Try GOLD - Free

WORLD'S LARGEST COMPANIES

Fortune Asia

|August/September 2024

Our annual list of the world’s largest companies by revenue reflects the eternal tug of war between venerable giants and young upstarts. We visit the German factory where Volkswagen—No. 11 on this year’s Fortune Global 500—is arming itself to vie with Chinese newcomers for electriccar dominance (page 30). We look at the weight-loss-drug windfall that turned 148-year-old Eli Lilly into the world’s most valuable drugmaker (page 36). And we profile India’s HDFC Bank (page 26), a “new age” bank cracking the list after a daring merger. For the full scorecard of winners and losers in global business, head to the Lists (page 44).

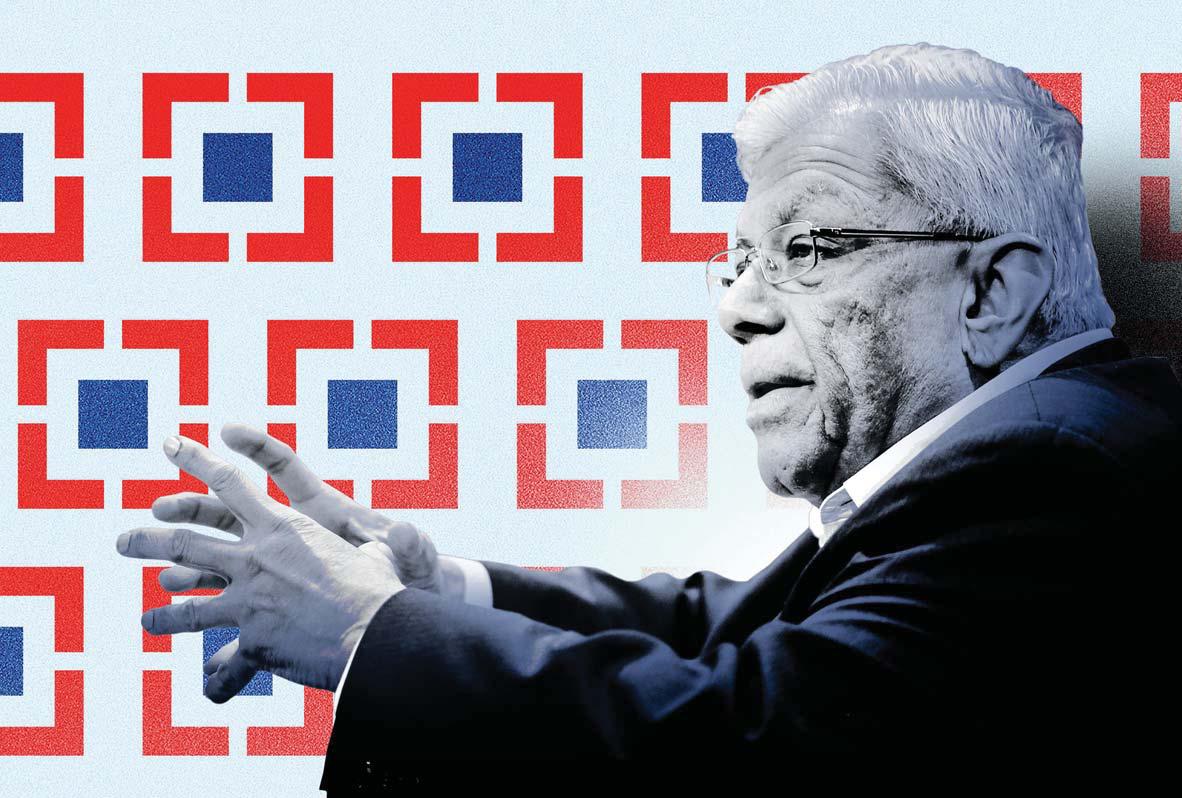

THE POSTER CHILD for India's liberalized banking sector is joining the ranks of the world's largest companies. Mumbai-based HDFC Bank is fresh off last year's $40 billion merger with its parent companya somewhat risky move, but one that reflects the bank's confidence in the continued strength of the Indian consumer class that fueled the rise of both companies.

The bank debuts on the Fortune Global 500 at No. 306, with $49.3 billion in revenue for the 2023 fiscal year, almost double the figure for the previous year. It's the only wholly private bank from India on this year's ranking; State Bank of India, owned by the country's finance ministry, is at No. 178.

HDFC Bank has 93 million customers, more people than the entire population of Germany. With almost 8,800 branches, it has a larger physical footprint than Bank of America's and Wells Fargo's U.S. networks combined (albeit with only 17% of their combined revenue). HDFC Bank is also India's largest bank by market capitalization, at $145 billion in mid-July.

Its size is, in part, the fruit of staying focused. As other banks chased trends like lending to infrastructure projects or telcos-and got stuck with bad loansHDFC Bank focused on providing retail financial products to an army of consumers, building a reputation for credibility and consistency in India's sometimes rough-andtumble banking world. It's "the gold standard when it comes to credit quality," says Suresh Ganapathy, an analyst with Macquarie.

This story is from the August/September 2024 edition of Fortune Asia.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

Listen

Translate

Change font size