Intentar ORO - Gratis

Defensive To Remain In Limelight

Dalal Street Investment Journal

|August 17 - 30, 2020

With the Sensex recovering nearly 50 per cent from its March lows it is becoming a risky proposition for investors and traders to bet on high beta stocks. Low beta stocks could do the trick in the current market situation. Defensive stocks once again may lead the market rally as the craze for the financials and high beta stocks fizzles out slowly. Yogesh Supekar and Geyatee Deshpande explain why it makes sense to park extra monies in defensive stocks while the DSIJ Research Team churns out the best contenders in the defensive space to beat the markets

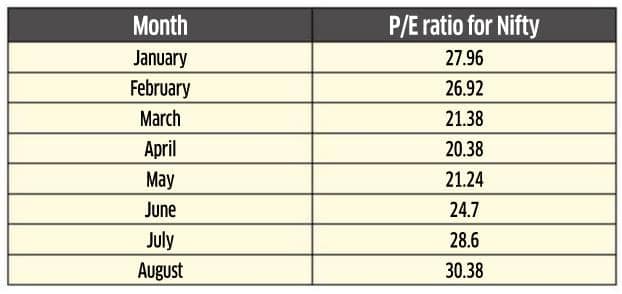

Sensex and Nifty, key benchmark indices that are the barometer of the health of the Indian equity markets, have risen almost 46 per cent each since their March 23, 2020 lows. Such a sudden and record-breaking rise, though financially satisfying, has got experts worried – the single biggest concern being ‘valuations’. The valuations are way too far-stretched to not predict a market correction. If we simply look at the PE levels for 2020 in all the months, we get a fair idea.

If we look at the above table, we see that the PE has expanded steadily since the correction in March. One might say that the PE has been the highest in August at 30.38 for 2020. That may not seem very informative per se but when we realise that the Nifty PE has never been so high ever, it can be an alarming piece of information for both traders and investors. Even in 2008, when the markets were pumped up by liquidity and frenzied leveraged buying, the PE for Nifty in January 2008 was 25.33. The correction pushed the PE for Nifty towards 12.73 in January 2009 and eventually when the markets recovered, the PE clawed back to the 25.33 levels by October 2010.

If we look at the above table, we see that the PE has expanded steadily since the correction in March. One might say that the PE has been the highest in August at 30.38 for 2020. That may not seem very informative per se but when we realise that the Nifty PE has never been so high ever, it can be an alarming piece of information for both traders and investors. Even in 2008, when the markets were pumped up by liquidity and frenzied leveraged buying, the PE for Nifty in January 2008 was 25.33. The correction pushed the PE for Nifty towards 12.73 in January 2009 and eventually when the markets recovered, the PE clawed back to the 25.33 levels by October 2010.Esta historia es de la edición August 17 - 30, 2020 de Dalal Street Investment Journal.

Suscríbete a Magzter GOLD para acceder a miles de historias premium seleccionadas y a más de 9000 revistas y periódicos.

¿Ya eres suscriptor? Iniciar sesión

MÁS HISTORIAS DE Dalal Street Investment Journal

Dalal Street Investment Journal

Capital Markets 2.0: From a Banyan Tree to Billion-Dollar Trades

From open street gatherings to today's tech-driven markets handling crores in daily turnover, India's capital markets have truly come a long way. But the transformation isn't over yet. In this story, Mandar Wagh explores the next wave of evolution reshaping India's financial landscape, highlighting SEBI's progressive reforms, the rise of a strong digital backbone, and the key companies positioned to benefit from this structural shift

6 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

India Inc's Q1 FY26: A Tale of Resilience and Reckoning

Q1FY26 has revealed a corporate India that's adapting smartly to shifting global currents while drawing strength from domestic policy support. With RBI's timely rate cuts cushioning demand, sectors like banking and insurance have surged ahead, even as IT and consumer segments navigate headwinds. Early results from 200+ companies suggest a story of selective strength and strategic resilience. The rest of the earnings season could either cement this momentum—or test it

5 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

RIDING WATER INFRA BOOM WITH VALUE-ADDED GROWTH

Jai Balaji Industries Ltd

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

Active Momentum Funds Timing the Market or Tapping the Trend?

Abhishek Wani evaluates whether India's active momentum funds are skillfully timing markets or simply riding trends. By dissecting strategies of Samco and Quant, he scrutinizes the fine line between tactical rotation and disciplined trend-following in a volatile momentum investing landscape

10 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

FIEM INDUSTRIES LTD LEADING THE CHARGE IN AUTOMOTIVE LED LIGHTING

India has become the fastestgrowing major economy in the world in recent years, which has led to significant demand for automobiles, including auto components.

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

The Case for Value-Oriented Mutual Funds

We Indians love a good bargain. Known for our haggling skills, we take pride in not overpaying - whether it's for a product or a service. After all, why pay more than what something is truly worth?

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

EMI vs SIP : Finding the Financial Sweet Spot

With rising home loan interest rates and evolving tax rules, many individuals face a critical choice- should surplus funds go toward prepaying their loan or building long-term wealth through SIPs? This piece compares both strategies across scenarios, helping you make an informed decision based on savings, returns, risk, and time horizon

9 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

Make Your Portfolio Inflation-proof

Inflation is crucial to investing as it reduces the value of your money over time. Therefore, keeping up with the rate of inflation, to protect the value of investments, should be the top priority for every long-term investor. Remember, the ability to earn a positive real rate of return, i.e., gross returns minus taxes minus inflation, would depend upon the composition of the portfolio.

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

AI Tailwind in IT Stocks: Time to Reboot Your Tech Portfolio?

After one year of sectoral underperformance, Indian IT is quietly undergoing its most radical overhaul since the cloud revolution, this time led by AI. The shift isn't cosmetic; it's existential. GenAI is reshaping services, rewarding agile midcaps and prompting investors to rethink legacy bets. The future of tech belongs to the AI-ready.

11 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

Gen Z: High Conviction Story, but Priced to Perfection?

From skincare routines to fashion trends, Gen Z is transforming how India consumes. This digital-first generation doesn't just buy; they curate experiences, demand personalization, and look for authenticity in every swipe and scroll. As India's 440-million-strong Gen Z cohort begins to dominate discretionary spending, platforms built to speak their language stand to gain immensely. Nykaa, India's leading content-led, lifestyle retail platform, is at the forefront of this generational shift

8 mins

July 28 - August 10, 2025

Translate

Change font size