Prøve GULL - Gratis

Africa's Beating Economic Pulse

The Business NG

|July 04, 2025

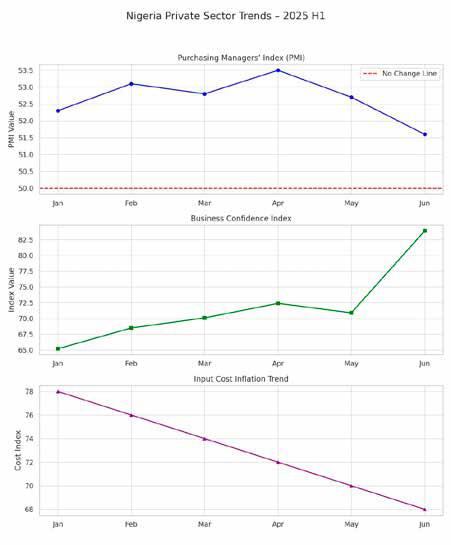

Nigeria's private sector showed resilience in H1 2025, driven by improved purchasing activity, stable exchange rates, and easing inflation. According to economic analyst ABIODUN JIMOH, despite lingering challenges such as high fuel costs and insecurity, business confidence remained upbeat, supported by government reforms and a favourable monetary environment.

-

Nigeria's private sector remained in expansion territory for the seventh consecutive month in June 2025, though the pace of growth has softened. The latest Stanbic IBTC Bank Purchasing Managers' Index (PMI), compiled by S&P Global, declined to 51.6 from 52.7 in May, signaling a slower but still positive business environment. Any figure above 50 indicates growth, while below 50 signals contraction.

The index, which aggregates data from around 400 firms across key sectors including agriculture, manufacturing, wholesale and retail, construction, and services, provides a snapshot of the economy's health from the perspective of private businesses. In June, while growth persisted, it did so at its weakest pace since the start of 2025, raising questions about the sustainability of the current momentum.

Output and new business orders continued to rise, but the rate of expansion lost steam. Companies noted that demand remained positive but lacked the energy witnessed earlier in the year. Manufacturing and services remained the primary drivers of growth, while agriculture and retail faced headwinds, partly due to weaker consumer purchasing power and logistical challenges.

Adding to the concerns were rising backlogs of work, reported at the highest level since February 2023. These backlogs suggest that while demand exists, operational delays and inefficiencies are beginning to creep in. Respondents cited delayed customer payments and insufficient staffing as major contributors to the backlog buildup.

Denne historien er fra July 04, 2025-utgaven av The Business NG.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA The Business NG

The Business NG

MPC Meeting: All Eyes on CBN as Analysts Predict Fresh Rate Cut

As Nigeria's Monetary Policy Committee (MPC) prepares to meet on November 24-25, analysts across the financial sector are forecasting another policy rate cut, citing easing inflation, stronger macroeconomic fundamentals, and improved foreign exchange stability. The meeting comes just weeks after the Central Bank of Nigeria (CBN) cut the Monetary Policy Rate (MPR) by 50 basis points to 27%, marking the first rate reduction in nearly ten consecutive policy meetings under Governor Olayemi Cardoso. Stakeholders say this week's meeting will be a decisive test of the CBN's confidence in Nigeria's emerging disinflation trend. Inflation eased to 16.05% in October—down from 18.02% in September—following the CPI rebasing exercise and improvements in food supply, FX liquidity, and general price stability.

1 min

The BusinessNG

The Business NG

More Nigerians Seek Schooling Abroad as Education Crisis Triggers $1.39bn Outflow

Nigeria’s persistent crisis in the education sector has continued to fuel a massive exodus of students to foreign institutions, with new data show-

1 min

The BusinessNG

The Business NG

2026 Tax Reform Triggers Concerns Over Data Privacy, Income Monitoring

Nigeria's new tax framework, set to take effect in January 2026, is stirring debate over the government's ability to access citizens' personal financial data, particularly for remote workers and Nigerians with foreign assets.

1 min

The BusinessNG

The Business NG

Nigeria Launches 2025 Oil and Gas Licensing Round on Dec 1

Nigeria is set to launch its 2025 oil and gas licensing round on December 1, as the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) moves to revive the country's production capacity and attract fresh global investment.

1 min

The BusinessNG

The Business NG

Investors Scramble for N1.23tn T-Bills as Market Signals Yield Peak

Nigeria's Treasury Bills market continued its bullish momentum at the November 19, 2025 auction, with investors submitting an overwhelming N1.23 trillion in bids for the 364-day tenornearly triple the Central Bank of Nigeria's (CBN) N450 billion offer. The aggressive demand signals a clear race by investors to lock in high yields before the expected monetary policy easing cycle begins in 2026.

1 min

The BusinessNG

The Business NG

Court Sentences Nnamdi Kanu to Life Imprisonment for Terrorism

Leader of the Indigenous People of Biafra (IPOB), Nnamdi Kanu, has been sentenced to life imprisonment by a Federal High Court in Abuja after being convicted on all seven terrorism charges filed against him by the Federal Government.

1 min

The BusinessNG

The Business NG

Panic Selloffs, FX Fears Hammer Banking Stocks, ASI Down 3.5%

Nigeria's equities market remained under severe pressure through November 2025, with the All-Share Index (ASI) declining steadily on the back of heavy selloffs in banking stocks.

1 min

The BusinessNG

The Business NG

GDP Debate: Analysts Split on Nigeria's Q3 Performance

As Nigeria prepares to release its Q3 2025 GDP report, analysts remain divided on how the economy performed. Some expect a modest expansion of 3.6%-3.9%, while others forecast a stronger 4.5% growth, building on the 4.23% recorded in Q2.

1 min

The BusinessNG

The Business NG

Nigerians Still Feeling Price Pressures Despite Falling Inflation

Despite Nigeria's headline inflation rate falling to 16.05 per cent in October, the cost of living for ordinary households remains steep, the Centre for the Promotion of Private Enterprise (CPPE) has warned.

1 min

The BusinessNG

The Business NG

PDP Crisis Boils Over in Abuja

•Wike Allies Sacked Makinde, Bala Over 'Anti-Party

1 min

The BusinessNG

Listen

Translate

Change font size