Intentar ORO - Gratis

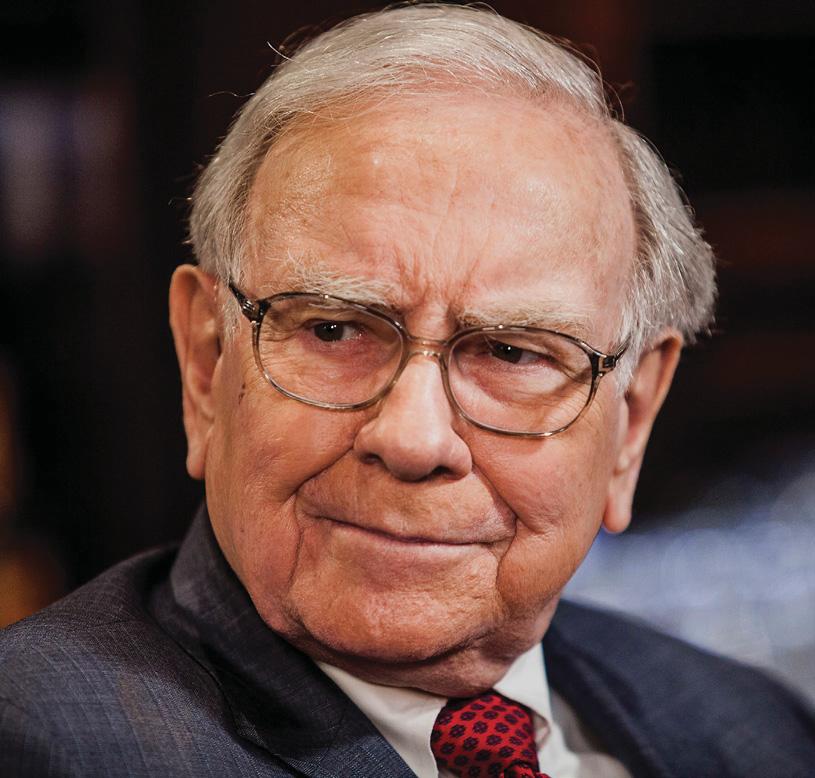

BUFFETT'S LATEST PORTFOLIO MOVES

Kiplinger's Personal Finance

|May 2025

The Oracle of Omaha added a beverage company and said buh-bye to more bank shares.

WARREN Buffett kicks off Berkshire Hathaway's annual meeting on May 3, marking the conglomerate's 60th year under the 94-year-old's leadership. In a letter to shareholders and in the company’s annual report, Buffett disclosed that Berkshire’s stock portfolio ended 2024 worth $272 billion, down from $354 billion at year-end 2023, while cash and cash-equivalent securities jumped to $334.2 billion, up from $167.6 billion—an indication of how hard it has been for Buffett and his co-managers, Ted Weschler and Todd Combs, to find the kind of stock bargains they prefer. One exception is the holding company’s stake in a handful of Japanese conglomerates, now worth $23.5 billion, which Buffett said investors can expect to grow over time.

Whether we're talking about Berkshire’s biggest bets or the scores of stocks it maintains at the margins, it’s clear that the portfolio’s focus has changed dramatically over the past few years. Although old-guard favorites such as American Express and Coca-Cola still form the core of the portfolio, Buffett and his co-managers have taken a shine to names such as Apple and Amazon.com, and even to lesser-known companies such as financial services firm Nu Holdings. Buffett owned airline stocks at the start of 2020; now he holds none. Banks were aces among Buffett stocks to begin 2020; Berkshire soon kicked most of them to the curb. And it seems like only yesterday that Buffett was an enthusiastic buyer of select pharmaceutical names. Today, most of those positions have been closed out, too.

Esta historia es de la edición May 2025 de Kiplinger's Personal Finance.

Suscríbete a Magzter GOLD para acceder a miles de historias premium seleccionadas y a más de 9000 revistas y periódicos.

¿Ya eres suscriptor? Iniciar sesión

MÁS HISTORIAS DE Kiplinger's Personal Finance

Kiplinger's Personal Finance

A TAX BREAK FOR MEDICAL EXPENSES

The editor of The Kiplinger Tax Letter responds to readers asking about health care write-offs.

2 mins

February 2026

Kiplinger's Personal Finance

Volunteering to Help Others at Tax Time

Through an IRS program, qualifying individuals can get free assistance with their tax returns.

2 mins

February 2026

Kiplinger's Personal Finance

CATCH-UP SAVERS FACE A TAXING 401(K) CHANGE

Under new rules, you may lose an up-front deduction but gain tax-free income once you retire.

2 mins

February 2026

Kiplinger's Personal Finance

The Case for Emerging Markets

Economic growth, earnings acceleration and bargain prices favor EM stocks.

3 mins

February 2026

Kiplinger's Personal Finance

THE NEW RULES OF RETIREMENT

Popular guidelines about how to save, invest and spend need to be updated and personalized to ensure you'll never run out of money.

15 mins

February 2026

Kiplinger's Personal Finance

Smart Ways to Share a Credit Card

Adding an authorized user has its benefits, but make sure you set the ground rules.

2 mins

February 2026

Kiplinger's Personal Finance

THE BEST AFFORDABLE FITNESS TRACKERS

These devices monitor your exercise, sleep patterns and more- and they don't cost an arm and a leg.

4 mins

February 2026

Kiplinger's Personal Finance

A VALUE FOCUS CLIPS RETURNS

THERE'S more to Mairs & Power Growth than its name implies. The managers favor firms with above-average earnings growth. But a durable, competitive position in their market- “a number-one or number-two position and gaining share,” says comanager Andrew Adams—and a reasonable stock price matter even more.

1 mins

February 2026

Kiplinger's Personal Finance

Look Beyond the Tech Giants

I am hooked on a podcast called Acquired, in which two smart guys do a deep analytical dive, typically lasting three or four hours, on a single successful company such as Coca-Cola or Trader Joe's. Ben Gilbert and David Rosenthal, a pair of venture capitalists, are especially adept at explaining what's behind the success of such tech giants as Alphabet (symbol GOOGL, $320), the former Google, which recently merited 11 hours and 42 minutes of dialogue all by itself.

4 mins

February 2026

Kiplinger's Personal Finance

How to Pay for Long-Term Care

A couple of months ago, I wrote that many Americans significantly underestimate how long they could live in retirement (see “Living in Retirement,” Dec.). With the possibility of a 30-year retirement becoming more common, retirees need to plan for so-called longevity risk to make sure their assets last a lifetime. And the longer you live, the more likely you'll need to pay for some form of long-term care. That can range from assistance with activities of daily living to in-home care to a nursing home stay.

2 mins

February 2026

Listen

Translate

Change font size