Intentar ORO - Gratis

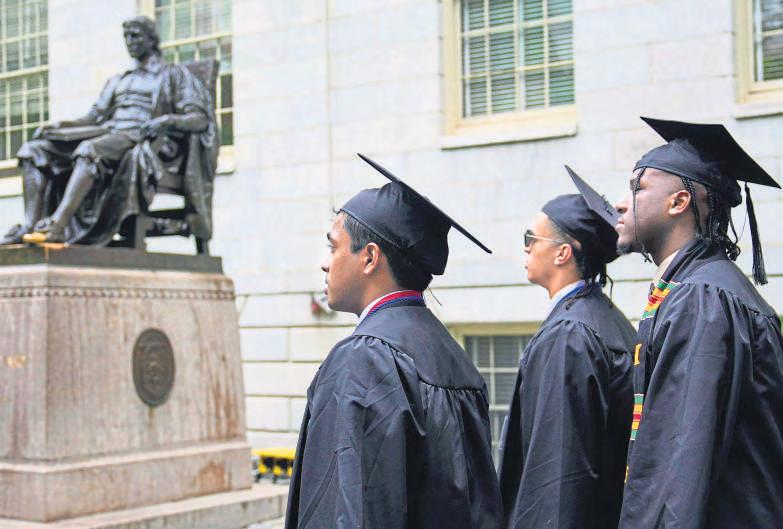

Study-Abroad Startups Face Testing Times

Mint Mumbai

|June 16, 2025

With popular foreign-study destinations tightening visa rules for students, the industry has been hit hard

Samarth G.S., 25, hasn't been to his hometown, in Karnataka, in nearly two years. But not for the usual reasons. Last year, he stayed back in the US to look for an internship. This year, even though he has one, he's hesitating because of tightening visa regulations.

"The situation is dicey here," said Amarth, who is studying for a master's degree. With only a brief window between the end of his internship and the start of the next academic term, he's worried that even a slight delay in returning could put his visa at risk. "Even if I come back a day late, they might use it as an excuse to cancel my visa," he said, referring to US President Donald Trump's regime.

Even when they are traveling within the US, universities are advising international students to carry their passports at all times.

Since Trump returned to power, the US's immigration policies have become draconian. On May 27, the administration ordered US embassies around the world to stop scheduling appointments for student visas. It even halted Harvard University's ability to enroll foreign students. Amid all this, several international students have faced deportation for minor infractions.

While much of the attention around US visa restrictions has focused on students, the Big Brother approach in the US has made another group, India's study-abroad startups, anxious. Companies such as Leap Scholar, Leverage Edu, AdmitKard, and upGrad, which promise smooth overseas admissions and counseling services, are now facing business uncertainty. Because it is not just the US, but key markets such as Canada, the UK, and Australia as well that have tightened rules for international student admissions, according to industry insiders.

After the crash of mainstream edtech in India, the study-abroad industry had emerged as a bright spot. But populist politics across the globe threaten to shake the foundations of the business model. Can these startups weather the storm?

Esta historia es de la edición June 16, 2025 de Mint Mumbai.

Suscríbete a Magzter GOLD para acceder a miles de historias premium seleccionadas y a más de 9000 revistas y periódicos.

¿Ya eres suscriptor? Iniciar sesión

MÁS HISTORIAS DE Mint Mumbai

Mint Mumbai

Infosys may lose $150 mn a year from Daimler

Infosys Ltd risks losing over a third of its $400 annual revenue from Daimler, one of its three largest clients, as the German auto giant seeks a new vendor for software and equipment following execution delays, according to two people familiar with the details.

3 mins

January 12, 2026

Mint Mumbai

Market braces for turbulence as FPI shorts hit record

Indian markets could turn choppier early this week with foreign portfolio investors (FPIs) raising bearish index futures bets to a record high on Friday, ahead of the US Supreme Court decision this week on the validity of president Donald Trump's tariffs.

2 mins

January 12, 2026

Mint Mumbai

The extraordinary video grab has had a very short life

It would appear that we are still in the era of extraordinary mobile-phone videos.

4 mins

January 12, 2026

Mint Mumbai

Clean slate in IBC to be reality soon

Govt accepts panel suggestions, no retrospective application

2 mins

January 12, 2026

Mint Mumbai

Why waiting for a crash can cost you more than investing at highs

Data over the decades shows timing matters far less than staying invested, whether through SIPs or lump sums

4 mins

January 12, 2026

Mint Mumbai

The long tail of a blockbuster—Collections beyond the box-office

The box-office is no longer the only engine of value for a successful film.

3 mins

January 12, 2026

Mint Mumbai

Swiggy scales up Noice to expand private-label play

Swiggy’s Noice expanded its supplier base from 40 to nearly 70 contract manufacturers

2 mins

January 12, 2026

Mint Mumbai

Elon Musk relies on Gwynne Shotwell to make SpaceX soar

Gwynne Shotwell, the longtime president of SpaceX, confronted a delicate problem last June.

6 mins

January 12, 2026

Mint Mumbai

NSE’s unlisted shares in focus as IPO fog clears

The unlisted market could be in for a flurry of activity, with the National Stock Exchange (NSE) likely to get the market regulator’s approval to begin its listing process by the end of this month.

2 mins

January 12, 2026

Mint Mumbai

Hedge funds get ready for the 'Donroe Doctrine' trade

Call it the “Donroe trade.”

4 mins

January 12, 2026

Listen

Translate

Change font size