Try GOLD - Free

An Empire Shaken

Business Today

|March 24, 2019

Anil Ambani’s Reliance Group is going through one of its toughest times. Can it survive the debt bomb?

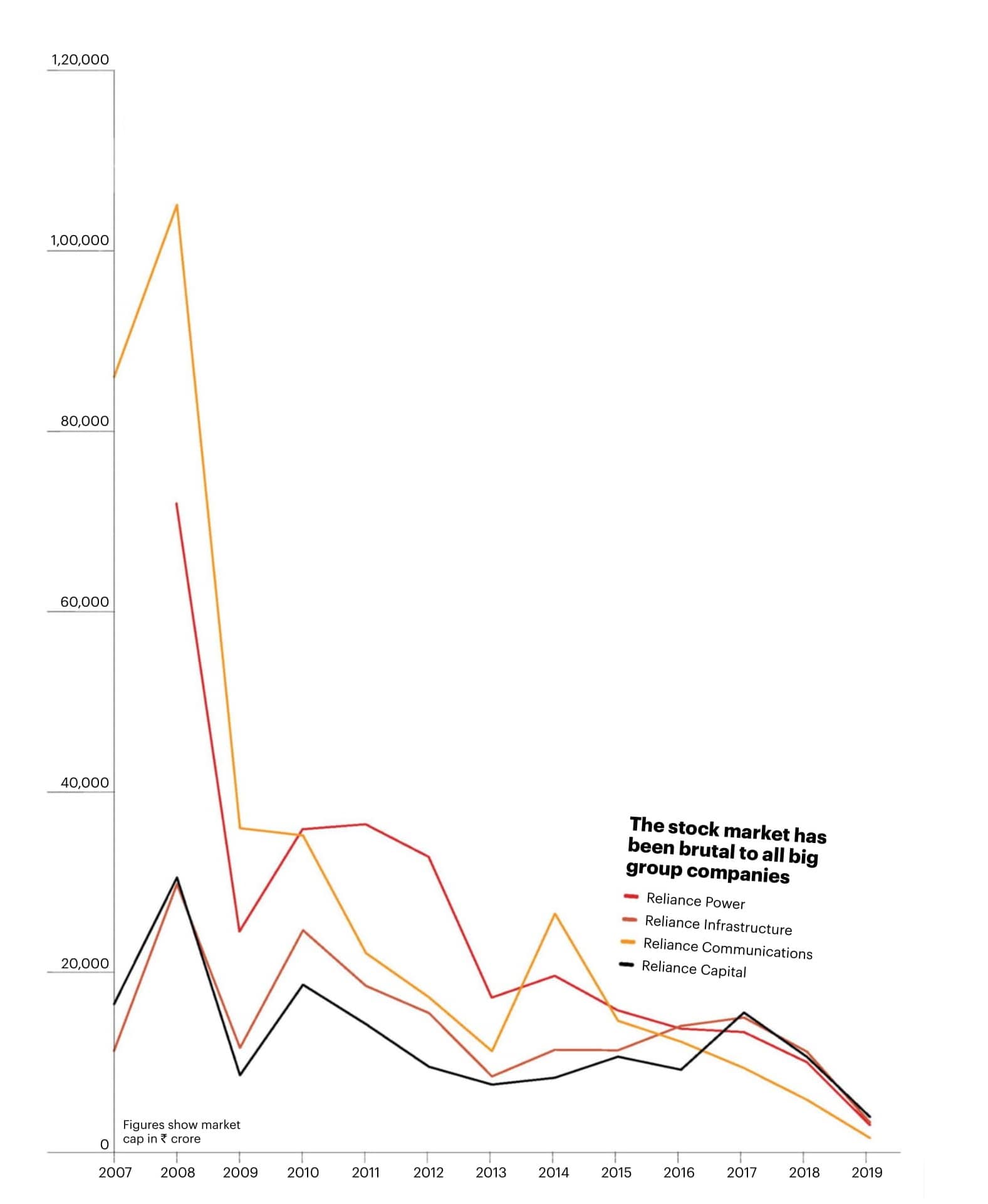

Everyone in the business circles of Mumbai – and other metros as well – seems to have an opinion on Anil Ambani’s current predicament and his fall from being one of the richest men in the world 10 years ago to one who is hanging on to his billionaire status by a mere thread. Most rivals say he was over ambitious. Only a few seem to speak up in his favour saying that at least some of his companies went down because the entire sectors were in trouble.

Reliance Communications (RCom), his telecom company, wants to go for voluntary bank- ruptcy to settle with debtors. The power business has a slew of unfinished projects and has had to sell some lucrative assets to reduce debt. The Supreme Court has pulled him up for not repaying the money RCom owes to operational creditor Ericsson, and has said he will have to spend time behind bars if he does not pay 550 crore by the third week of March. His defence company, Reliance Naval and Engineering, which he bought from Nikhil Gandhi, is reeling under debt, as is his infrastructure venture.

Only the financial company – Reliance Capital (RCap) – is doing well, though it, too, has lost opportunities while peers such as Bajaj Finance, Shriram Capital and Capital First (now merged with IDBI Bank) gained substantially in the past few years.

In 2008, a survey estimated him to be the 6th richest man in the world with a wealth in excess of $42 billion. Currently, his wealth as promoter of seven listed companies is valued around 13,742 crore – a shade under $2 billion at current exchange rates. But if the pledged shares are taken into account, his current net worth would be around 8,000 crore, even as the share prices of most of his companies are falling. He has dropped in the

This story is from the March 24, 2019 edition of Business Today.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM Business Today

Business Today India

MANAGING THE GREAT MBA MIGRATION

WITH VISA CHANGES AND COST PRESSURES SHAKING UP THE GLOBAL MBA SCENE, INDIAN STUDENTS ARE RETHINKING STRATEGY, DESTINATIONS, AND FINANCIAL PLANNING FOR THEIR OVERSEAS DREAMS

5 mins

December 07, 2025

Business Today India

TOWARDS GLOBAL RANKINGS

Indian B-schools are thriving in career and alumni outcomes but research and thought leadership remain critical to make a global mark

3 mins

December 07, 2025

Business Today India

TRAINING THE LEADERS

B-SCHOOLS ARE MAKING EXECUTIVE MBAS FLEXIBLE, PERSONALISED AND TECHNOLOGY-DRIVEN

4 mins

December 07, 2025

Business Today India

HOW WE PICKED THE WINNERS

A DETAILED LOOK INTO THE METHODOLOGY AND PROCESS FOLLOWED FOR THE BT-MDRA INDIA'S BEST B-SCHOOLS SURVEY 2025

3 mins

December 07, 2025

Business Today India

FOREIGN RETURNED

SEVERAL STUDENTS ARE PURSUING MANAGEMENT EDUCATION OVERSEAS ONLY TO RETURN AND CREATE AN IMPACT IN INDIA

5 mins

December 07, 2025

Business Today India

REDEFINING SUCCESS

In a rapidly changing world, institutions need to embrace a more holistic approach, one that recognises learning quality and student well-being

2 mins

December 07, 2025

Business Today India

I FOR INNOVATION

At SPJIMR, the focus over the last year has been on innovation, an area that the institute aims to link with societal impact

3 mins

December 07, 2025

Business Today India

"B-SCHOOLS PREPARE LEADERS WHO CAN NAVIGATE UNCERTAINTIES"

Francesca Cornelli, Dean, Northwestern University's Kellogg School of Management, on geopolitical uncertainties, disruptions affecting businesses, and more

3 mins

December 07, 2025

Business Today India

THE START-UP SCHOOL

From adding courses in areas such as AI and sustainability to supporting more than 250 start-ups, IIML has been expanding steadily

2 mins

December 07, 2025

Business Today India

STRENGTHENING LEGACY

IIMC stays its ground despite job market pressures, launches cutting-edge courses in AI, corporate sustainability, and private equity

2 mins

December 07, 2025

Translate

Change font size