Try GOLD - Free

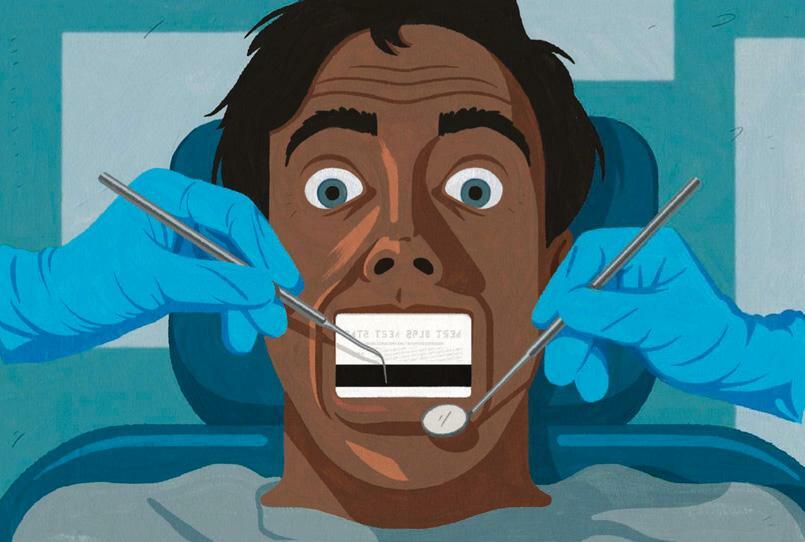

The problem with medical credit cards

TIME Magazine

|February 10, 2025

DAVID ZHAO SIGNED UP FOR A MEDICAL CREDIT CARD while supine in a dentist's chair. In December 2018, the consumer lawyer from Los Angeles went for a routine appointment at Western Dental in San Mateo, in the suburbs of San Francisco. Zhao was told by the dentist that his gums were receding. He needed a special mouth guard or he'd have to have surgery, he recalls being told.

Zhao says that he asked if the mouth guard was covered by insurance, and that office staff said most of the cost was not. Instead, Zhao says, he was told he could sign up for a payment plan used by many of Western Dental's patients. As he lay in the chair, Zhao recalls, an assistant came over with a clipboard and a document for him to initial. Zhao normally would have read each page of the document closely, scrutinizing the terms. But he had fluoride trays in his mouth and was stressed about his gum condition. “In hindsight, it was duress,” he says. After the appointment was over, he recalls, a Western Dental employee gave him a gift bag and escorted him out of the office.

Three weeks later, Zhao got a bill from Synchrony Bank, which owns CareCredit, the largest medical-credit-card company in the U.S. It was for $1,200. Among the charges on the statement, which was reviewed by TIME, were $425 for a mold made of his mouth and $290 for the contents of the gift bag, which included an expensive mechanical toothbrush Zhao says he hadn't requested. But that was just the first surprise. Though the dentist's office had told Zhao he was signing up for a payment plan with no interest, he says, in fact he had signed up for what's known as a deferred-interest credit card, which charges no interest on payments during a promotional period, but imposes hefty fees on top of the original payments if the user doesn't pay off the entire balance within that time.

Zhao says he had to take out a chunk of his savings to pay off the card so he wouldn't be charged 26.99% in deferred interest. “I never want to have anything to do with the dentist ever again,” Zhao says.

This story is from the February 10, 2025 edition of TIME Magazine.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

Listen

Translate

Change font size