Denemek ALTIN - Özgür

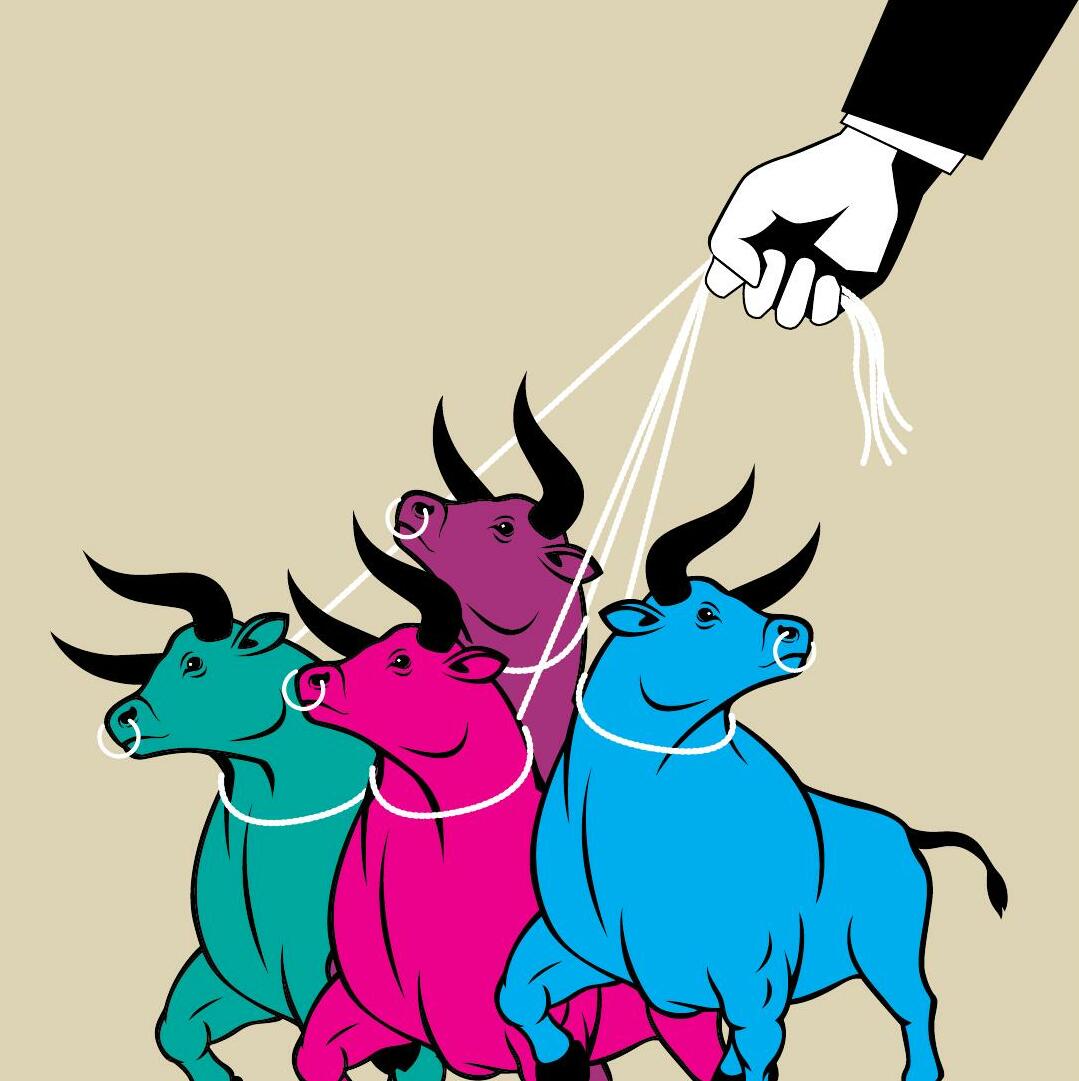

RIDING THE INDEX

Business Today India

|November 09, 2025

AS INVESTORS GRAPPLE WITH A VOLATILE LANDSCAPE, PASSIVE FUNDS ARE PROVING INDISPENSABLE TO GET MARKET RETURNS FROM A DIVERSIFIED SET OF STOCKS AT A VERY LOW COST

What he meant is simple. Instead of trying to pick individual winners and looking to beat the market, own the entire market through index funds.

Mumbai-based Parth Parikh, 37, who works in the fintech and investment space, seems to have heeded that advice. He keeps a core part of his portfolio in broad market exchange-traded funds (ETFs) like S&P 500 ETF, Nasdaq 100 ETF, and even some exposure to Vanguard Total World Stock ETF.

Parikh’s is not an isolated view. Index funds and ETFs have assets of over ₹12 lakh crore in India and have grown to account for 17% of the total mutual fund industry.

Basics First

Stay Calm Amid SwingsVolatile markets make emotional decisions costly; passive strategies help you stay on track

Cut Costs, Keep ReturnsLow-fee index funds and ETFs maximise gains even when expenses rise

Diversify Without StressSpread risk across sectors and stocks without constant monitoring

Long-Term GrowthConsistent, hands-off investing benefits from compounding over time

Leverage TechnologyRobo-advisors and digital platforms make investing simple, fast, and automated

In fact, though passive products have been in India for nearly 25 years, they have seen exponential growth in the past five years. In 2020, index funds had AUM of ₹8,000 crore. Today, it is ₹1.5 lakh crore. ETFs have grown tenfold in the same period. It’s clear that retail and institutional investors alike have jumped on the passive bandwagon.

Bu hikaye Business Today India dergisinin November 09, 2025 baskısından alınmıştır.

Binlerce özenle seçilmiş premium hikayeye ve 9.000'den fazla dergi ve gazeteye erişmek için Magzter GOLD'a abone olun.

Zaten abone misiniz? Oturum aç

Business Today India'den DAHA FAZLA HİKAYE

Business Today India

The Start-up She-shift

Women founders are reshaping India's start-up landscape-breaking biases, defying funding gaps, and proving that entrepreneurship is no longer a space they're expected to enter quietly or temporarily

4 mins

December 21, 2025

Business Today India

The Male Gaze at Work

Can India Inc. truly progress if the male gaze continues to shape women's everyday reality at work?

5 mins

December 21, 2025

Business Today India

Towards Financial Independence

While gold and FDs were once the default option, today's women are exploring MFs, equities, and other financial products

5 mins

December 21, 2025

Business Today India

Clothes Maketh A Woman?

Appearance expectations don't always show up as written dress codes or grooming rules. More often, they seep into culture in quiet but powerful ways

3 mins

December 21, 2025

Business Today India

BEST Management Advice

Learning is a constant process and the world that we live in today demands both un-learning as well as learning. So, work to enhance your skills and build your knowledge

2 mins

December 21, 2025

Business Today India

Transforming Women's Rights

The Labour Codes will not only unlock the untapped potential of the female workforce but also empower women through increased participation in the economy

3 mins

December 21, 2025

Business Today India

Ambition versus Biology

Elective egg freezing once largely a medical necessity-has gradually transformed into a planned step in long-term career and life strategy

4 mins

December 21, 2025

Business Today India

The Silent LOAD

Women are climbing the career ladder, but invisible burdens and structural barriers are still weighing them down

5 mins

December 21, 2025

Business Today India

Understanding Egg Freezing

For many, egg freezing is not about delaying motherhood; it is about keeping a door open

3 mins

December 21, 2025

Business Today India

A Bigger Canvas

For Ritu Gangrade Arora, Country Head- India, Allianz Services Pvt Ltd, the latest venture seems like a new beginning

2 mins

December 21, 2025

Listen

Translate

Change font size