Denemek ALTIN - Özgür

Finweek English

|10 August 2017

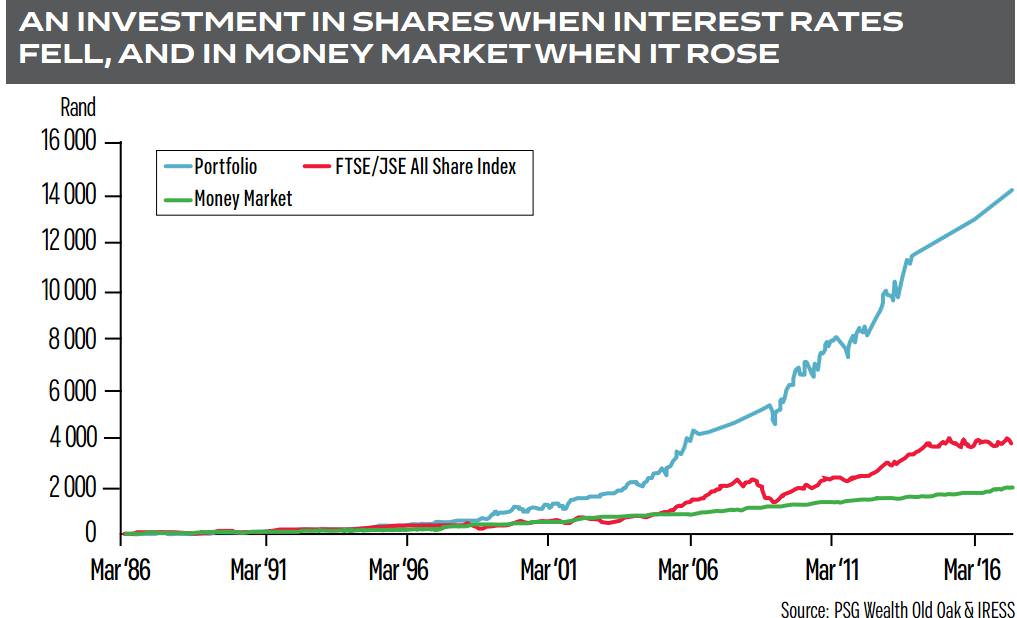

Don’t bank on this, but historical data shows that declining interest rate phases are particularly favourable environments for equity investments.

-

So many things in our daily lives go hand in hand, whether it’s sunshine and summer, tea and biscuits or Hashim Amla and centuries. When we take a closer look at our stock market and interest rates, we will note that even these two go hand in hand.

On 20 July, the South African Reserve Bank (SARB) announced its decision to, for the first time in five years, lower interest rates by 0.25 percentage points. This decision follows after local GDP showed negative growth for two quarters in a row – something that plunged us right back into a full-blown recession. Although the interest rate cut may not be a huge saving for the average South African consumer, the message that the SARB is trying to send is very positive, namely it’s attempting to stimulate growth.

However, the question of how this will affect local shares now that we find ourselves in a declining interest rate phase remains. In an attempt to answer this question, I would like to refer to the period since 1973 as an example (please note that historical figures do not guarantee future performance in any way whatsoever).

Bu hikaye Finweek English dergisinin 10 August 2017 baskısından alınmıştır.

Binlerce özenle seçilmiş premium hikayeye ve 9.000'den fazla dergi ve gazeteye erişmek için Magzter GOLD'a abone olun.

Zaten abone misiniz? Oturum aç

Finweek English'den DAHA FAZLA HİKAYE

Finweek English

THE HEALTH OF SA'S MEDICAL SCHEMES

As the Covid-19 pandemic abates, finweek takes a look at the financial performance of some of the largest players.

7 mins

5 November 2021

Finweek English

The effect of Gilbertson's departure

With Ntsimbintle Holdings now the major shareholder of Jupiter Mines, it could change SA’s manganese industry.

3 mins

5 November 2021

Finweek English

Making money from music

Why investors are increasingly drawn to the music industry.

3 mins

5 November 2021

Finweek English

Conviction is key

Sandy Rheeder plays a critical role in Mukuru’s mission to open up financial services to the emerging consumer market in Africa through tailor-made technology solutions and platforms.

5 mins

5 November 2021

Finweek English

The post-pandemic toolkit

How CFOs can use technology to support growth.

4 mins

5 November 2021

Finweek English

Big city living exodus

Mini cities like Waterfall City and Steyn City are redefining city-style apartment living.

3 mins

5 November 2021

Finweek English

Big compact, big value

Handsome, with a hefty level of standard specification, the roomy Haval Jolion compact crossover is a great value proposition.

3 mins

5 November 2021

Finweek English

On barriers to entry

There are various ways in which a company or sector can achieve competitive dominance. They usually make for good investments.

2 mins

5 November 2021

Finweek English

Fear and greed in one index

To buck the trend, when markets are hot or cold, is a tough thing to do. However, it can deliver solid returns.

3 mins

5 November 2021

Finweek English

Africa's largest data centre facility coming soon

Vantage Data Centers plans to invest over R15bn for its first African data centre facility in Attacq’s Waterfall City.

3 mins

5 November 2021

Translate

Change font size