Try GOLD - Free

Goods & Services Tax Cases Magazine - August 20, 2019

Go Unlimited with Magzter GOLD

Read Goods & Services Tax Cases along with 10,000+ other magazines & newspapers with just one subscription

View CatalogSubscribe only to Goods & Services Tax Cases

Cancel Anytime.

(No Commitments) ⓘIf you are not happy with the subscription, you can email us at help@magzter.com within 7 days of subscription start date for a full refund. No questions asked - Promise! (Note: Not applicable for single issue purchases)

Digital Subscription

Instant Access ⓘSubscribe now to instantly start reading on the Magzter website, iOS, Android, and Amazon apps.

Verified Secure

payment ⓘMagzter is a verified Stripe merchant.

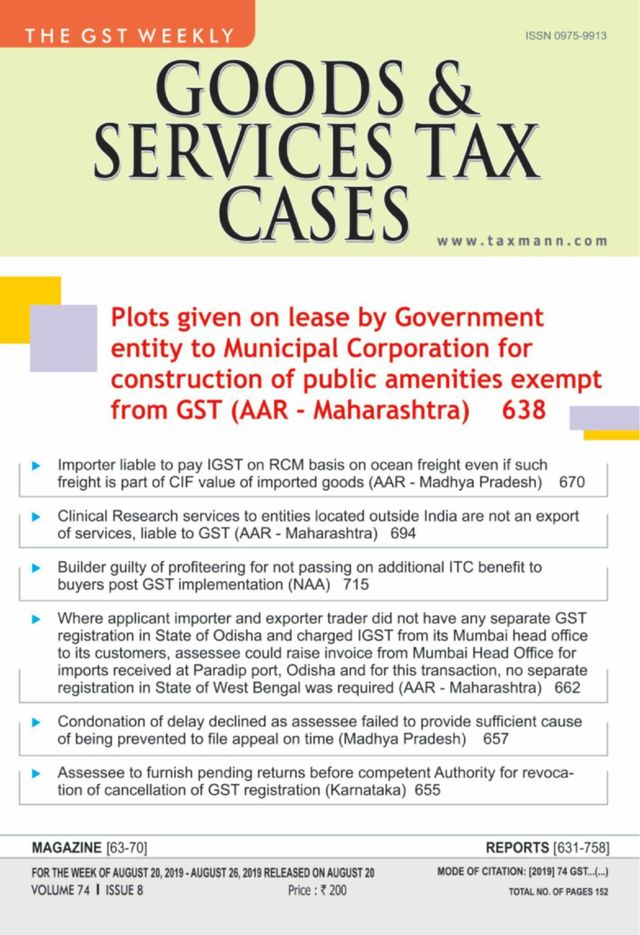

In this issue

Importer liable to pay IGST on RCM basis on ocean freight even if such freight is part of CIF value of imported goods (AAR - Madhya Pradesh) 670,

Clinical Research services to entities located outside india are not an export of services, liable to GST (AAR-Maharashtra) 694,

Builder guilty of profiteering for not passing on additional ITC benefit to buyers post GST implementation (NAA) 715

Goods & Services Tax Cases Magazine Description:

Publisher: TAXMANN-ALLIED-SERVICES-PVT.-LTD.

Category: Education

Language: English

Frequency: Weekly

Weekly journal incorporates recent developments in GST law.

Recent issues

July 28, 2020

July 21, 2020

July 14, 2020

July 07, 2020

May 05 - July 06, 2020

March 31 - May 04, 2020

March 24,2020

March 17, 2020

March 10, 2020

March 03, 2020

February 25, 2020

February 18, 2020

February 11, 2020

February 04, 2020

January 28, 2020

January 21, 2020

January 14, 2020

January 07,2020

December 31, 2019

December 24, 2019

December 17, 2019

December 10, 2019

December 3, 2019

November 26, 2019

November 19, 2019 - November 25, 2019

November 12, 2019 - November 18, 2019

November 5, 2019

October 29, 2019

October 22, 2019

October 15, 2019

Related Titles

Pratiyogita Darpan English

Careers 360

NEXT IAS Current Affairs

Mathematics Today

Biology Today

RobinAge

Journal for Studies in Management and Planning

Journal of Contradicting Results in Science

Journal of Advanced Research in English & Education - Volume 2 - 2017

Journal of Advanced Research in English & Education - Volume 3 - 2018

Journal of Advanced Research in English & Education - Volume 4 - 2019

Journal of Advanced Research in Aeronautics and Space Science - Volume 1 - 2014

Indian Journal of Positive Psychology

International Journal of Education and Management Studies

Journal of Advanced Research in Journalism & Mass Communication Volume 1 - 2014

Journal of Advanced Research in English & Education - Volume 1 - 2016

BASICS OF PHOTOGRAPHY

Physics For You

Chemistry Today

Employment News

NEET ENTRANCE WINNER

Banking & SSC English

NEET-Prep-Chemical Bonding

The Ultimate iPod Guide

Electronics Projects Volume 15

Lawteller

The Junior Age

iNTELLYJELLY- Junior

ICT Connect

Idog - How to Train a Dog