कोशिश गोल्ड - मुक्त

RIDING THE INDEX

Business Today India

|November 09, 2025

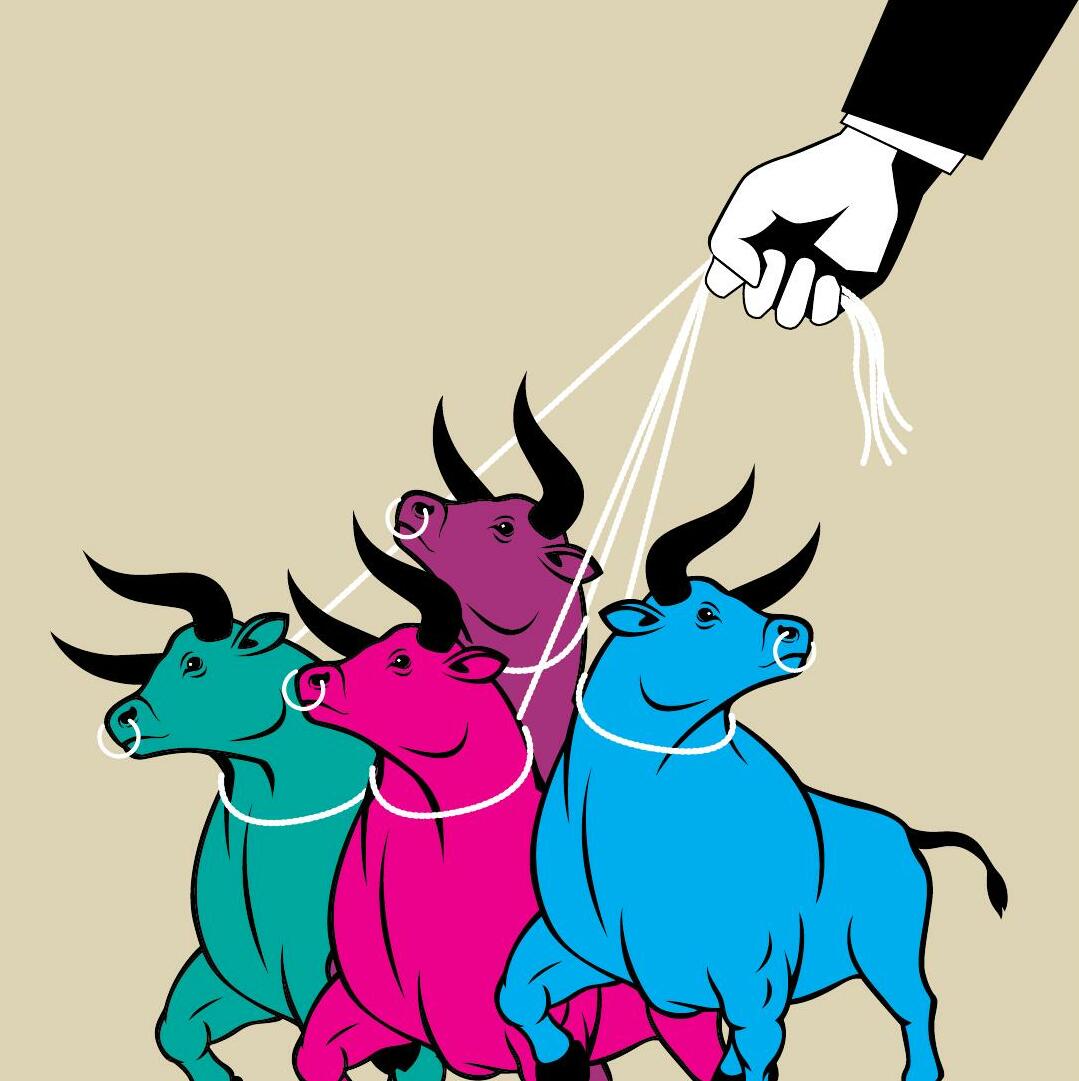

AS INVESTORS GRAPPLE WITH A VOLATILE LANDSCAPE, PASSIVE FUNDS ARE PROVING INDISPENSABLE TO GET MARKET RETURNS FROM A DIVERSIFIED SET OF STOCKS AT A VERY LOW COST

What he meant is simple. Instead of trying to pick individual winners and looking to beat the market, own the entire market through index funds.

Mumbai-based Parth Parikh, 37, who works in the fintech and investment space, seems to have heeded that advice. He keeps a core part of his portfolio in broad market exchange-traded funds (ETFs) like S&P 500 ETF, Nasdaq 100 ETF, and even some exposure to Vanguard Total World Stock ETF.

Parikh’s is not an isolated view. Index funds and ETFs have assets of over ₹12 lakh crore in India and have grown to account for 17% of the total mutual fund industry.

Basics First

Stay Calm Amid SwingsVolatile markets make emotional decisions costly; passive strategies help you stay on track

Cut Costs, Keep ReturnsLow-fee index funds and ETFs maximise gains even when expenses rise

Diversify Without StressSpread risk across sectors and stocks without constant monitoring

Long-Term GrowthConsistent, hands-off investing benefits from compounding over time

Leverage TechnologyRobo-advisors and digital platforms make investing simple, fast, and automated

In fact, though passive products have been in India for nearly 25 years, they have seen exponential growth in the past five years. In 2020, index funds had AUM of ₹8,000 crore. Today, it is ₹1.5 lakh crore. ETFs have grown tenfold in the same period. It’s clear that retail and institutional investors alike have jumped on the passive bandwagon.

यह कहानी Business Today India के November 09, 2025 संस्करण से ली गई है।

हजारों चुनिंदा प्रीमियम कहानियों और 10,000 से अधिक पत्रिकाओं और समाचार पत्रों तक पहुंचने के लिए मैगज़्टर गोल्ड की सदस्यता लें।

क्या आप पहले से ही ग्राहक हैं? साइन इन करें

Business Today India से और कहानियाँ

Business Today India

HOW WE ZEROED IN ON THE FUNDS

SOME FUNDS STAND OUT FOR THEIR CONSISTENT OUTPERFORMANCE COMPARED TO PEERS. HERE ARE THE 100 BEST-PERFORMING MUTUAL FUND SCHEMES IDENTIFIED BY BT & VALUE RESEARCH

4 mins

November 09, 2025

Business Today India

GLOBAL FUNDS, BIG RETURNS

INTERNATIONAL FUNDS HAVE DELIVERED 29% RETURN IN THE PAST YEAR. WILL VOLATILE MARKETS TEST INVESTOR RESILIENCE?

5 mins

November 09, 2025

Business Today India

THE HYBRID PATH TO RICHES

THE HYBRID FUND SPACE IS EVOLVING FAST, AND INVESTORS NEED TO STAY ON TOP TO ENSURE THEY ARE PICKING STABILITY OVER RISK

4 mins

November 09, 2025

Business Today India

SPREADING YOUR BETS

AS MARKET LEADERSHIP FRAGMENTS AND RETURNS TURN UNEVEN, ATTENTION IS SHIFTING BACK TO DIVERSIFIED EQUITY FUNDS, WHICH BALANCE GROWTH WITH STABILITY

4 mins

November 09, 2025

Business Today India

RIDING THE INDEX

AS INVESTORS GRAPPLE WITH A VOLATILE LANDSCAPE, PASSIVE FUNDS ARE PROVING INDISPENSABLE TO GET MARKET RETURNS FROM A DIVERSIFIED SET OF STOCKS AT A VERY LOW COST

6 mins

November 09, 2025

Business Today India

The Quiet Revolution

HOW INDIA'S INVESTORS DISCOVERED THAT BORING WORKS

5 mins

November 09, 2025

Business Today India

Management Advice

KAVIL RAMACHANDRAN PROFESSOR OF ENTREPRENEURSHIP (PRACTICE) AND SENIOR ADVISOR, INDIAN SCHOOL OF BUSINESS (ISB)

2 mins

November 09, 2025

Business Today India

CAUTIOUS MONEY

FOCUS ON GSECS AND QUALITY OF CORPORATE BOND PORTFOLIO MAKE DEBT FUNDS A STEADY ANCHOR FOR DIVERSIFIED INVESTMENT STRATEGIES.

5 mins

November 09, 2025

Business Today India

MAKING THE MOST OF SMALL- AND MID-CAPS

SMALL- AND MID-CAP FUNDS ARE NOT FOR THE FAINT-HEARTED. FOR LONG-TERM INVESTORS, DISCIPLINE, DIVERSIFICATION, AND ALIGNMENT WITH FINANCIAL GOALS REMAIN FAR MORE EFFECTIVE THAN TRYING TO TIME THE MARKET

6 mins

November 09, 2025

Business Today India

“Don't go overboard on small- and mid-cap stocks”

Parag Parikh Financial Advisory Services' Rajeev Thakkar on why investors should avoid the volatile stocks

5 mins

November 09, 2025

Listen

Translate

Change font size