Poging GOUD - Vrij

$6B Exposure Threatens Collapse as Asset Sales and Tata Sons Shares Hang in Balance

BW Businessworld

|May 31, 2025

THE SHAPOORJI PALLONJI (SP) GROUP, one of India's oldest conglomerates, is teetering on the edge of a financial abyss as it grapples with a staggering nearly $6 billion debt exposure, fuelled by a series of high-yield private credit deals and relentless asset disposals.

The latest chapter in this saga - a $3.4 billion, three-year, zero-coupon rupee bond with a jaw-dropping 19.75 per cent annual yield - marks India's largest private credit deal, but it's not the lifeline it seems. Behind the headlines, industry insiders reveal a grim reality: this is the fourth rollover of a debt facility that's ballooned to $6 billion in total exposure, with the Reserve Bank of India (RBI) reportedly greenlighting the gamble against SP's 18.37 per cent stake in Tata Sons and its sprawling property portfolio. The SP Group is estimated to have a total debt of between Rs 55,000 crore and Rs 60,000 crore. This debt is roughly split evenly between the Mistry family (promoters) and the group's operating real estate and construction businesses. As the group sells assets to service crushing interest payments, a burning question looms: what happens when there's nothing left to sell?

A Debt Spiral Fuelled by Desperation

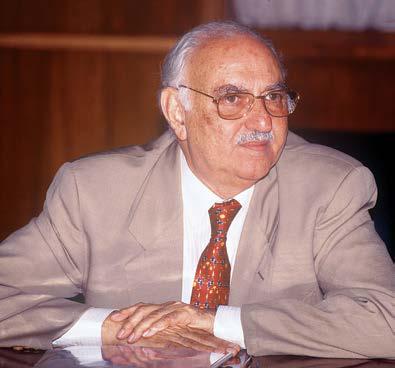

The SP Group, led by billionaire Shapoor Mistry, has been battling liquidity woes since the Covid-19 pandemic exacerbated its debt burden, which peaked at Rs 45,000 crore ($5.4 billion) in March 2020. Fast forward to 2025, and the group's consolidated external debt stands at Rs 20,000 crore ($2.4 billion), down from Rs 37,000 crore in 2020, thanks to aggressive asset sales. But the relief is fleeting. The latest $3.4 billion bond, arranged by Deutsche Bank and backed by global heavyweights like Ares Management, Cerberus Capital, and Davidson Kempner, is a zero-coupon deal - meaning no interest is paid until maturity in 2028, when the principal and accrued interest will hit like a financial tsunami.

Dit verhaal komt uit de May 31, 2025-editie van BW Businessworld.

Abonneer u op Magzter GOLD voor toegang tot duizenden zorgvuldig samengestelde premiumverhalen en meer dan 9000 tijdschriften en kranten.

Bent u al abonnee? Aanmelden

MEER VERHALEN VAN BW Businessworld

BW Businessworld

8 GADGETS THAT WHISPER CLASS - AND JUST WORK

Eight impeccably designed gadgets that define modern luxury through effortless performance, proving that true class whispers-it never shouts

3 mins

November 01, 2025

BW Businessworld

A CELEBRATION OF ART

The first week of October saw the Blue City hosting the first edition of the Jodhpur Arts Week

2 mins

November 01, 2025

BW Businessworld

"WE PLAN TO OPEN 10 TO 15 NEW STORES ANNUALLY"

This festive season Decathlon Sports India is offering a curated range of their products in the sports and fitness categories. We caught up with Gaudham Ganesh, Head of Marketing, Decathlon Sports India, to ascertain the shopping behaviour of Decathlon customers. Excerpts:

2 mins

November 01, 2025

BW Businessworld

"30 per cent of our sales come from our digital channels"

We caught up with ADOSH SHARMA, Country Commercial Manager, IKEA to speak about their focus on the Indian market and more

2 mins

November 01, 2025

BW Businessworld

RADO

INNOVATION AND TIMELESS DESIGN

1 min

November 01, 2025

BW Businessworld

Modern twist to a timeless memory

By engaging deeply with our consumers and monitoring online chatter, we can identify emerging trends swiftly and efficiently

3 mins

November 01, 2025

BW Businessworld

THE GUT-BRAIN CONNECTION

A striking fact is that most of our neurotransmitters are produced in the gut. Nearly 80 percent of serotonin, the “calming” hormone that regulates mood, sleep and even gut motility is made in the digestive tract.

2 mins

November 01, 2025

BW Businessworld

"LUXURY IS TO BE ABLE TO CONTROL THE PACE OF YOUR LIFE"

Actor TAAPSEE PANNU champions fearless authenticity as her brand. To her, luxury is to be 'present', to be able to make a choice and be able to control the pace of one's life

4 mins

November 01, 2025

BW Businessworld

THE PROMISE OF LUXURY

The luxury market in India shows promise despite slow growth globally. Investing in building an enduring relationship with a consumer, who is spoiled for choice and has a short attention span, is what will help brands elevate their game.

3 mins

November 01, 2025

BW Businessworld

INSIDE THE 2025 SHOPPING FRENZY

As India steps into the 2025 festive season, online retail is poised for a record-breaking year

4 mins

November 01, 2025

Listen

Translate

Change font size