Prøve GULL - Gratis

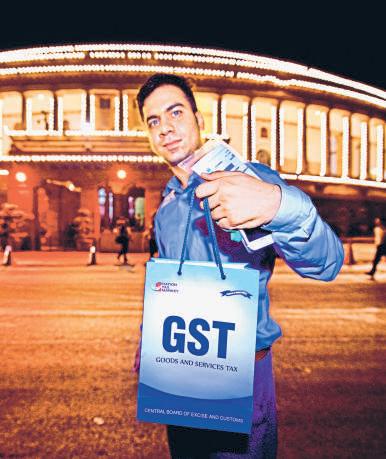

A Nationwide GST Identification Mandate Can Simplify the Regime

Mint Mumbai

|July 18, 2025

India should relieve businesses operating across the country of the need to comply with multiple sub-national GST systems

The goods and services tax (GST), which recently completed eight years in India, was originally envisioned as a "good and simple tax." However, over time, it has become increasingly complex. While a national GST would have been an ideal value-added tax (VAT) system, the imperatives of a federal structure led to a compromise, resulting in a dual GST system comprising Central GST (CGST), State GST (SGST), and Integrated GST (IGST). Under this system, the Centre and state governments have concurrent authority to tax the consumption of goods and services based on the principle of incidence at destination, in contrast with the previous indirect tax regime, which followed an origin-based taxation approach.

While the uniformity of SGST laws across states has reduced compliance complexities compared to the VAT regime, challenges remain. Businesses with a pan-India presence still need multiple SGST registrations and must manage compliance separately for each state, including GST payments and return filings. This fragmented approach retains some of the administrative burdens of the VAT era despite the procedural standardization.

Denne historien er fra July 18, 2025-utgaven av Mint Mumbai.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Mint Mumbai

Mint Mumbai

Bank-funded acquisitions won't displace private credit

The Reserve Bank of India's (RBI) draft framework for bank-led acquisition finance marks a decisive policy turn: Indian banks can now enter the acquisition finance market within a clear perimeter, reshaping the competitive dynamics between banks and private credit funds.

3 mins

November 20, 2025

Mint Mumbai

Air India lobbies to use airspace over China's Xinjiang

India-China flights resumed after a five-year hiatus.

1 mins

November 20, 2025

Mint Mumbai

Nitish Kumar to take oath as Bihar CM

JD(U) supremo Nitish Kumar to be sworn-in as Bihar chief minister for a record 10th time.

1 min

November 20, 2025

Mint Mumbai

A fresh perspective on abstraction in art

A new exhibition in Mumbai showcases different approaches to abstraction by artists like Zarina, Seher Shah and Mehlli Gobhai

3 mins

November 20, 2025

Mint Mumbai

Govt eyes post-cut GST revenue surge

FinMin expects Nov GST receipts growth to rebound to 10%

2 mins

November 20, 2025

Mint Mumbai

PayMate pulls plug on West Asia operations

The Visa-backed B2B payments firm is scrambling to raise more funds

2 mins

November 20, 2025

Mint Mumbai

Exide's dual bet: Can lithium-ion offset a weakening core?

Exide Industries Ltd is struggling to fuel its core lead-acid business while simultaneously turning its capex-heavy lithium-ion venture into a viable second growth engine.

1 mins

November 20, 2025

Mint Mumbai

Bank-funded acquisitions won’t displace private credit

The Reserve Bank of India's (RBI) draft framework for bank-led acquisition finance marks a decisive policy turn: Indian banks can now enter the acquisition finance market within a clear perimeter, reshaping the competitive dynamics between banks and private credit funds.

3 mins

November 20, 2025

Mint Mumbai

Afghanistan trade minister seeks India investments, goods

Afghanistan's Taliban trade minister arrived in India on Wednesday on a maiden visit to draw greater investments and goods as both countries consider ways to enhance their relations in the backdrop of souring relations with neighboring Pakistan.

1 min

November 20, 2025

Mint Mumbai

Fractal Analytics bets heavily on R&D in AI race before IPO

Enterprise artificial intelligence firm Fractal Analytics plans to maintain high research and development (R&D) spending ahead of its market debut for which a date has not yet been set, a top executive has said.

2 mins

November 20, 2025

Listen

Translate

Change font size