Prøve GULL - Gratis

Al-Powered Investigation: The missing link in India's fight against insurance fraud

THE INSURANCE TIMES

|March 2025

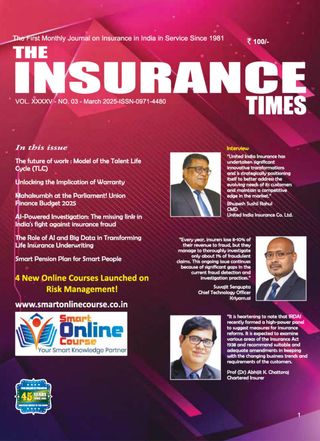

Every year, insurers lose 8-10% of their revenue to fraud, but they manage to thoroughly investigate only about 1% of fraudulent claims. This ongoing issue continues because of significant gaps in the current fraud detection and investigation practices.

Indian insurance companies lose nearly ?30,000 crore an- nually to insurance fraud-a staggering figure. When you consider that India's insurance penetration rate[5] is just 3.7%, far below the global average, this loss becomes even more alarming. Insurers lose 8-10% of their revenue to fraud each year, yet they thoroughly investigate only about 1% of fraudulent claims. This issue persists due to significant gaps in current fraud detection and investigation practices.

While checks are in place to control some types of fraud, the more sophisticated schemes require highly coordinated efforts between fraud control units (FCUs), field investiga- tors, and sometimes even local authorities. However, FCUs often lack the resources and infrastructure to handle the sheer volume of investigations efficiently. As a result, scammers can exploit weaknesses in the system, allowing many fraudulent transactions to slip through the cracks.

This highlights the urgent need for a comprehensive fraud investigation system that can aid FCUs with more efficient and streamlined field investigation to combat the evolving threat. In this article, I'll explore the key challenges insur- ers face in tackling fraud and discuss potential solutions, including the role of artificial intelligence and optimizing field operations to stay ahead of the fraud curve.

The Challenges of Manual Investigation Processes

Insurance companies in India are no strangers to the ineffi- ciencies that plague their investigation processes. Unfortu- nately, the pace at which fraud schemes are evolving-be- coming more sophisticated and complex-is outstripping the ability of fraud control units to keep up. Many insurers are still relying on outdated, manual processes and legacy sys- tems, which only serve to slow down their response times further and reduce their effectiveness.

The growing challenges in fraud investigation are driven by several key factors:

Denne historien er fra March 2025-utgaven av THE INSURANCE TIMES.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA THE INSURANCE TIMES

THE INSURANCE TIMES

GST 2.0 Reforms: What They Mean for the Life Insurance Industry and Consumers

The Indian insurance industry has long been advocating for rationalisation of Goods and Services Tax (GST) on life and health insurance products. With the rollout of GST 2.0 reforms, expectations are high that the sector will finally receive much-needed relief and structural clarity. The reforms aim to simplify compliance, widen the tax base, and rationalise rates—moves that could significantly alter how insurers price products and how consumers perceive insurance as a financial tool.

3 mins

October 2025

THE INSURANCE TIMES

Building a Risk-Aware Culture at AIG Post-2008 Crisis

What is Risk Culture?

6 mins

October 2025

THE INSURANCE TIMES

Unrealised Potential: Rural Insurance in India

Rural insurance penetration remains low due to several factors. Products typically cater to urban areas, but prices often fail to account for irregular income cycles, and distribution channels lack local trust and durability.

4 mins

October 2025

THE INSURANCE TIMES

World's First Insurance Salvage Patent: Transforming Accident Recovery into Safety Innovation

The patent's implementation is projected to save lives through prevention of untimely deaths and disabilities. By ensuring transparent disclosure of accident history and repair quality, the system reduces the likelihood of compromised vehicles causing subsequent accidents.

6 mins

October 2025

THE INSURANCE TIMES

Redressal of grievances under the Liability Insurance : An overview

As public liability insurance became integral to modern business risk management, the expectation was that insurers would offer not only financial protection but also prompt and fair resolution in times of distress. However, the ground reality often paints a different picture. Despite purchasing policies with the intent of securing peace of mind, many policyholders-particularly small businesses- experience frustration and uncertainty when filing claims.

14 mins

October 2025

THE INSURANCE TIMES

Bridging the Trust Gap: Why Insurers Need an Internal Ombudsman

The Reserve Bank of India (RBI) has already introduced an Internal Ombudsman Scheme for banks, requiring all banks to designate an independent officer to address escalated consumer complaints. If appropriate, insurance regulators may implement a similar model for the sector.

8 mins

October 2025

THE INSURANCE TIMES

29th FAIR Conference 2025 to be Hosted by GIC Re in Mumbai Media Partner: The Insurance Times

The insurance and reinsurance fraternity will gather in Mumbai from 5th to 8th October 2025 for the 29th FAIR (Federation of Afro-Asian Insurers and Reinsurers) Conference, hosted by GIC Re. Themed \"Emerging Markets Towards Resilient Growth\", this year's edition will focus on strengthening cooperation, resilience, and innovation across Afro-Asian markets.

1 mins

October 2025

THE INSURANCE TIMES

Do's and Don'ts for Purchasing Marine Cargo Insurance in India

Do’s (Things You Must Do)

3 mins

October 2025

THE INSURANCE TIMES

Insurance Regulator Update

Ajay Seth takes charge as IRDAI chairman amid key sector reforms

4 mins

October 2025

THE INSURANCE TIMES

Legal Briefs

Insurer to pay crash victim's kin Rs. 2.5 crore

2 mins

October 2025

Listen

Translate

Change font size