Try GOLD - Free

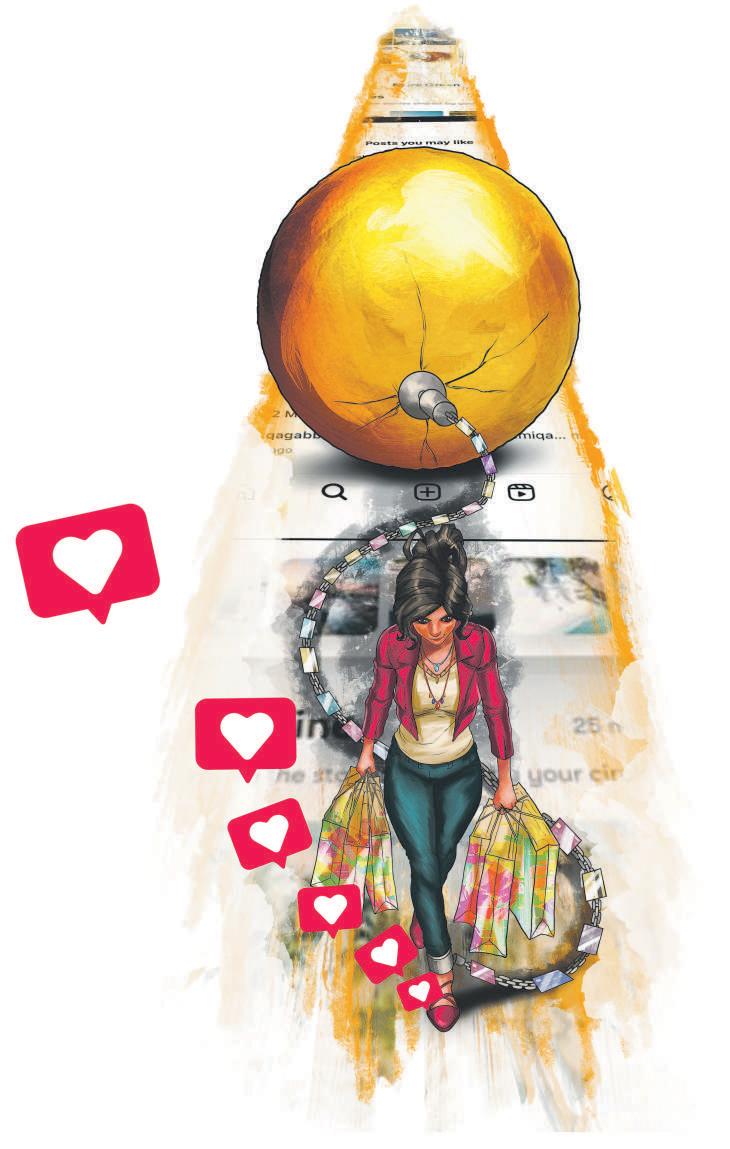

Social Media Debt: Borrowing for the 'Gram

Mint Mumbai

|January 28, 2025

Desperate to look cool, young Indians are taking loans to fund a lifestyle curated for social media

Recently, a marketing professional from Bengaluru was trying to buy a ticket to the Diljit Dosanjh concert. The young woman, who does not want her identity to be revealed, was eyeing a ₹3,000 ticket, but those sold out in minutes. Without batting an eyelid, she booked one in the ₹15,000 VIP section using her credit card.

The 23-year-old admits that she paid almost as much as her monthly rent, but believes her Instagram post on the show will make it all worthwhile. A quick scroll through the woman's account reveals carefully crafted and aesthetically pleasing posts: Prada sunglasses make a regular appearance; other shots include impeccably tailored outfits that scream luxury and a New Year's getaway in Thailand. It's clear that maintaining this image is a priority for her, even if it means regularly ending the month broke or in debt.

While she wishes to be more disciplined with her payments—this year alone, she's been hit with late payment fees twice by her credit card company—and more pragmatic in her purchases, she keeps succumbing to impulse shopping urges. "Like it or not, social media is the real deal for me and everyone in my social circle," says the Bathinda native, who moved to Bengaluru for work a year ago.

The young woman's story, while troubling, is not uncommon. It reflects the rise of 'social media debt'. Driven by the pressure to project a cool image online, young Indians are increasingly taking loans or using credit cards to fund a lifestyle curated for social media. From luxury vacations to pre-wedding shoots done solely for Instagram, youngsters chasing online validation are stuck in a dangerous cycle of hyper-consumerism fuelled by debt.

Shrishti Arora is another case in point. Between her friends and the influencers she follows on Instagram, Arora, a copywriter from Bengaluru, feels a compulsive need to follow a certain lifestyle.

This story is from the January 28, 2025 edition of Mint Mumbai.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM Mint Mumbai

Mint Mumbai

Paint firms strengthen moats as competition heats up

A bruising market-share battle is escalating in India's ₹70,000-crore paints sector, forcing companies to look beyond aggressive discounting and instead strengthen their foothold in key geographical areas while sharpening their product portfolios.

2 mins

November 28, 2025

Mint Mumbai

Telcos slam Trai penalty plan for financial report flaws

Trai has proposed turnover-linked penalties for filing incorrect, incomplete financial reports

2 mins

November 28, 2025

Mint Mumbai

Consumers warm up to Bolt as it aces 10-min hunger games

A year after launch, Bolt is emerging as Swiggy's fastest-scaling bet.

2 mins

November 28, 2025

Mint Mumbai

Doing India’s needy a good turn: Everyone is welcome to pitch in

What may seem weakly linked with positive outcomes on the ground could work wonders over time

3 mins

November 28, 2025

Mint Mumbai

GOING SOLO: FACING THE GROWING REALITY OF SOLITARY RETIREMENT IN INDIA

What we plan for ourselves isn't always what life plans for us.

2 mins

November 28, 2025

Mint Mumbai

Catamaran to boost manufacturing bets

Catamaran is focused on a few areas in manufacturing, such as aerospace

2 mins

November 28, 2025

Mint Mumbai

How the latest labour codes will benefit most employees

Workers may see an increase in some statutory benefits such as gratuity and leave encashment

4 mins

November 28, 2025

Mint Mumbai

Tune into weak signals in a world of data dominance

World War II saw the full fury of air power in battle, first exercised by Axis forces and then by the Allies, culminating in American B-29 bombers dropping atomic bombs on Hiroshima and Nagasaki.

4 mins

November 28, 2025

Mint Mumbai

Investors expect AI use to soar. That's not happening

An uncertain outlook for interest rates. Businesses may be holding off on investment until the fog clears. In addition, history suggests that technology tends to spread in fits and starts. Consider use of the computer within American households, where the speed of adoption slowed in the late 1980s. This was a mere blip before the 1990s, when they invaded American homes.

2 mins

November 28, 2025

Mint Mumbai

Tech startups on M&A route to boost scale, market share

M&As were earlier used to enter new markets or geographies, but that strategy has evolved

2 mins

November 28, 2025

Listen

Translate

Change font size