Poging GOUD - Vrij

US TARIFF-LED RISKS PERSIST FOR INDIA

Mint New Delhi

|October 08, 2025

The Indian economy stumbled in August, hit by the US's additional 25% tariffs on top of the 25% reciprocal levy, as external risks weighed on domestic momentum through a weakening rupee, continued selling by foreign investors, sliding stock market and slowing exports.

Global trends, particularly the trade uncertainty triggered by US President Donald Trump's tariffs, continued to weigh on sentiments. However, the intensity of those jitters has eased in September and October so far. But the worst may not be over yet. Even as the economy is expected to hold well, benefiting from the goods and services tax (GST) revamp, loss of export competitiveness to other Asian emerging markets and a steep valuation premium remain key concerns.

RUPEE ROUT

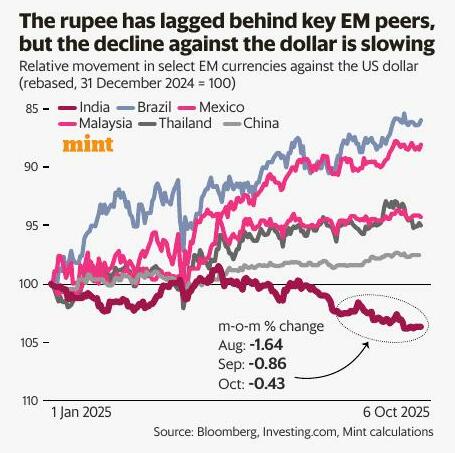

RUPEE ROUT THE INDIAN rupee has become the worst-performing Asian currency this year, particularly in August, when additional tariffs eroded India's trade advantage among its emerging market peers. This prompted a 1.6% month-on-month depreciation against the US dollar in August, while the central bank intervention helped reduce volatility. Data shows that the magnitude of the decline was nearly half, at around 0.8% in September, and even smaller at 0.4% in the first few days of October.

While the RBI holds a $700-billion forex buffer to support the rupee, the focus would be on reducing volatility. "India's relative loss of export competitiveness vs EM Asia, amid higher tariffs, and especially now with services coming in the trade war ambit, would, in principle, warrant some adjustment via a weaker currency," Emkay Global said in a note.

Dit verhaal komt uit de October 08, 2025-editie van Mint New Delhi.

Abonneer u op Magzter GOLD voor toegang tot duizenden zorgvuldig samengestelde premiumverhalen en meer dan 9000 tijdschriften en kranten.

Bent u al abonnee? Aanmelden

MEER VERHALEN VAN Mint New Delhi

Mint New Delhi

Afghan, Pakistani forces battle along the border

Afghan and Pakistani troops battled along their border, Afghan residents and officials told on Sunday, with the fighting coming alongside multiple strikes including the former US air base at Bagram.

2 mins

March 02, 2026

Mint New Delhi

Indian firms in crisis mode as conflict escalates

The safety of human life is our foremost priority, and the Company will deploy every resource at its disposal to ensure the well-being of all its people,” the spokesperson said.

1 mins

March 02, 2026

Mint New Delhi

Iran crisis threatens worst gas market disruption since 2022

A widening Middle East conflict looks set to create the most significant disruption for gas markets since Russia's invasion of Ukraine upended global trade four years ago.

1 mins

March 02, 2026

Mint New Delhi

Act in favour of homebuyers left in the lurch by property builders

India's Supreme Court has laid out the principle of protecting home investments. Follow it through

3 mins

March 02, 2026

Mint New Delhi

India’s innovation gap shows up in the financial data of our firms

Corporate India must recognize R&D as the foundation of long-term competitiveness before we can hope for breakthroughs

4 mins

March 02, 2026

Mint New Delhi

THE REAL SCANDAL IN IDFC CASE GOES BEYOND THE FRAUD

The IDFC First Bank fraud has angered people.

2 mins

March 02, 2026

Mint New Delhi

India-EU free trade deal draft clarifies textile origin rules

The draft text allows limited use of non-originating textile materials within fixed percentage limits by weight

1 mins

March 02, 2026

Mint New Delhi

Middle East conflict unlikely to dent remittance inflows

Experts say any dip in inflows to be short-lived if tensions do not escalate into full-scale war

3 mins

March 02, 2026

Mint New Delhi

Why one should not be afraid of artificial intelligence

The fear of artificial intelligence (AI) is so rampant now that it appears to be a matter of decorum to admit to this fear.

4 mins

March 02, 2026

Mint New Delhi

Novo deepens healthcare bets with larger India deals

The Denmark-based investor is scaling up from $20-30 mn deals to $40-100 mn investments

2 mins

March 02, 2026

Listen

Translate

Change font size