Versuchen GOLD - Frei

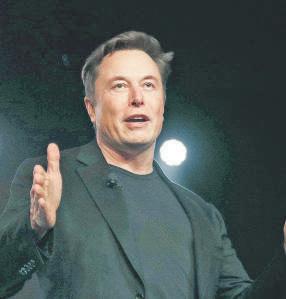

How Elon Musk rescued X from the brink

Mint Mumbai

|April 10, 2025

Musk borrowed $13 billion to complete his 2022 take-private of Twitter and the loans quickly went bad

A crowd of investors gathered at Morgan Stanley's New York office to hear X's sales pitch, eager to get a piece of debt that Wall Street had once shunned. Cellphones were a no-go at the January event and the audience was told to stay seated until X Chief Executive Linda Yaccarino and others had left the room after brief remarks—and without taking audience questions.

Banks had planned to sell $3 billion in bonds at 95 cents per dollar, but ended up selling more than $10 billion at even higher prices. It was a testament to X's ability to bring advertisers back to the platform, helped in no small part by owner Elon Musk's proximity to President Trump.

Also underpinning the debt sale was the possibility that X would one day merge with a hotter, ascendant company, Musk's xAI. In private meetings with Wall Street, X executives said there was a good chance that the social-media platform might eventually merge with Musk's artificial-intelligence company, which makes the Grok chatbot.

The billionaire has said he never lost money for investors, but for a long time it looked like he was going to with X. After Musk bought it in 2022, advertisers fled over content-moderation concerns and its loans soured as revenue fell. A month after he took over, Musk said the company—formerly known as Twitter—was on the verge of bankruptcy.

Then, late last month, Musk posted on X that he was merging the company with xAI in a deal that valued the newly combined company at more than $100 billion. Folding X into a larger company competing in a global race to develop sophisticated generative AI tools could open the door to raising money at a valuation considered impossible just a few years ago.

The merger caps a string of events—some strategic, others fortuitous—that helped Musk announce a deal before Trump's tariffs effectively closed the market for deals.

Diese Geschichte stammt aus der April 10, 2025-Ausgabe von Mint Mumbai.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Mint Mumbai

Mint Mumbai

Paint firms strengthen moats as competition heats up

A bruising market-share battle is escalating in India's ₹70,000-crore paints sector, forcing companies to look beyond aggressive discounting and instead strengthen their foothold in key geographical areas while sharpening their product portfolios.

2 mins

November 28, 2025

Mint Mumbai

Telcos slam Trai penalty plan for financial report flaws

Trai has proposed turnover-linked penalties for filing incorrect, incomplete financial reports

2 mins

November 28, 2025

Mint Mumbai

Consumers warm up to Bolt as it aces 10-min hunger games

A year after launch, Bolt is emerging as Swiggy's fastest-scaling bet.

2 mins

November 28, 2025

Mint Mumbai

Doing India’s needy a good turn: Everyone is welcome to pitch in

What may seem weakly linked with positive outcomes on the ground could work wonders over time

3 mins

November 28, 2025

Mint Mumbai

GOING SOLO: FACING THE GROWING REALITY OF SOLITARY RETIREMENT IN INDIA

What we plan for ourselves isn't always what life plans for us.

2 mins

November 28, 2025

Mint Mumbai

Catamaran to boost manufacturing bets

Catamaran is focused on a few areas in manufacturing, such as aerospace

2 mins

November 28, 2025

Mint Mumbai

How the latest labour codes will benefit most employees

Workers may see an increase in some statutory benefits such as gratuity and leave encashment

4 mins

November 28, 2025

Mint Mumbai

Tune into weak signals in a world of data dominance

World War II saw the full fury of air power in battle, first exercised by Axis forces and then by the Allies, culminating in American B-29 bombers dropping atomic bombs on Hiroshima and Nagasaki.

4 mins

November 28, 2025

Mint Mumbai

Investors expect AI use to soar. That's not happening

An uncertain outlook for interest rates. Businesses may be holding off on investment until the fog clears. In addition, history suggests that technology tends to spread in fits and starts. Consider use of the computer within American households, where the speed of adoption slowed in the late 1980s. This was a mere blip before the 1990s, when they invaded American homes.

2 mins

November 28, 2025

Mint Mumbai

Tech startups on M&A route to boost scale, market share

M&As were earlier used to enter new markets or geographies, but that strategy has evolved

2 mins

November 28, 2025

Listen

Translate

Change font size