IMF warns SL must entrench fiscal discipline to avoid repeat crisis

Daily FT

|September 29, 2025

A September 2025 International Monetary Fund (IMF) Working Paper has said Sri Lanka's debt restructuring is nearing completion, but cautioned that fiscal discipline, stronger institutions, and careful debt management are essential to prevent a return to crisis.

-

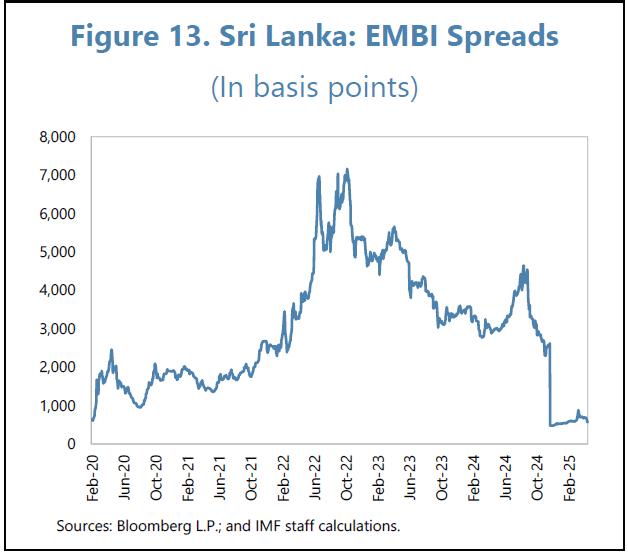

The report, titled 'Sri Lanka's Sovereign Debt Restructuring: Lessons from Complex Processes,' said spreads on the country's international bonds had fallen to post-restructuring norms and ratings agencies had lifted sovereign credit scores. Treasury Bill yields eased to around 8.5% by March 2025, and the Government shifted more borrowing into longer-dated Treasury Bonds, reducing refinancing risk.

Debt operations had eased the domestic overhang, while a banking crisis was avoided and private credit began to grow again.

But the IMF cautioned that "significant efforts in improving the debt management function are needed to fully restore the functioning Treasury Bond market Sri Lanka had before the debt crisis." The paper stressed that restructuring alone would not secure long-term stability. "It also requires continued prudent fiscal and macro policies and stronger institutions during and after the current Extended Fund Facility (EFF) arrangement. There is no room for slippage on the fiscal front," it said.

The IMF credited the Public Finance Management and Public Debt Management Acts as milestones but urged further reforms. These included a disciplined public investment program, transparent procurement, and rigorous cost-risk analysis of new borrowing. "A thorough cost-risk analysis before signing any new debt contract would help the authorities work out the debt service consistent with preserving sustainability," it said.

The report traced the debt crisis to weak public finances and external shocks. By 2019, Sri Lanka's tax revenues had fallen to one of the lowest levels among emerging markets. The COVID-19 pandemic exposed Balance of Payments vulnerabilities, while an overvalued exchange rate and heavy issuance of international bonds in the 2010s created mounting repayment pressures. Combined with lax fiscal policy, the result was a first-ever sovereign default in April 2022.

Bu hikaye Daily FT dergisinin September 29, 2025 baskısından alınmıştır.

Binlerce özenle seçilmiş premium hikayeye ve 9.000'den fazla dergi ve gazeteye erişmek için Magzter GOLD'a abone olun.

Zaten abone misiniz? Oturum aç

Daily FT'den DAHA FAZLA HİKAYE

Daily FT

Marikkar tears into Rs. 500 b Supplementary Estimate

SAMAGI Jana Balawegaya (SJB) MP S.M. Marikkar yesterday tore into the Government's Rs. 500 billion Supplementary Estimate for post-Ditwah recovery in 2026.

1 min

December 19, 2025

Daily FT

SSC certainly mean business

SSC certainly means business the way they have launched their campaign to win the Tier B 3-day league and gain promotion next year to the Major Clubs 3-day league.

1 mins

December 19, 2025

Daily FT

HNB General Insurance wins Gold award in Insurance Sector at National Management Excellence Awards 2025

HNB General Insurance has been crowned the Gold Winner in the Insurance Sector at the National Management Excellence Awards (NMEA) 2025, organised by the Institute of Management of Sri Lanka (IMSL).

2 mins

December 19, 2025

Daily FT

Sampath Bank announces two-year Rs. 20 b capital raising program

SAMPATH Bank PLC has moved to strengthen its Basel III Tier Il regulatory capital through a proposed Rs. 20 billion listed debenture program, to be implemented in phases over the next two years.

1 min

December 19, 2025

Daily FT

Evolution Auto launches Riddara RD6 Active

Auto has officially announced the launch of the Riddara RD6 Active, the country's latest all-electric double-cab pickup, which was unveiled at the prestigious BMICH Motor Show.

2 mins

December 19, 2025

Daily FT

Tourism levy revenue rises as Govt. pushes unified nation brand and community-centred growth

Tourism Minister Vijitha Herath SRI Lanka's tourism sector is being steered towards a more integrated, communityfocused, and strategically branded future, with revenues from the Tourism Development Levy (TDL) continuing to rise and a renewed policy emphasis on positioning the country under a single national brand, Foreign Affairs, Foreign Employment and Tourism Minister Vijitha Herath told Parliament.

3 mins

December 19, 2025

Daily FT

Colombo Shopping Festival 40th edition officially inaugurated

THE 40th edition of Colombo Shopping Festival was has inaugurated by, Aitken Spence Travels Managing Director Nalin Jayasundera with the participation of event partners and exhibitors.

1 min

December 19, 2025

Daily FT

HNB strengthens national response to Cyclone Ditwah with Rs. 100 m commitment

HNB PLC has contributed Rs. 100 million towards the Rebuilding Sri Lanka Fund, reinforcing its commitment to national recovery efforts following the devastation caused by Cyclone Ditwah.

1 min

December 19, 2025

Daily FT

Economist warns IMF RFI too costly for Sri Lanka

Verité Research Chief warns Sri Lanka poised to repeat past mistakes amid cyclone recovery funding push Argues IMF RFI financing effective rate exceeds 6% and time-based surcharges add further 2.75% after three years IMF Executive Board decides on $ 200 m RFI today

3 mins

December 19, 2025

Daily FT

Appeals Court clears Home LandsPentara project to proceed

Court refuses injunctions with costs, Home Lands continues with Rs. 30-35 b Pentara Residences construction Notes that Home Lands had obtained all necessary approvals from relevant authorities, and engaged in the construction process for several months Project is largest residential development investment, and Rs. 4.5 b land transaction highest in history of Colombo

3 mins

December 19, 2025

Listen

Translate

Change font size