Try GOLD - Free

India's GDP Growth Is Impressive: Now Let's Universalize the Gains

Mint Mumbai

|June 12, 2025

The country's uneven economic emergence requires policymakers to focus on shared prosperity as much as overall output

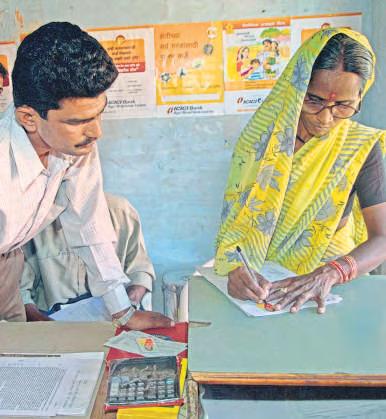

India's climb towards becoming the world's fourth-largest national economy is a defining moment in its development journey. With a national income of ₹336 trillion and aggregate household savings of ₹84 trillion, the country is gaining recognition not just as a large market, but as a rising economic power. Yet, while the numbers impress globally, the reality within reveals an important challenge: ensuring this growth enhances the disposable income and financial well-being of all Indians.

Estimates based on data from the PRICE ICE 360° survey offer valuable insights into how income, consumption, savings and debt are distributed across households. It reveals that India is not one economy, but three.

At the top, the richest 20% of households account for ₹155 trillion in income, save ₹57 trillion and consume just 63.6% of what they earn. In stark contrast, the bottom 20% earn ₹22 trillion but spend ₹23 trillion, resulting in negative savings and the highest debt-to-income ratio of 15.4%. The middle 60%, earning ₹159 trillion and saving ₹28 trillion, are the backbone of consumption but remain economically vulnerable.

These numbers highlight a macro-micro disconnect. India's 25% household saving rate and 11.9% average debt burden appear healthy in aggregate, but are deeply unequal in distribution. Without corrective action, this imbalance could undermine both financial resilience and the long-term stability needed to realize Viksit Bharat, India's vision of becoming a fully developed economy by 2047.

This story is from the June 12, 2025 edition of Mint Mumbai.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM Mint Mumbai

Mint Mumbai

In India's car labs, Chinese models new benchmark

Walk into the vehicle development centre of any major Indian carmaker and you'll find dozens of rival cars stripped to their bones, engineers poring over every exposed circuit, nut and wire. Such 'benchmark-ing' helps companies understand why some models work while others don't, track technology trends, and plan their own vehicle roadmaps.

2 mins

November 17, 2025

Mint Mumbai

Insurance merger plan gets new life

Centre weighs consolidating National, Oriental, United

3 mins

November 17, 2025

Mint Mumbai

India's telecom spectrum: Who actually owns it?

On 13 November, the Supreme Court reserved its order on how spectrum held by Aircel and Reliance Communications (RCom) will be treated under their insolvency proceedings. The decision will bring clarity on whether spectrum can be sold to recover dues. Mint. explores.

2 mins

November 17, 2025

Mint Mumbai

Why are India's rich finally protesting for a better life?

They stood holding English placards, some of which even had commas.

4 mins

November 17, 2025

Mint Mumbai

BJP FACES TWO TESTS: ELECTORAL & FISCAL

The mammoth win in Bihar is done and dusted. Can the Bharatiya Janata Party (BJP) now break into regional bastions in the upcoming state polls in 2026, and can it continue hiking welfare spending to garner votes?

4 mins

November 17, 2025

Mint Mumbai

Resilience spells hope as uncertainty reigns high

As trade-policy turmoil prolongs global uncertainty on an IMF index, we have some bright spots too. India should consider shifting focus from supply-side policies to demand stirrers

2 mins

November 17, 2025

Mint Mumbai

IFC, two others may pick 49% in green H₂ maker Hygenco

The World Bank's International Finance Corp. (IFC), Munich-headquartered Siemens AG, and Singapore's Fullerton Fund Management may acquire at least 49% in Gurugram-based green hydrogen manufacturer Hygenco Green Energies Pvt. Ltd, two people aware of the development said.

4 mins

November 17, 2025

Mint Mumbai

DO YOU OWN PAPER OR GOLD? THE CRITICAL FINE PRINT ON SGBS

Ow Bertie is quite chuffed that he owns Sovereign Gold Bonds (SGBs).

2 mins

November 17, 2025

Mint Mumbai

Financial sector’s report card reveals regulatory gaps

The quinquennial report cards on India’s financial sector have been issued and they present a disturbing picture.

3 mins

November 17, 2025

Mint Mumbai

NEW WAVE OF TECH IPOs LEAVES RETAIL INVESTORS AT RISK

The Indian stock markets are bracing for another wave of what the fashionable set calls 'digital IPOs'.

3 mins

November 17, 2025

Listen

Translate

Change font size