Try GOLD - Free

Dalal Street Investment Journal Magazine - July 31, 2023

Go Unlimited with Magzter GOLD

Read Dalal Street Investment Journal along with 10,000+ other magazines & newspapers with just one subscription

View CatalogSubscribe only to Dalal Street Investment Journal

Cancel Anytime.

(No Commitments) ⓘIf you are not happy with the subscription, you can email us at help@magzter.com within 7 days of subscription start date for a full refund. No questions asked - Promise! (Note: Not applicable for single issue purchases)

Digital Subscription

Instant Access ⓘSubscribe now to instantly start reading on the Magzter website, iOS, Android, and Amazon apps.

Verified Secure

payment ⓘMagzter is a verified Stripe merchant.

In this issue

COVER STORY Vol. 38 Issue No. 18

Q1FY24 Hits & Misses : Q1 Results at a Glance

After hitting a record high in the last quarter of FY23, compared with their poor showing in the previous two quarters of the financial year, the first quarter of FY24 has started on expected lines. India Inc.’s earnings for the quarter ended June 2023 are yet to cross the halfway mark and have largely remained as per market expectations with no major surprises.

MF - Cover Story

Embracing Stocks for Long-Term Growth

The Indian equity market has exhibited extraordinary steadiness amidst global volatility, setting it apart from its international counterparts. This resilience becomes evident when analysing the drawdown figures. It showcases the Indian equity market’s superior performance compared to several others in the period spanning the last two years until June 2023. Notably, the BSE Sensex, representing the Indian equity index, outshines its peers by experiencing a relatively limited maximum drawdown of only -16.85 per cent.

Dalal Street Investment Journal Magazine Description:

Thirty one-years old but conventional, Dalal Street Investment Journal (DSIJ), India’s No 1 equity research and capital investment magazine is published every fortnight to cater to the needs of its reader-investors. Armed with a set of chosen experts on markets and corporate India, the fortnightly magazine has its focus on stock market research and recommendations, capital market analysis, personal finance investment advice and also analysis of various economic activities in the country along with its impact on Indian share markets. This is the one and only complete resource guide for a wide loyal base of over 8 lakh HNI readers.

Recent issues

September 08 - 21, 2025

August 25 - September 07, 2025

July 28 - August 10, 2025

July 29, 2024

July 15, 2024

July 1, 2024

June 17, 2024

June 03, 2024

May 20, 2024

May 06, 2024

April 22, 2024

April 08, 2024

March 25, 2024

March 11, 2024

February 26, 2024

February 12, 2024

January 29, 2024

January 15, 2024

January 01, 2024

December 18, 2023

December 04, 2023

November 20, 2023

November 06, 2023

October 23, 2023

October 09, 2023

September 25, 2023

September 11, 2023

August 28, 2023

August 14, 2023

Related Titles

Business Today India

Mint Mumbai

Outlook Business

BW Businessworld

Indian Economy & Market

Outlook Money

BANKING FINANCE

India Business Journal

Retailer

BUSINESS ECONOMICS

THE INSURANCE TIMES

Beyond Market

Banking Frontiers

Consultants Review

Smart Investment

Business Sphere

Forgings Today

Business Standard

Financial Express Delhi

DataQuest

Siliconindia - India Edition

Business Traveller India

The Business Guardian

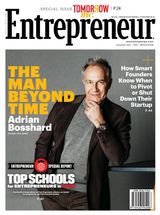

Entrepreneur magazine

Auto Components India

CEO Insights

Cruising Heights

BioSpectrum Asia

Architect and Interiors India

The Machinist