Try GOLD - Free

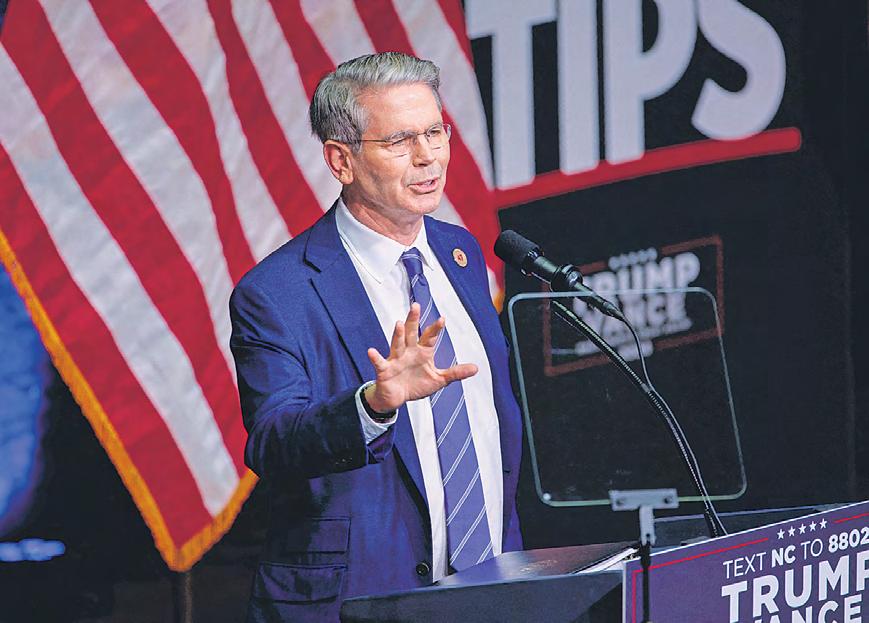

Scott Bessent sees a coming 'global economic reordering.' He wants to be part of it.

Mint Mumbai

|November 26, 2024

Trump's pick for Treasury secretary has been a fierce defender of his activist approach to trade

Scott Bessent spent the past 40 years studying economic history. Now, as Donald Trump's choice to lead the Treasury Department, he has the chance to make his mark on it.

As a hedge-fund manager, first at George Soros's firm and later at his own, Bessent specialized in macro investing, or analyzing geopolitical situations and economic data to wager on big-picture market moves. He generated billions of dollars in profits betting on and against currencies, interest rates, stocks and other asset classes around the world.

He was motivated to step out from behind his desk and get involved with Trump's campaign in part because of a view that time is running out for the U.S. economy to grow its way out of excessive budget deficits and indebtedness.

Around 4:30 p.m. on Friday, Trump called Bessent at his Palm Beach hotel, telling him he was Trump's choice. Bessent left for Mar-a-Lago Club to join Trump, Vice President-elect JD Vance and incoming chief of staff Susie Wiles, where they shook hands and discussed policy strategy.

In his first interview following his selection, Bessent said his policy priority will be to deliver on Trump's various tax-cut pledges. Those include making his first-term cuts permanent, and eliminating taxes on tips, social-security benefits and overtime pay.

Enacting tariffs and cutting spending will also be a focus, he said, as will be "maintaining the status of the dollar as the world's reserve currency."

Bessent became one of Trump's closest advisers by adding depth to his economic proposals and defending his plans for more activist trade policies. He has argued that the president-elect's plans to extend tax cuts and deregulate parts of the U.S. economy would create an "economic lollapalooza."

This story is from the November 26, 2024 edition of Mint Mumbai.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM Mint Mumbai

Mint Mumbai

NBFCs go easy on MSMEs as bad loans begin to bite

Top NBFCs turn cautious as weakness in MSME sector reflects in repayments

4 mins

November 18, 2025

Mint Mumbai

India's music stardom has moved from film sets to feeds

A few verses, a guitar, and an Instagram Reel were enough to catapult Anumita Nadesan into the national spotlight.

2 mins

November 18, 2025

Mint Mumbai

NBFCs go easy on MSMEs as NPAs bite

IFL Finance maintains a \"very cautious status\" on MSMEs and the microfinance business, chief financial officer Kapish Jain told analysts on 31 October, adding the focus is largely on \"recovery and collection.”

2 mins

November 18, 2025

Mint Mumbai

Navi Mumbai to see flights from 25 Dec

Navi Mumbai International Airport (NMIA) will start commercial flight operations from 25 December and initially, there will be 23 scheduled daily departures.

1 min

November 18, 2025

Mint Mumbai

Trump's bets on China and Argentina are souring fast

When it comes to US foreign economic polic policy, President Donald Trump’s administration has two problems on its hands.

3 mins

November 18, 2025

Mint Mumbai

Inox Green loses grid access for 300 MW wind project

Clean energy developer Inox Green Energy Services has lost grid connectivity for its 300 megawatt (MW) wind project in Gujarat after failing to complete it on time, a filing with the power regulator showed.

1 min

November 18, 2025

Mint Mumbai

India-made 40nm chip to power smart meters by June

Cyient Ltd will start supplying a locally patented 40-nanometre (nm) chip to clients building smart electricity meters by June, according to the two top executives.

2 mins

November 18, 2025

Mint Mumbai

Gas for goodwill

Even as India’s exports to the US fell in October, as revealed by trade data issued by the government on Monday, Union petroleum and natural gas minister Hardeep Singh Puri announced the signing of a one-year agreement for the import of 2.2 million tonnes of liquefied petroleum gas (LPG) from America.

1 min

November 18, 2025

Mint Mumbai

Rural demand drives FMCG growth in September quarter

India’s fast-moving consumer goods (FMCG) sector reported a 5.4% rise in September-quarter volumes, which moderated sequentially on account of disruptions related to the transition to new goods and services tax rates, while the value of sales jumped 12.9%, according to data released by consumer intelligence platform NielsenIQ.

1 mins

November 18, 2025

Mint Mumbai

Advent, Warburg join Encube race; promoters may sell stake

Global private equity firms Advent International and Warburg Pincus have joined the race for a stake purchase in contract drug maker Encube Ethicals Pvt.Ltd, three people aware of the development said.

2 mins

November 18, 2025

Listen

Translate

Change font size