IMF warns SL must entrench fiscal discipline to avoid repeat crisis

Daily FT

|September 29, 2025

A September 2025 International Monetary Fund (IMF) Working Paper has said Sri Lanka's debt restructuring is nearing completion, but cautioned that fiscal discipline, stronger institutions, and careful debt management are essential to prevent a return to crisis.

-

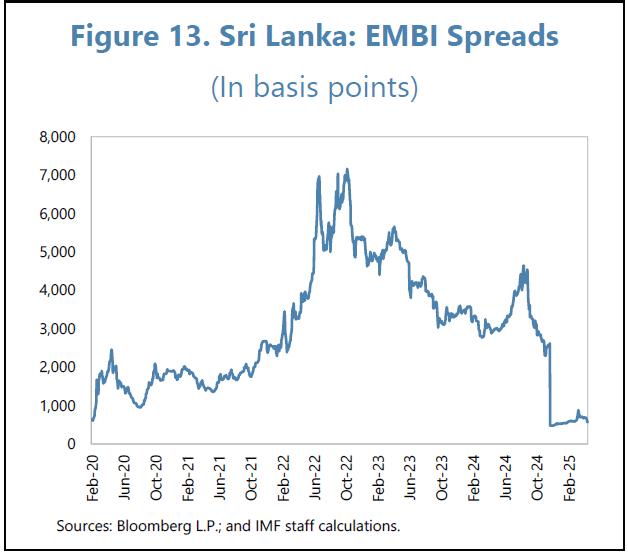

The report, titled 'Sri Lanka's Sovereign Debt Restructuring: Lessons from Complex Processes,' said spreads on the country's international bonds had fallen to post-restructuring norms and ratings agencies had lifted sovereign credit scores. Treasury Bill yields eased to around 8.5% by March 2025, and the Government shifted more borrowing into longer-dated Treasury Bonds, reducing refinancing risk.

Debt operations had eased the domestic overhang, while a banking crisis was avoided and private credit began to grow again.

But the IMF cautioned that "significant efforts in improving the debt management function are needed to fully restore the functioning Treasury Bond market Sri Lanka had before the debt crisis." The paper stressed that restructuring alone would not secure long-term stability. "It also requires continued prudent fiscal and macro policies and stronger institutions during and after the current Extended Fund Facility (EFF) arrangement. There is no room for slippage on the fiscal front," it said.

The IMF credited the Public Finance Management and Public Debt Management Acts as milestones but urged further reforms. These included a disciplined public investment program, transparent procurement, and rigorous cost-risk analysis of new borrowing. "A thorough cost-risk analysis before signing any new debt contract would help the authorities work out the debt service consistent with preserving sustainability," it said.

The report traced the debt crisis to weak public finances and external shocks. By 2019, Sri Lanka's tax revenues had fallen to one of the lowest levels among emerging markets. The COVID-19 pandemic exposed Balance of Payments vulnerabilities, while an overvalued exchange rate and heavy issuance of international bonds in the 2010s created mounting repayment pressures. Combined with lax fiscal policy, the result was a first-ever sovereign default in April 2022.

Dit verhaal komt uit de September 29, 2025-editie van Daily FT.

Abonneer u op Magzter GOLD voor toegang tot duizenden zorgvuldig samengestelde premiumverhalen en meer dan 9000 tijdschriften en kranten.

Bent u al abonnee? Aanmelden

MEER VERHALEN VAN Daily FT

Daily FT

SEC eases Minimum Public Holding rules for listings via Introductions

Says move aimed at boosting market flexibility

3 mins

January 01, 2026

Daily FT

Govt. unveils National Electricity Policy in push for cost-reflective tariffs, reforms

Energy Ministry invites public consultations on or before 9 January Energy pricing, reforms crucial components of IMF EFF program

3 mins

January 01, 2026

Daily FT

Right of Reply: BPPE responds to PMAC over water contracts

BUSINESS Promoters & Partners Engineering Ltd., (BPPE) has issued the following Right of Reply to the artide headlined RTI exposes irregularities in SL water contracts involving Chinese SOES-PMAC calls for accountability and urgent probe into unsolicited bids and inflated costs published in the Daily FT on 29 November 2025:

1 min

January 01, 2026

Daily FT

Gangaramaya Temple City taking shape to be world-class tourist and cultural hub

Rs. 600 m initiative part of Colombo City Tourism Attraction Enhancement Program being implemented in collaboration with Western Province Governor, UDA, and Gangaramaya Temple/ Sri Jinarathana Adyapana Ayathana Palaka Sabhawa 550-seat performance hall, heritage galleries, exhibition spaces, and outdoor recreational areas designed to host cultural performances, educational workshops, and community events

2 mins

January 01, 2026

Daily FT

Staying competitive by transferring pay risks through performance-based compensation

MY interest in performance-based compensation in Sri Lanka heightened when combating the trickle-down effects of the Global Financial Crisis of 2008 and the end of the civil war in 2009.

9 mins

January 01, 2026

Daily FT

Sri Lanka needs more than transparency to break the cycle of corruption: University of London Economists

SRI Lanka will not escape another cycle of unsustainable public debt if it relies only on transparency and traditional “good governance” reforms without creating real pressure from actors who can enforce rules in their own interest, senior economists from SOAS University of London warned in Colombo last week.

9 mins

January 01, 2026

Daily FT

CCPI remains steady in December

HEADLINE inflation, as measured by the year-on-year (YoY) change in the Colombo Consumer Price Index (CCPI), remained steady in December 2025 for the second consecutive month.

1 mins

January 01, 2026

Daily FT

India doubles financial commitment to 3 housing projects in North and South

INDIAN has announced a doubling of financial commitment to three housing projects in the Northern and Southern Provinces.

2 mins

January 01, 2026

Daily FT

New CEO at Siyapatha Finance assumes office today

■Veteran Ananda Seneviratne concludes his tenure as Managing Director

2 mins

January 01, 2026

Daily FT

Rebranding Sri Lanka is a collective responsibility: Booking.com Regional Chief

BOOKING.COM Regional Head for South Asia Santosh Kumar said rebranding Sri Lanka and unlocking its next phase of economic growth will require a collective national effort that goes well beyond Government-led initiatives, stressing that recovery alone is not a long-term strategy for sustainable development.

2 mins

January 01, 2026

Listen

Translate

Change font size