Prøve GULL - Gratis

Mining reform plan hits state pushback

Mint New Delhi

|November 19, 2025

Revenue loss fears rise; high upfront fees may aid large steel firms

Two of India's major mineral-producing states have opposed an overhaul of the country's iron ore auction rules out of fear of revenue loss, in yet another blow to an ambitious plan to boost production and cool prices.

Resistance from states and steelmakers has stalled the process, and a mines ministry committee set up to shepherd The reform has not met in more than two months, three people aware of the matter said.

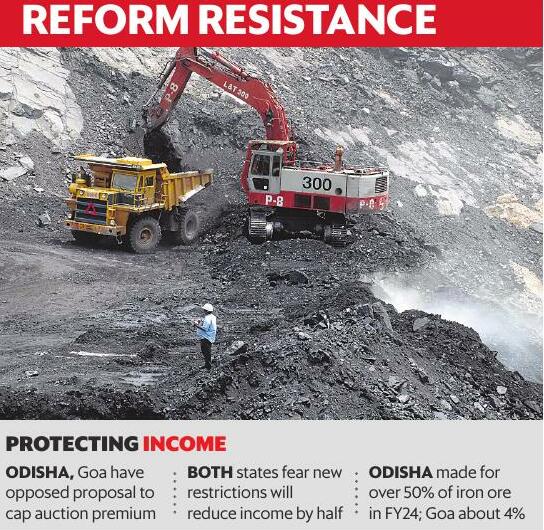

The ministry plans to limit so-called auction premiums to 50% of the ore value, replacing the current system where bids can cross even 100%. Also, companies who win the mining blocks would need to pay more money upfront. Premium is the extra amount a bidder agrees to pay the government above the base price.

Odisha and Goa have opposed the proposal to cap premiums, said one of the three people, a senior official in the steel ministry. Auction premiums are the biggest revenue earners for mineral-rich states, and both states fear the restrictions will hurt. For instance, when ore valued at ₹1,000 per tonne attracts a 100% premium, the state earns an equal ₹1,000 per tonne in premium, but a 50% cap would cut this income in half.

Odisha and Goa have opposed the proposal to cap premiums, said one of the three people, a senior official in the steel ministry. Auction premiums are the biggest revenue earners for mineral-rich states, and both states fear the restrictions will hurt. For instance, when ore valued at ₹1,000 per tonne attracts a 100% premium, the state earns an equal ₹1,000 per tonne in premium, but a 50% cap would cut this income in half.Queries emailed to the governments of Goa and Odisha remained unanswered. Odisha accounted for over 50% of iron ore mined in India in FY24 and Goa slightly over 4%.

The ministry official cited above said the measures to change the auction format are "currently on hold." A second official added, "Lower premiums directly translate into lower state revenues."

Denne historien er fra November 19, 2025-utgaven av Mint New Delhi.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Mint New Delhi

Mint New Delhi

Tech solutions exist to mitigate KYC data leakage risks

Today, more than half of all data breach incidents target personally identifiable information—tax identities, passport numbers, biometric data and the like.

3 mins

January 07, 2026

Mint New Delhi

Maduro’s capture threatens China's ambitions in Latin America

Beijing has steadily built relationships over the past two decades in Washington's backyard

4 mins

January 07, 2026

Mint New Delhi

Wall Street investors who stuck with Venezuela are poised for a payday

The ouster of Nicolas Maduro is rewarding investors who spent years betting on a Venezuela comeback.

4 mins

January 07, 2026

Mint New Delhi

TVs ward off smartphone threat with AI

Uber robotaxis are on their way in, in 2026—and other AI news this week

1 min

January 07, 2026

Mint New Delhi

Much can be done to relieve urban India of its toxic air

Air pollution in the National Capital Region (NCR) continues to dominate headlines this winter, highlighting the absence of any long-term strategy to deal with a deadly subject that is affecting millions of lives in and around India’s capital.

3 mins

January 07, 2026

Mint New Delhi

Modulus taps UBS for private credit biz

Modulus Alternatives Investment Managers hired a veteran banker from UBS Group AG to lead its private credit business, according to people familiar with the matter, as demand for talent in the sector heats up.

1 min

January 07, 2026

Mint New Delhi

NHAI asks DoT to fix mobile network gaps on highways

As India builds highways at a record pace, a critical digital gap is becoming harder to ignore.

1 min

January 07, 2026

Mint New Delhi

Hospitals are a proving ground for what AI can do, and what it can't

Amir Abboud, chief of emergency radiology for Northwestern Medicine, thought he was already working at maximum speed.

6 mins

January 07, 2026

Mint New Delhi

Mid-sized startups ditch unicorn chase, pursue IPOs earlier

According to one of the people cited above, these startups are likely to raise ₹400-600 crore through IPOs.

2 mins

January 07, 2026

Mint New Delhi

Gold price spike lifts Titan Q3 sales

Titan Company on Tuesday posted a 40% jump in overall sales for the December quarter, driven by a higher average selling price for its gold jewellery and festive demand.

1 min

January 07, 2026

Listen

Translate

Change font size