Denemek ALTIN - Özgür

Nothing Scripted

Mint Mumbai

|July 05, 2025

Dharma Productions reported consolidated revenue of ₹512.2 crore in FY24, including ₹111 crore from distribution and exhibition of films

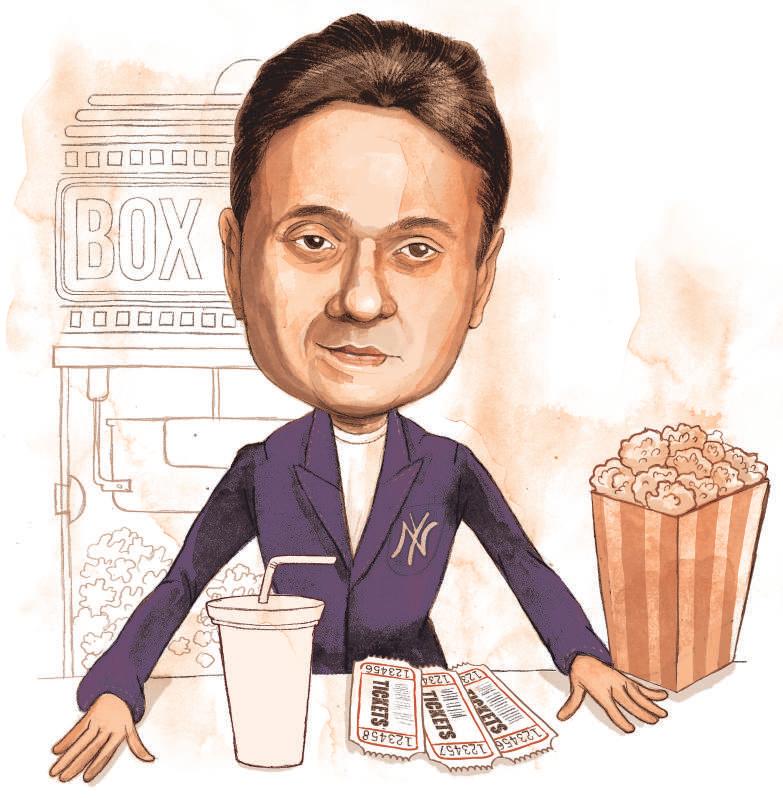

Apoorva Mehta had no idea that a seemingly ordinary day back in class VI at Greenlawns High School in south Mumbai was going to set the course for the rest of his life. A student from another section was transferred to his class. The principal asked who was willing to make friends with the new boy. Mehta put his hand up. Forty years on, they are still friends and run a film production house that has diversified into web shows, talent management and advertising, well known in Bollywood circles as Dharma Productions.

That boy was filmmaker Karan Johar, owner of Dharma, the company he inherited from his father Yash Johar, where Mehta has served as CEO for the past 20 years.

"For many people, their careers are happy accidents and I'm certainly a testament to that," Mehta, 53, says over a video call, days before leaving for the Cannes Film Festival where Dharma's latest film Homebound premiered in the Un Certain Regard category. "I didn't know him (Johar) at all. It was just one of those things, I don't know why I did it (put my hand up to agree to be his friend) but I'm very glad I did."

Mehta and Johar continued to stay friends through school, and eventually enrolled at HR College of Commerce & Economics, bonding over Hindi films and music all through (though they promptly changed cassettes in the car stereo to English songs while approaching college so as to not appear uncool). After college, Mehta joined his family's copper rolling business—his father died when he was just 17—while Johar went on to make friends in the film industry, such as distributor Anil Thadani and filmmaker Aditya Chopra. He assisted the latter on his directorial debut Dilwale Dulhania Le Jayenge (1995), eventually making his own film, Kuch Kuch Hota Hai (1998). Mehta, meanwhile, wasn't exactly happy.

Bu hikaye Mint Mumbai dergisinin July 05, 2025 baskısından alınmıştır.

Binlerce özenle seçilmiş premium hikayeye ve 9.000'den fazla dergi ve gazeteye erişmek için Magzter GOLD'a abone olun.

Zaten abone misiniz? Oturum aç

Mint Mumbai'den DAHA FAZLA HİKAYE

Mint Mumbai

HCLTech reports $146 mn in advanced AI revenue, up 46%

HCL Technologies Ltd's management said it would continue to share revenue from automation tools, as this would give stakeholders a ringside view of the company’s prowess in making itself future-ready.

2 mins

January 14, 2026

Mint Mumbai

Battery storage set to get local flavour

Components in BESS may need compulsory 50% local content

3 mins

January 14, 2026

Mint Mumbai

USK buys into US snack brand Go Raw

USK Capital, the family office of billionaire banker Uday Kotak, has acquired a majority stake in Freeland Foods LLC, which owns the US-based seed-snack brand Go Raw.

1 mins

January 14, 2026

Mint Mumbai

Road ministry outlay to stay flat, in push for pvt capital

The Centre may keep the road ministry's allocation in the Union Budget 2026-27 nearly unchanged from the previous year's ₹2.72 trillion, aiming to shift focus towards attracting private investment, even as highway construction slows, according to two officials close to the discussions.

4 mins

January 14, 2026

Mint Mumbai

FPIs switch gears: Cyclicals gain, defensives lose in 2025

FPIs pulled 1.67 trillion from Indian equities in 2025, despite sharp sector-level divergence

4 mins

January 14, 2026

Mint Mumbai

Consent at a tap becomes a challenge for digital lending

Lenders want continuous access to and use of certain borrower data for duration of live loans

3 mins

January 14, 2026

Mint Mumbai

Electronics to beat IT pace in 5 years

Driven by aggressive policy support and a global realignment of supply chains, India's electronics manufacturing industry is set to grow nearly three times faster than the country's flagship information technology (IT) services sector and draw level with it in terms of revenues over the next five years, a top government official said.

2 mins

January 14, 2026

Mint Mumbai

Why FIIs are back in consumer durables

Foreign institutional investors (FIIs) reversed the four-month selling streak in December, turning net buyers of Indian consumer durable stocks with purchases worth $438 million.

2 mins

January 14, 2026

Mint Mumbai

TCS, HCL signal no broad revival

The December quarter (Q3FY26) results of large-cap information technology (IT) companies Tata Consultancy Services Ltd (TCS) and HCL Technologies Ltd played out largely as expected, with HCL leading on revenue growth.

2 mins

January 14, 2026

Mint Mumbai

He's their daddy. Meme-stock traders rush to Powell's defense.

When Jerome Powell went public with his defense of the Federal Reserve's independence, the central bank’s chair found an unlikely army standing behind him: the meme-stock crowd.

3 mins

January 14, 2026

Listen

Translate

Change font size