Prøve GULL - Gratis

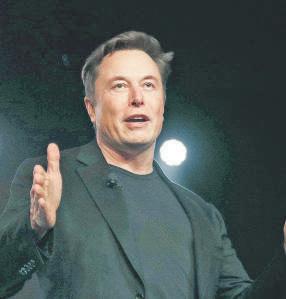

How Elon Musk rescued X from the brink

Mint Mumbai

|April 10, 2025

Musk borrowed $13 billion to complete his 2022 take-private of Twitter and the loans quickly went bad

A crowd of investors gathered at Morgan Stanley's New York office to hear X's sales pitch, eager to get a piece of debt that Wall Street had once shunned. Cellphones were a no-go at the January event and the audience was told to stay seated until X Chief Executive Linda Yaccarino and others had left the room after brief remarks—and without taking audience questions.

Banks had planned to sell $3 billion in bonds at 95 cents per dollar, but ended up selling more than $10 billion at even higher prices. It was a testament to X's ability to bring advertisers back to the platform, helped in no small part by owner Elon Musk's proximity to President Trump.

Also underpinning the debt sale was the possibility that X would one day merge with a hotter, ascendant company, Musk's xAI. In private meetings with Wall Street, X executives said there was a good chance that the social-media platform might eventually merge with Musk's artificial-intelligence company, which makes the Grok chatbot.

The billionaire has said he never lost money for investors, but for a long time it looked like he was going to with X. After Musk bought it in 2022, advertisers fled over content-moderation concerns and its loans soured as revenue fell. A month after he took over, Musk said the company—formerly known as Twitter—was on the verge of bankruptcy.

Then, late last month, Musk posted on X that he was merging the company with xAI in a deal that valued the newly combined company at more than $100 billion. Folding X into a larger company competing in a global race to develop sophisticated generative AI tools could open the door to raising money at a valuation considered impossible just a few years ago.

The merger caps a string of events—some strategic, others fortuitous—that helped Musk announce a deal before Trump's tariffs effectively closed the market for deals.

Denne historien er fra April 10, 2025-utgaven av Mint Mumbai.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Mint Mumbai

Mint Mumbai

These firms will sell shovels during semaglutide gold rush

Weight-loss drug semaglutide, also used to treat type-2 diabetes, will face its next big turning point in early 2026, when patents held by Novo Nordisk expire in India.

1 mins

November 27, 2025

Mint Mumbai

'First-gen founders take bigger investment risks'

India’s markets are minting a new class of first-generation millionaires: entrepreneurs who’ve scaled ideas into Initial public offerings (IPOs) and unlocked unprecedented personal wealth.

2 mins

November 27, 2025

Mint Mumbai

EV, hydro boom to power 6x rise in battery storage by ‘47

India is preparing to meet a projected cumulative battery energy storage capacity of nearly 3 terawatt-hours (TWh) by 2047 across electric mobility, power, and electronic components, according to two people aware of the development, with electric vehicles (EVs) expected to contribute a third of the demand.

2 mins

November 27, 2025

Mint Mumbai

Candidates using AI? No, thanks, say IIT recruiters

As the annual placement season dawns at the Indian Institutes of Technology (IITs), colleges and recruiters are working to bar artificial intelligence (AI) tools and prevent cheating at test venues, a concern that first rose last year.

3 mins

November 27, 2025

Mint Mumbai

Taxpayer base soars, but return filings lag sharply: CBDT data

India’s income tax base is growing faster than the number of those conscientiously filing returns, driven by the expanding reach of the tax deducted at source (TDS) system, according to latest data from the central board of direct taxes (CBDT).

3 mins

November 27, 2025

Mint Mumbai

Market nears peak on dollar tailwind

Stocks jump 1.2%, but futures rollovers signal weak conviction

3 mins

November 27, 2025

Mint Mumbai

SP Eyes Tata exit to cut debt costs

Debt-laden Shapoorji Pallonji Group is banking on Tata Trusts softening the stance on its potential exit from Tata Sons to reduce its borrowing costs, two people aware of the matter said.

2 mins

November 27, 2025

Mint Mumbai

MO Alternates launches its maiden private credit fund

The %3,000 crore fund has drawn capital from family offices, ultra-HNIs and institutions

3 mins

November 27, 2025

Mint Mumbai

HP to cut jobs after profit outlook miss

HP Inc.gave a profit outlook for current year that fell short of estimates and the company said it will cut 4,000 to 6,000 employees through fiscal 2028 by using more AI tools

1 mins

November 27, 2025

Mint Mumbai

Apple set to regain top smartphone maker spot after 14 yrs

Apple Inc.will retake its crown as the world’s largest smartphone maker for the first time in more than a decade, lifted by the successful debut of a new iPhone series and a rush of consumers upgrading devices, according to Counterpoint Research.

1 min

November 27, 2025

Listen

Translate

Change font size