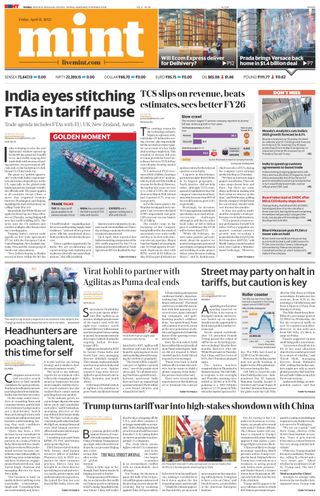

There is a difference between a pause in the fighting and a cease-fire. When it comes to the trade war, that really matters for the biggest U.S. banks.

President Trump's about-face on tariffs Wednesday brought the big banks instant relief after days of intense pain—shares of the big six U.S. banks all soared.

While the move was understandable, banks aren't out of the woods yet. Retaliatory tariffs remain in place against China, the U.S.'s third-largest trading partner. Those could still cause economic dislocation and possibly inflation, which might keep the Federal Reserve in check for some time. Other tariffs are on hold, but only for 90 days.

So investors will still be on edge Friday when banks' earnings season kicks off. Bellwether JPMorgan Chase leads the charge on first-quarter results, and chief Jamie Dimon's economic and business commentary will hold more weight than ever. Wells Fargo and Morgan Stanley also report that day, while the following week brings results from Bank of America, Citigroup, and Goldman Sachs.

Generally, the first-quarter results will be noted but won't matter much. Investors want to know what the outlook is, and if it is even possible to gauge what comes next.

Recession risks are rising but are less acute than when the world was being subjected to the full extent of Trump's tariffs. This means concerns remain around banks' credit risks, or the possibility lenders won't get repaid in full on loans and bondholdings.

Market risks, known and unknown, haven't really diminished, either. Sudden shocks have a way of causing jarring blowups in unforeseen ways, such as the collapse of hedge fund Long-Term Capital Management after Russia's surprise debt default in 1998.

Market volatility can do wonders for revenue on a big bank's trading desk, until it gets so out of hand that liquidity dries up.

This story is from the April 11, 2025 edition of Mint Mumbai.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM Mint Mumbai

Mint Mumbai

Israel to relocate Jews from northeast

Israel’s government has approved a proposal to bring all the remaining 5,800 Jews from India’s northeastern region, commonly referred to as Bnei Menashe, over the next five years.

1 min

November 26, 2025

Mint Mumbai

IndoSpace Core acquires six logistics parks for over $300 mn

IndoSpace Core, a joint venture between the Canada Pension Plan Investment Board, or CPP Investments, and IndoSpace, has acquired six industrial and logistics parks valued at over $300 million.

1 min

November 26, 2025

Mint Mumbai

Businesses mustn't wait for a global climate consensus

This year’s United Nations climate summit in Belém, Brazil, ended last week. Countries made promises on paper and avoided hard decisions. Having gathered nearly 200 nations to chart out climate action, CoP-30 produced a ‘Belém Political Package’ that deferred questions rather than answer them. We should not pretend that this is progress.

3 mins

November 26, 2025

Mint Mumbai

Husk Power aims to raise $400 mn

Husk Power Systems, the world’s biggest solar mini-grid operator, has begun an industry-record capital raise of $400 million as it seeks to grow revenue 10-fold by 2030 and prepare for an initial public offering (IPO).

1 min

November 26, 2025

Mint Mumbai

Don't make AI models but make the most of what exists

Earlier this year, Amazon announced that it was eliminating 4,000 management positions because artificial intelligence (Al) tools had rendered those middle-management roles redundant.

3 mins

November 26, 2025

Mint Mumbai

The Federal Reserve’s tool for calming short-term funding markets is being tested

The Federal Reserve is struggling to persuade some banks to use a lending tool designed to improve the central bank’s control over short-term money markets.

3 mins

November 26, 2025

Mint Mumbai

Wipro to enter pet foods with ‘HappyFur’

Wipro Consumer Care and Lighting, the consumer venture of Wipro Enterprises, is set to enter India’s fast-growing pet food market with a new brand, ‘HappyFur’, said three people aware of the plan.

2 mins

November 26, 2025

Mint Mumbai

KKR strengthens its play in Lighthouse

Private equity firm KKR has made a fresh round of investment in Lighthouse Learning, along with new investor PSP Investments.

1 mins

November 26, 2025

Mint Mumbai

JioMart pulled up for uncertified walkie-talkies

India's top consumer watchdog has held Reliance JioMart guilty of misleading advertisements and unfair trade practices by allowing the sale of uncertified walkie-talkies on its platform, government officials aware of the matter said, in a first such action against an e-commerce portal.

1 mins

November 26, 2025

Mint Mumbai

Old medical history vs current claims: What do Irdai rules say?

My insurer has rejected my claim for acute motor axonal polyneuropathy, citing nondisclosure of resolved 2008 ankylosing spondylitis diagnosis. As it was fully cleared, I didn’t consider it relevant when buying the policy. Can insurers deny the claim on this basis, and what do Irdai rules say?

2 mins

November 26, 2025

Listen

Translate

Change font size