Poging GOUD - Vrij

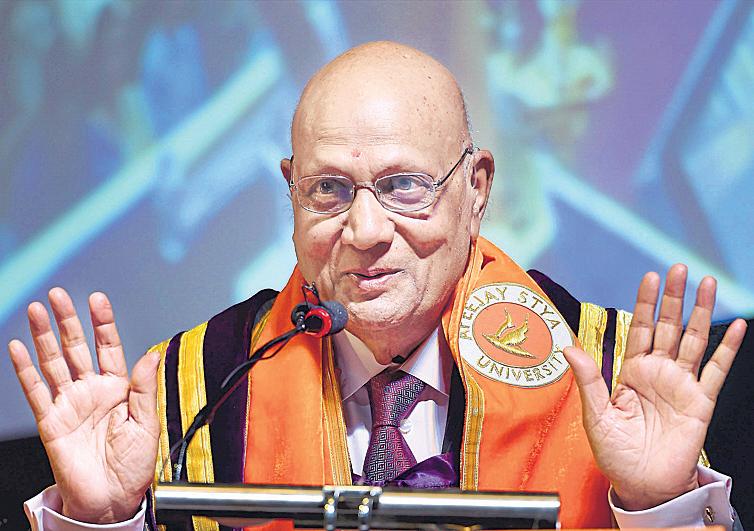

Swraj Paul, the capitalist rebel in a socialist India

Mint Mumbai

|August 23, 2025

Swraj Paul, who passed away in London on Thursday evening at the age of 94, was one of the most consequential entrepreneurs that the India of the past prevented from flourishing.

Born into a Punjabi Hindu family in Jullunder (now Jalandhar) on 18 February 1931, Paul's journey from foundry owner's son to London steel magnate began with a tragedy that would define his character.

His father Payare Lal ran a small foundry that produced steel buckets and farm machinery as part of the Apeejay Group, managed by Paul's older brothers Satya and Jit. After obtaining his Master's degree in mechanical engineering from MIT, Swraj returned to join the family business, but his life changed irrevocably in 1966 when his four-year-old daughter Ambika was diagnosed with leukemia.

Then Prime Minister Indira Gandhi personally removed bureaucratic hurdles to allow him the foreign currency he needed for treatment abroad — a rarity in socialist India. Despite Paul's efforts, Ambika passed away. Shattered, he relocated permanently to London, taking over the operations of Apeejay Overseas. Following a family partition, he renamed his business Caparo, establishing himself as an independent force while maintaining his Indian connections.

Tragedy would revisit him years later. In November 2015 his son Angad Paul, CEO of Caparo, died after falling from his Marylebone penthouse, dealing Paul another devastating blow in his golden years.

Dit verhaal komt uit de August 23, 2025-editie van Mint Mumbai.

Abonneer u op Magzter GOLD voor toegang tot duizenden zorgvuldig samengestelde premiumverhalen en meer dan 9000 tijdschriften en kranten.

Bent u al abonnee? Aanmelden

MEER VERHALEN VAN Mint Mumbai

Mint Mumbai

'FPIs, capex and earnings will drive markets up in Samvat 2082'

India is a market where exit is easy but entry is tough, says Nilesh Shah, MD of Kotak Mahindra AMC, the fifth-largest mutual fund based on quarterly assets under management (AUM) as of September-end.

4 mins

October 13, 2025

Mint Mumbai

Dissent aside, Tata Trusts keen to keep Tata Sons private

Tata Trusts remains committed to its decision to keep Tata Sons private, two Tata executives told Mint, hours after the Shapoorji Pallonji Group issued a public statement seeking a public share sale of the Tata Group holding company.

2 mins

October 13, 2025

Mint Mumbai

What the govt's capex growth does not reveal

The government's capital expenditure has surged sharply in the first five months (April-August) of FY26. It has already spent nearly 39% of the annual outlay of 11.2 trillion, a 43% year-on-year jump.

2 mins

October 13, 2025

Mint Mumbai

US seeks inventory model for e-comm

Negotiators cite 'level playing field', move may raise competition

2 mins

October 13, 2025

Mint Mumbai

EQT scraps Zelestra India sale, to pump in $600 mn

For scraps

2 mins

October 13, 2025

Mint Mumbai

INSIDE NADELLA'S AI RESET AT MICROSOFT

Earlier this month, Microsoft promoted Judson Althoff, its longtime sales boss, to chief executive of its commercial business, consolidating sales, marketing and operations across its products. The move was designed gence.

3 mins

October 13, 2025

Mint Mumbai

H-IB fee hike Trump's second blow to gems & jewellery firms

Losing sparkle

2 mins

October 13, 2025

Mint Mumbai

Slow drive for e-trucks as local sourcing rule bites

E-truck manufacturers wary of ambitious indigenization due to concerns over tepid demand

2 mins

October 13, 2025

Mint Mumbai

YOGA, AYURVEDA—INDIA CAN LEAD THE WISDOM ECONOMY

I was watching a video of a meditation studio in Manhattan when it struck me yet again. Twenty people, mostly American professionals, sitting cross-legged on expensive mats, were following breathing techniques that our grandparents and ancestors practised every morning.

2 mins

October 13, 2025

Mint Mumbai

Existing investors pour in $40 million into Dezerv

Wealth management platform Dezerv has raised ₹350 crore (about $40 million) in a new funding round from its existing investors, the company's top executive told Mint.

1 mins

October 13, 2025

Listen

Translate

Change font size