Try GOLD - Free

OMBUDSMAN FOR DIGITAL TRANSACTION

BANKING FINANCE

|April 2020

On 1st. July 2015 Govt Of India launched Digital India campaign. The motto is Power to Empower. The Govt. targeted to transfer maximum financial & non financial transaction on digital platform. Govt. has also taken initiatives to moving towards cashless economy. In our country the cash handling cost is approx. 0.25% of GDP.

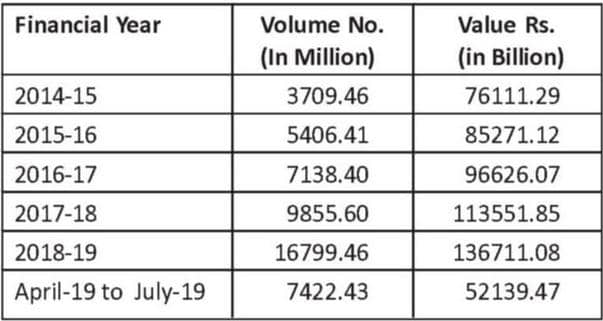

Cash transactions involves risk, inconvenience and monitoring problem. On 11th April 2016, NPCI (National Payment Corporation Of India) started new digital transaction gateway as UPI (Unified Payment Interface ). After Nov 2016, demonetization the volume of digital transaction increased many folds. The Govt.of India/ RBI announced many incentive to promote digital transactions such lower the MDR(merchant discount rate ), incentive for digital transactions in addition to DBT. Govt. of India taken initiative and 4G/3G network is made available in remote area. As a result of these initiatives the digital transactions increased many fold as shown in table below.

Data of transaction on Digital Platform

The digital transaction in volume term recorded a growth(Y to Y) of 38.06 % during 2017-18 and 70.46% during 201819. In value term the growth (Y to Y)is 17.51 % in 2017-18 and 20.39% in 2018-19.It is excepted that the digital transactions will increase more than4 times from Rs.2069 cr in Dec-18 to Rs.8707 cr in Dec-2021. RBI also push for 44% of debit card transaction on POS in next two years.

Many non-banking entity/organization come with state of the art technology and providing the facilities of transaction through digital platform. The main player of the digital platform are Paytm, PhonePe, Google Pay, BHIM. As the volume of digital transaction increases, the threat of digital fraud also increases. The number of complains, relating to fraud in digital transaction increased many fold.

This story is from the April 2020 edition of BANKING FINANCE.

Subscribe to Magzter GOLD to access thousands of curated premium stories, and 10,000+ magazines and newspapers.

Already a subscriber? Sign In

MORE STORIES FROM BANKING FINANCE

BANKING FINANCE

The Race for the Super App: Will India's BFSI Ecosystem Converge?

The concept of a Super App has its roots primarily in Asia. The term is often credited to refer to platforms that began with one core function (messaging, ride-hailing, payments) and then expanded to offer a portfolio of services accessed through the same interface. For example, WeChat in China began as a messaging app and evolved into payments, e-commerce, ride-hailing, mini-programs and more.

11 mins

January 2026

BANKING FINANCE

Digital Sustainability

ESG initiatives are vital for organizations aiming to achieve long-term sustainability, resilience, and stakeholder trust. They help businesses address pressing environmental challenges, such as carbon emissions, resource scarcity, and climate change, while ensuring ethical governance and social inclusion.

11 mins

January 2026

BANKING FINANCE

Ravi Ranjan appointed SBI managing director, to oversee risk and stressed assets

State Bank of India (SBI) has appointed Ravi Ranjan as its Managing Director with effect from December 15, 2025, according to a regulatory filing by the country's largest public sector lender.

1 min

January 2026

BANKING FINANCE

Reserve Bank News

Reserve Bank of India has appointed Usha Janakiraman as Executive Director with effect from December 1, 2025, according to an official release issued by the central bank. Her appointment comes just days ahead of the Monetary Policy Committee (MPC) meeting scheduled for December 3.

7 mins

January 2026

BANKING FINANCE

Mutual Fund News

Children's mutual funds, once a niche investment option, are increasingly becoming a mainstream tool for long-term financial planning in Indian households, especially for education-related goals.

7 mins

January 2026

BANKING FINANCE

Co-Operative Bank News

As per the Reserve Bank of India's Report on Trend and Progress of Banking in India 2024-25, State Cooperative Banks (StCBs) and District Central Cooperative Banks (DCCBs), which together constitute the short-term rural cooperative credit structure, reported steady balance sheet expansion, sustained growth in deposits and advances, and improving asset quality during 2024-25.

2 mins

January 2026

BANKING FINANCE

Legal News

Foreign firms can't claim full deduction for head of- fice expenses on Indian biz: SC

5 mins

January 2026

BANKING FINANCE

Banks unlikely to cut deposit and MCLR rates despite RBI repo rate reduction

Despite the Reserve Bank of India delivering a 25 basis points cut in the repo rate last week, banks are unlikely to reduce term deposit rates or marginal cost of funds-based lending rates (MCLR) aggressively, according to senior bankers.

1 min

January 2026

BANKING FINANCE

Government to divest up to 3% stake in Indian Overseas Bank via OFS

Shares of Indian Overseas Bank (IOB) came under selling pressure after the Government of India announced plans to divest up to 3% of its equity through an Offer for Sale (OFS).

1 min

January 2026

BANKING FINANCE

Unclaimed bank deposits in India more than double in five years

India's unclaimed bank deposits have more than doubled over the past five years, rising to Rs. 67,004 crore as on June 30, 2025, from Rs. 27,824 crore at the end of FY21, highlighting a growing challenge for the banking system.

1 min

January 2026

Translate

Change font size