Versuchen GOLD - Frei

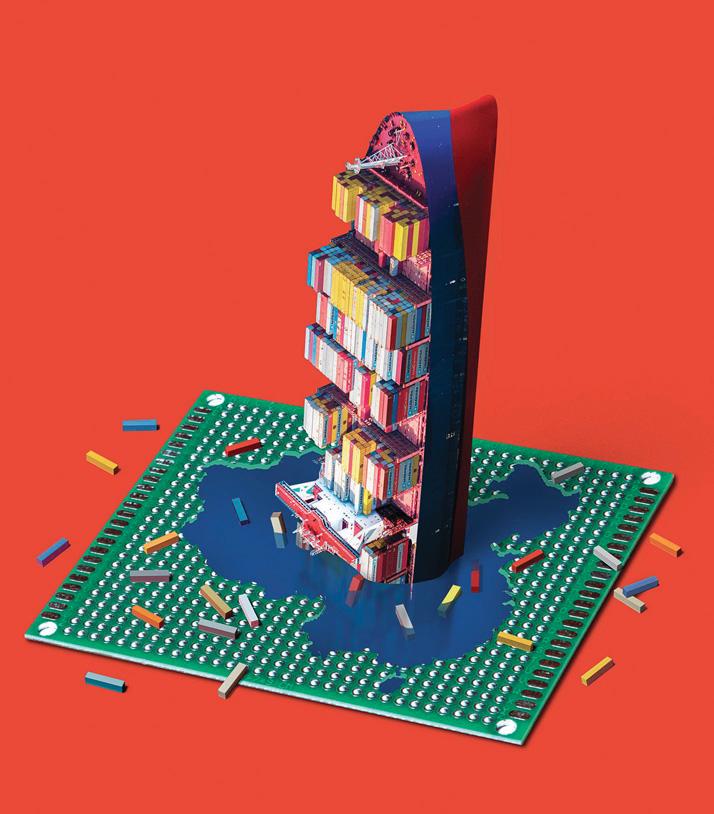

Trump's first trade war caused U.S. firms to flee China. Now comes round 2.

Fortune US

|February - March 2025

DDURING HIS FIRST TERM as president, Donald Trump shook up global trade by imposing new tariffs on China, the world's epicenter for manufacturing. Companies importing Chinese-made goods into the U.S. suddenly found themselves having to pay extra duties—sometimes 30% more—if they continued using that country as a supplier.

The response by U.S. businesses was swift: Many relocated at least some of their production from China to countries like Vietnam, India, and Mexico, which weren't in Trump's economic crosshairs.

Now, with Trump's second term underway, the tariffs plan is again on the table. But this time, he's promised an expanded version that, if implemented, would create even more corporate upheaval and turn some previously winning countries in his trade war into big losers.

“Trump Two is not Trump One,” warns Deborah Elms, head of trade policy at the Hinrich Foundation, a Singapore-based think tank that advocates for sustainable global trade. “I’m not convinced that everyone recognizes the extent of the danger. It’s going to catch a number of folks in the region really off guard.”

Trump’s specific road map for reshuffling global trade will emerge in the months and years ahead—or perhaps there will never be a map, leaving business leaders in the dark on a critical issue impacting their all-important planning. What is clear from his previous dance with tariffs is this: Even after nearly a decade of tensions with China, U.S. companies still haven’t been able to find a replacement for Chinese manufacturing.

In reality, Trump's tariffs-largely unchanged under President Joe Biden-accelerated a transition from China that was already underway. Companies had already started to move lower-value manufacturing, like textiles, to other countries as labor there became more expensive. “A lot of this diversification was the Chinese factories themselves, picking up their equipment and moving the whole thing to Vietnam and Cambodia,” says Joe Ngai, chairman for the Greater China region at consulting firm McKinsey.

Beijing's harsh COVID-era lockdowns, which closed factories nationwide and snarled the country's well-oiled supply chain, added even more urgency to the shift. U.S. companies realized that they didn't want to depend too much on a single country.

Diese Geschichte stammt aus der February - March 2025-Ausgabe von Fortune US.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Fortune US

Fortune US

COMPANIES ARE INUNDATING CUSTOMERS WITH SURVEYS-AND GETTING WORSE RESULTS

ONE WEEK LAST AUTUMN, I hit my customer feedback limit. I had seen my doctor and done some online shopping.

5 mins

February - March 2026

Fortune US

IT'S TIME TO TAKE TETHER SERIOUSLY

THE LEADER IN CRYPTO STABLECOINS HAS $15 BILLION IN THE BANK, U.S. EXPANSION PLANS—AND A CEO WITH A DARK VISION OF THE FUTURE.

15 mins

February - March 2026

Fortune US

THE BERKSHIRE HATHAWAY OF HOTELS: HOW A NUMBERS GUY MADE HYATT A LUXURY GIANT BY MATT HEIMER

WITH ITS V-SHAPED BASE and sloping windows that cantilever outward over the Chicago River, the 54-story skyscraper that houses Hyatt Hotels' headquarters is a “statement” building that awes tourists and architecture buffs alike.

4 mins

February - March 2026

Fortune US

GOOGLE'S AI PIONEER AND HIS DRUG-DESIGN MOONSHOT

DEEPMIND COFOUNDER DEMIS HASSABIS HAS ALREADY WON A NOBEL PRIZE AND A KNIGHTHOOD FOR HIS INSIGHTS INTO HUMAN BIOLOGY. HIS AI STARTUP ISOMORPHIC LABS COULD DELIVER EVEN BIGGER BREAKTHROUGHS.

10 mins

February - March 2026

Fortune US

INSIDE TODAY'S AI DATA CENTERS

THE DATA CENTER is getting a makeover. The nondescript industrial buildings once hummed away largely behind the scenes, powering the various facets of our online lives.

2 mins

February - March 2026

Fortune US

HOW NETFLIX SWALLOWED HOLLYWOOD

IT'S A STORY SO GOOD it could have been a screenplay. In 2000, Reed Hastings and Marc Randolph sat down across from John Antioco, then CEO of video rental giant Blockbuster, and pitched him on acquiring their still unprofitable DVD-by-mail startup, Netflix, which at the time had around 300,000 subscribers.

5 mins

February - March 2026

Fortune US

THE AI DATA CENTER BOOM PITS RURAL AMERICA AGAINST SILICON VALLEY BILLIONS

FACING A PROPOSAL FOR A MASSIVE FACILITY IN THE ARIZONA DESERT, LOCALS FIND THEMSELVES IN A BATTLE THEY NEVER WANTED-OVER ENERGY, WATER, LAND, AND WHO GETS TO DECIDE HOW THE AI ERA TAKES SHAPE.

12 mins

February - March 2026

Fortune US

INVEST LEARNING TO LOVE BONDS

MANY INVESTORS regard bonds as the frumpier cousins to stocks. Their prices rarely pop or plummet. They usually deliver a lower return, and—aside from a glamorous cameo in the 1980s thriller Die Hard— they are not part of popular culture in the same way as, say, GameStop or Tesla shares. They are, though, a critical part of any well-managed portfolio, and with the stock market looking particularly frothy, this may be more true than ever.

3 mins

February - March 2026

Fortune US

Where Senior Care Comes First

What began as one family's health crisis has grown into Alignment Healthcare, a company serving hundreds of thousands of seniors with innovative solutions.

1 mins

February - March 2026

Fortune US

HOW VICTORIA'S SECRET GOT ITS SEXY BACK

DETERMINED NOT TO REPEAT THE BRAND'S PAST MISTAKES, CEO HILLARY SUPER IS SHEDDING THE BODY-SHAMING AND THE PERFORMATIVE BOX-CHECKING—BUT NOT THE WINGS, GLAMOUR, AND GLITTER.

11 mins

February - March 2026

Listen

Translate

Change font size