Try GOLD - Free

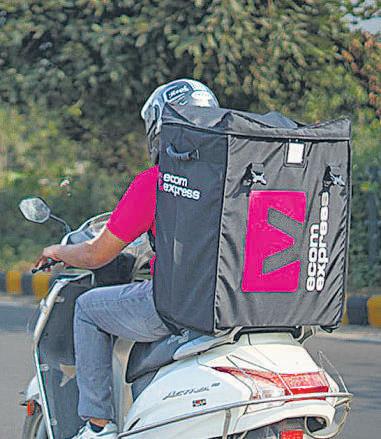

Will Ecom Express Deliver for Delhivery?

Mint Hyderabad

|April 11, 2025

Analysts remain divided on the merits of the purchase, the economies of scale it can generate

It took less than a year for everything to unravel.

In August 2024, India's second largest business-to-consumer (B2C) logistics firm, Ecom Express, filed for an initial public offering. Valuation: nearly ₹7,500 crore.

This month, the company was sold to its biggest competitor, Delhivery, for less than half that amount.

In between, both the companies had an awkward spat via stock exchange filings. Ecom Express had claimed in its draft prospectus that it performed better than the much bigger Delhivery on some key metrics, including cost per parcel. Delhivery countered it by saying Ecom Express may be lying about its numbers.

None of it matters now. Earlier in the year, Ecom Express put its public offering plans on pause and began downsizing aggressively. And by April, it was sold. The biggest reason for its decline is well known: more than half of Ecom Express' revenue came from a single client that most in the industry say is Meesho, the tier-II and -III focused e-commerce platform. In February 2024, Meesho launched its own in-house logistics arm called Valmo and reportedly stopped using Ecom Express' services for most of its shipments.

Bereft of its biggest client, Ecom Express quickly spiralled downwards and could not stick the landing on the best way out: a public listing. Acquisition was the next best outcome for its investors—the list includes PE firm Warburg Pincus and impact fund British International Investment.

It is clear why Ecom Express needed a deal with Delhivery, even at a paltry valuation. With a deal size of ₹1,407 crore, Ecom Express is selling for roughly 0.6x enterprise value-to-sales (EV/sales), based on its financial reporting for FY24.

But what's in it for Delhivery? The market leader has been struggling with profitability and poor market performance since it listed in May 2022. Can acquiring Ecom Express help it navigate the shifts in India's e-commerce logistics business?

This story is from the April 11, 2025 edition of Mint Hyderabad.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM Mint Hyderabad

Mint Hyderabad

Dalmia Bharat’s capacity drive promising, but risks remain

Dalmia Bharat Ltd's focus on capacity expansion could help it regain lost ground.

1 mins

October 24, 2025

Mint Hyderabad

Farm insurance: Time for climate-linked bulk payouts

India's agriculture sector employs nearly half of its population and accounts for about 18% of the country's gross domestic product (GDP).

3 mins

October 24, 2025

Mint Hyderabad

HUL bets on price cuts for sales after GST disruption

Wait for lower prices dampens sales; HUL expects volumes to rise from November

1 mins

October 24, 2025

Mint Hyderabad

Kenya on a budget: Three friends—and a dream safari

Exploring wildlife, secret beaches from Masai Mara to Diani Coast without breaking the bank

4 mins

October 24, 2025

Mint Hyderabad

SMALL STAYS, BIG MARGINS: INSIDE MMT'S PIVOT

MakeMyTrip is leaning on 'constructive paranoia' to counter rivals and the threat of direct booking

7 mins

October 24, 2025

Mint Hyderabad

India plans strict rules for gene therapy

India plans to bring the new generation of medical treatments involving gene and stem cell therapies under strict governmental control as the market for such treatments grows.

1 mins

October 24, 2025

Mint Hyderabad

Auto firms want clean energy to fuel 50% of cars sold by '30

It will require them to increase contribution of clean vehicles ten-fold over the next 5 years

3 mins

October 24, 2025

Mint Hyderabad

India stares at $2.7 bn hit as US sanctions Russian oil cos

Sanctions on Rosneft, Lukoil are likely to force Indian refiners to buy oil from other sources

2 mins

October 24, 2025

Mint Hyderabad

Companies Act changes soon

take a view on it,\" said the person.

1 mins

October 24, 2025

Mint Hyderabad

'My gold and silver are for my children'

Known for his contrarian view and focus on commodities like gold and silver, veteran investor Jim Rogers is cautious and a bit worried.

3 mins

October 24, 2025

Listen

Translate

Change font size