Denemek ALTIN - Özgür

The King Kong vs Godzilla battle of world trade: Guess who won?

Mint Hyderabad

|November 13, 2025

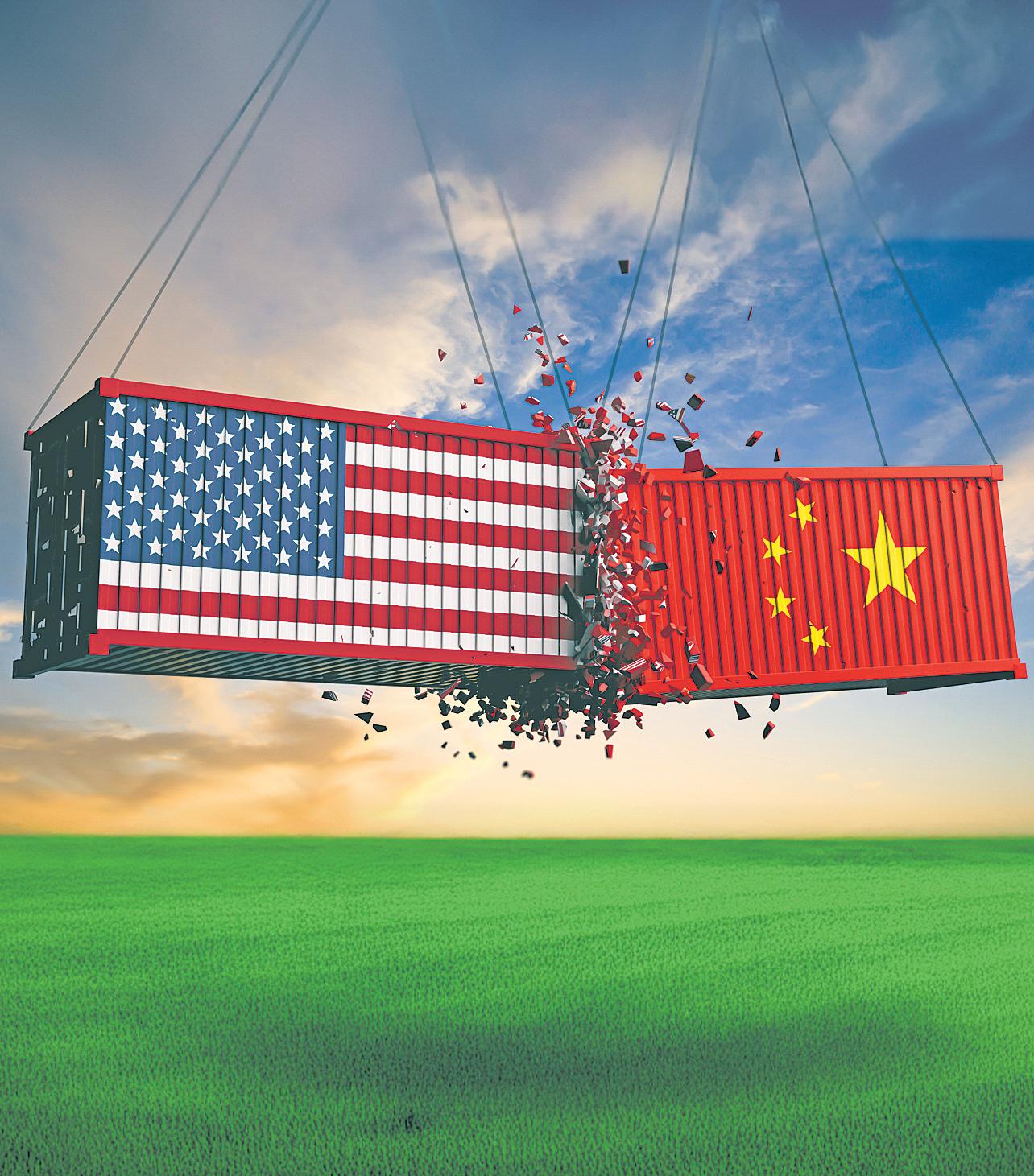

The trade truce between the US and China demonstrates Beijing’ leverage over key minerals that helped it come up trumps

Late last month, in Busan, South Korea, the leaders of the two largest economies in the world met face-to-face and both came away smiling. After months of escalating and tit-for-tat tariffs, the two sides achieved what is being called a détente, a pause in hostilities.

“The deal with China is going to be wonderful,” US President Donald Trump said. “It’s going to be long lasting.” Evoking comparison with along and stable marriage, Chinese President Xi Jinping said, “frictions now and then are normal...China’s development and rejuvenation are not incompatible with President Trump's goal of Making America Great Again.”

All this happy talk is the usual doublespeak and hypocrisy of politics, of course, except in this case the stakes are large. What we have witnessed for the last nine months is a test of wills between two fundamentally different views of market power. One giant, the US, believes—rather optimistically—that it is a monopsony. It (we can think of it as King Kong) initiated a tariff war because it may have convinced itself that as the largest economy and biggest importer with the greatest purchasing power in global trade, it had the ability to demand concessions from countries that were selling to it. King Kong's primary target was the other giant, China, which believes—correctly—that it holds a monopoly over several goods and inputs that are essential for high tech manufacturing. The target (we can call it Godzilla) refused to yield and initiated countermeasures to restrict access to some of these essential inputs.

Bu hikaye Mint Hyderabad dergisinin November 13, 2025 baskısından alınmıştır.

Binlerce özenle seçilmiş premium hikayeye ve 9.000'den fazla dergi ve gazeteye erişmek için Magzter GOLD'a abone olun.

Zaten abone misiniz? Oturum aç

Mint Hyderabad'den DAHA FAZLA HİKAYE

Mint Hyderabad

Marico’s margin on slippery slope despite healthy demand

The Marico Ltd stock hit a new 52-week high of ₹764.65 on the NSE on Monday after its consolidated revenue surged 31% year-on-year to ₹3,482 crore in the September quarter (Q2FY26), led by broad-based growth across product categories.

1 mins

November 18, 2025

Mint Hyderabad

'Many blitzscaling startups don't transition to discipline'

overthe last decade havescaled much more than anyone anticipated.

1 mins

November 18, 2025

Mint Hyderabad

India ships jet fuel to US West Coast

India has exported its first-ever jet fuel cargo to the US West Coast for energy major Chevron, according to traders and shipping data, seizing upon a rare arbitrage opportunity to fill supply shortfalls in Los Angeles.

1 min

November 18, 2025

Mint Hyderabad

Gold spike, Trump tariffs lift goods trade deficit to all-time high

Overall merchandise exports slipped to $34.38 billion from $36.38 billion in September and $38.98 billion a year earlier. Agarwal said India maintained steady export growth in the first seven months of FY25, even as global demand softened.

2 mins

November 18, 2025

Mint Hyderabad

Blockbuster year in sight for IPO street as issuers queue up

A decade-high number of filings for initial public offers, or IPOs, in 2025 has brought India within sighting distance of the highest ever amount of money raised in such share sales in a single year, data analysed by Mint showed.

1 min

November 18, 2025

Mint Hyderabad

Govt keen on timely payments to MSMEs

The Union government is considering a new set of measures—including charging interest and imposing a substantial levy on defaulters—to address the longstanding issue of delayed payments to micro, small, and medium enterprises (MSMEs), said two people close to the matter.

2 mins

November 18, 2025

Mint Hyderabad

Blockbuster year in sight for IPO street

capital markets, Avendus Capital, a Mumbai-based investment bank.

2 mins

November 18, 2025

Mint Hyderabad

Do pre-IPO gains get long-term tax status?

I live in Australia and I own shares in a Indian company which got recently listed. I invested about 1.5 years back when it was not listed. When I sell the shares now, will it be considered as shortor long-term gains? —Name withheld on request

1 mins

November 18, 2025

Mint Hyderabad

Bezos takes on first ops role since Amazon

Jeff Bezos will serve as co-chief executive officer of a new artificial intelligence (AI) startup that focuses on AI for engineering and manufacturing of computers, automobiles and spacecraft, The New York Times reported on Monday.

1 min

November 18, 2025

Mint Hyderabad

Meity clears projects worth ₹7,172-crore

The ministry of electronics and information technology (MeitY) on Monday cleared 17 projects, with a cumulative investment of ₹7,172 crore, in the second tranche of approvals under a scheme that aims to boost the production of electronic goods within the country.

1 min

November 18, 2025

Listen

Translate

Change font size